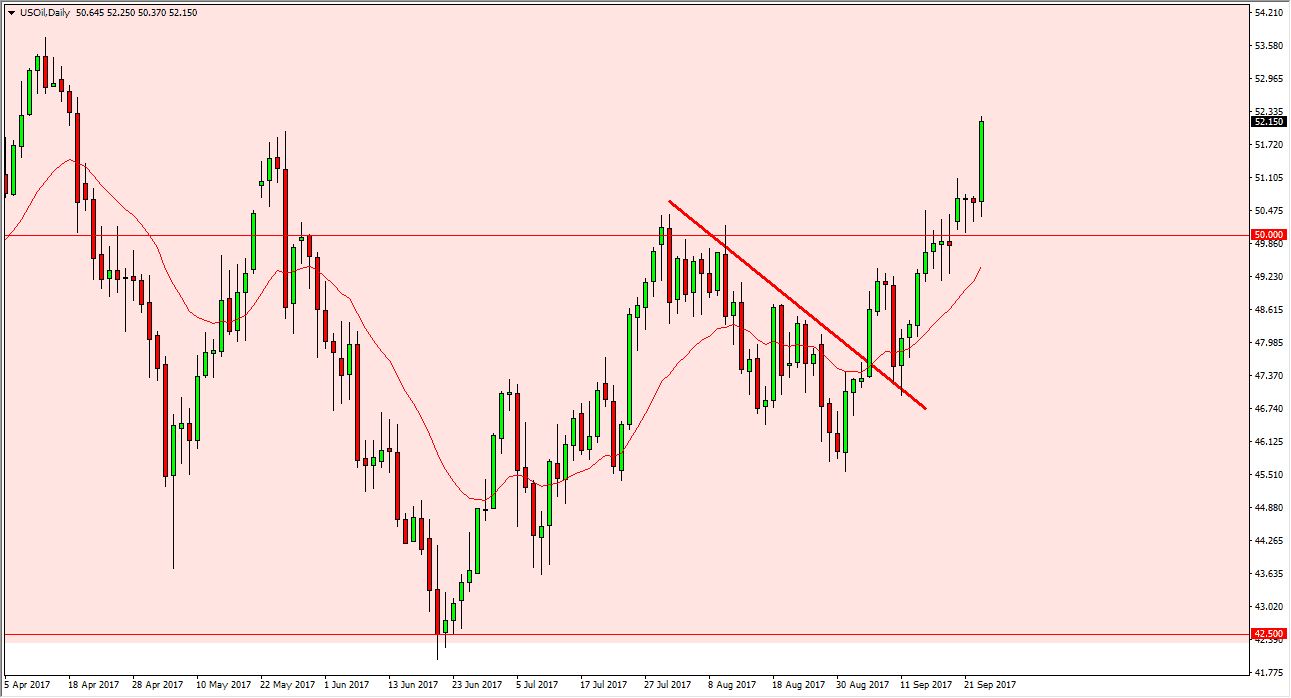

WTI Crude Oil

The WTI Crude Oil market fell initially on Monday, but found enough support just above the $50 level to turn things around and explode to the upside. We broke above the $52 level handily, and now I think we are going to go looking for even higher levels. Short-term pullback should continue to be buying opportunities, perhaps looking towards the $55 level over the next several sessions. I believe that there is essentially the “floor” down at the $50 level, meaning that this is a “buy on the dips” situation going forward, and I have no interest in shorting WTI and less of course we broke down below the $49 level, which seems unlikely given the extraordinarily bullish session that we had on Monday. I do recognize that $55 is going to be very resistive, so I would not be surprised at all to see the sellers come out in that area.

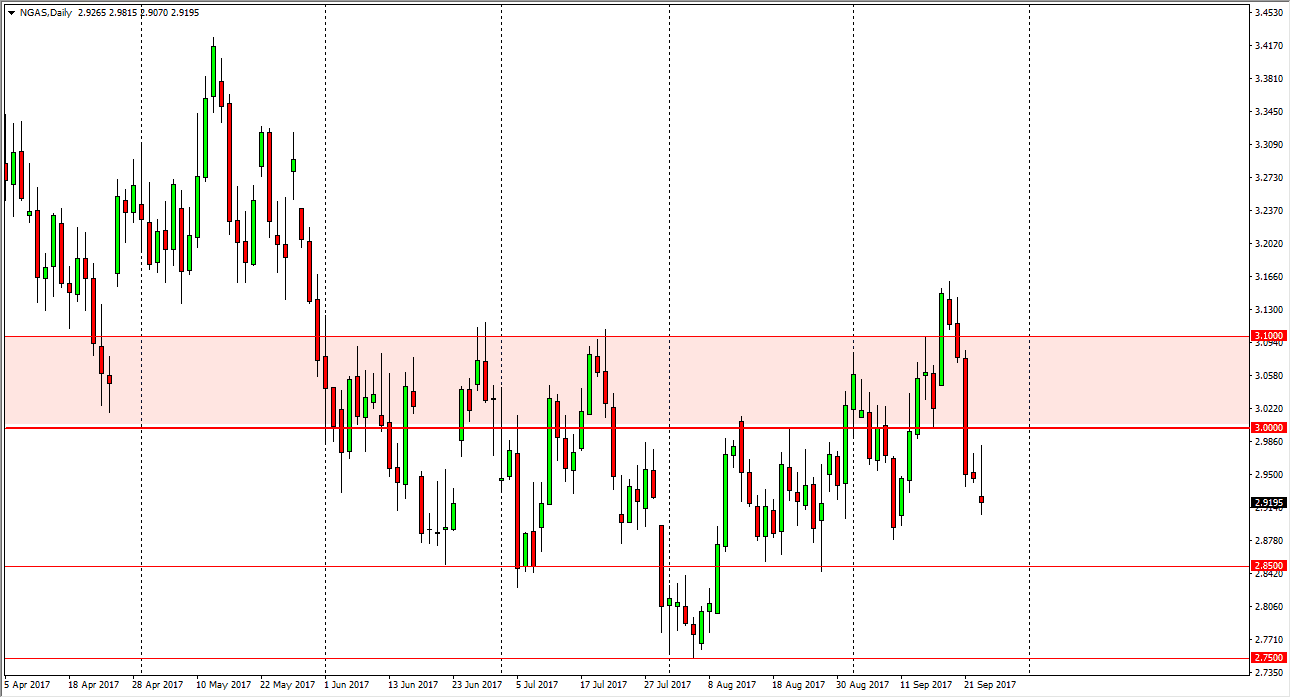

Natural Gas

The natural gas markets gapped lower at the open on Monday, but turned around to fill the gap and the market even broke to the upside. However, we continue to see massive amounts of resistance at the $3 level, and the shooting star the form for the day shows just how much bearish pressure there is in this market, and I believe we may go looking towards the $2.85 level underneath. Ultimately, I believe that short-term rallies should continue to be selling opportunities, as the market is obviously broken. If the hurricanes could not disrupt supply of natural gas, I don’t know what will. I believe that the massive turn around over the last several sessions has shown just how bearish this market is. Ultimately, this is a market that is absolutely broken and can be bought.