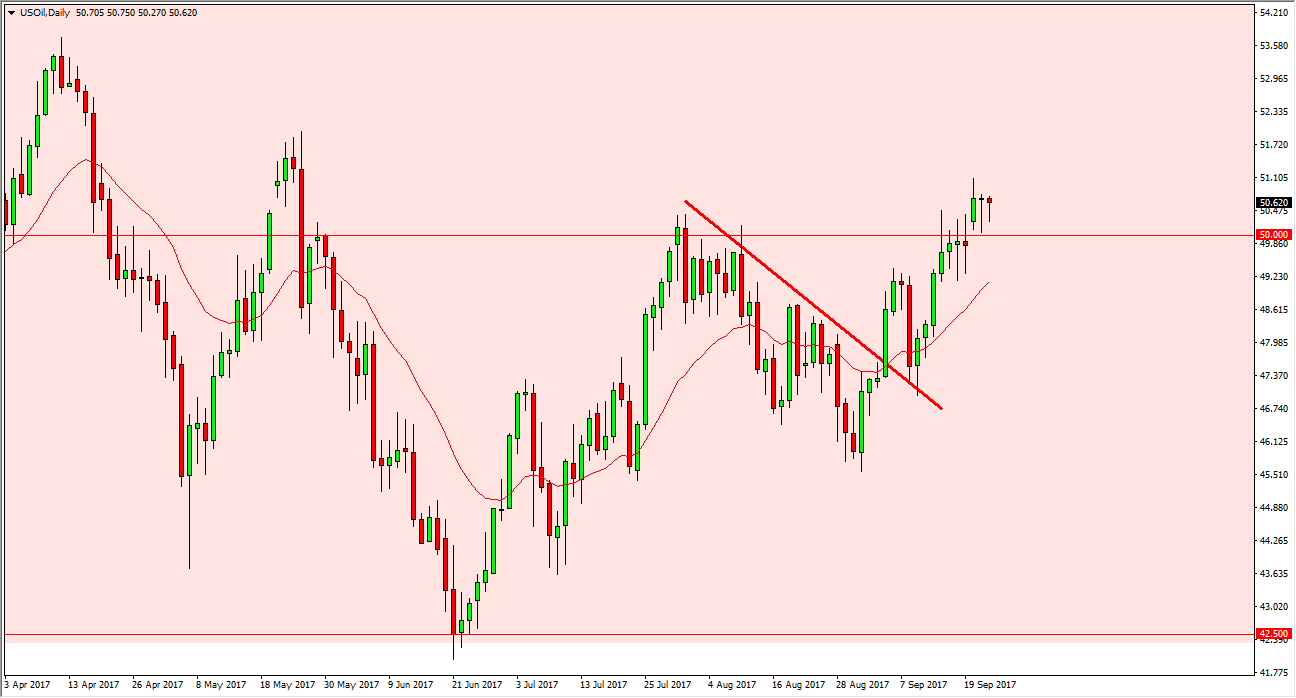

WTI Crude Oil

The WTI Crude Oil market initially fell on Friday but continues to find buyers near the $50 level. By forming a hammer yet again, this shows just how much bullish pressure there is underneath. I think if we can break above the $51 level, the market is free to go higher. In the meantime, I suspect that we will see a significant amount of volatility. The alternate scenario is dropping below the $49 level, which would be negative. At that point, I anticipate that the market would probably go looking for the $40 level next. I suspect there’s going to be a lot of volatility but it looks as if the buyers are trying to make a stand here, and I think that the market could find itself looking as high as $53.50 over the next several sessions if they get their way.

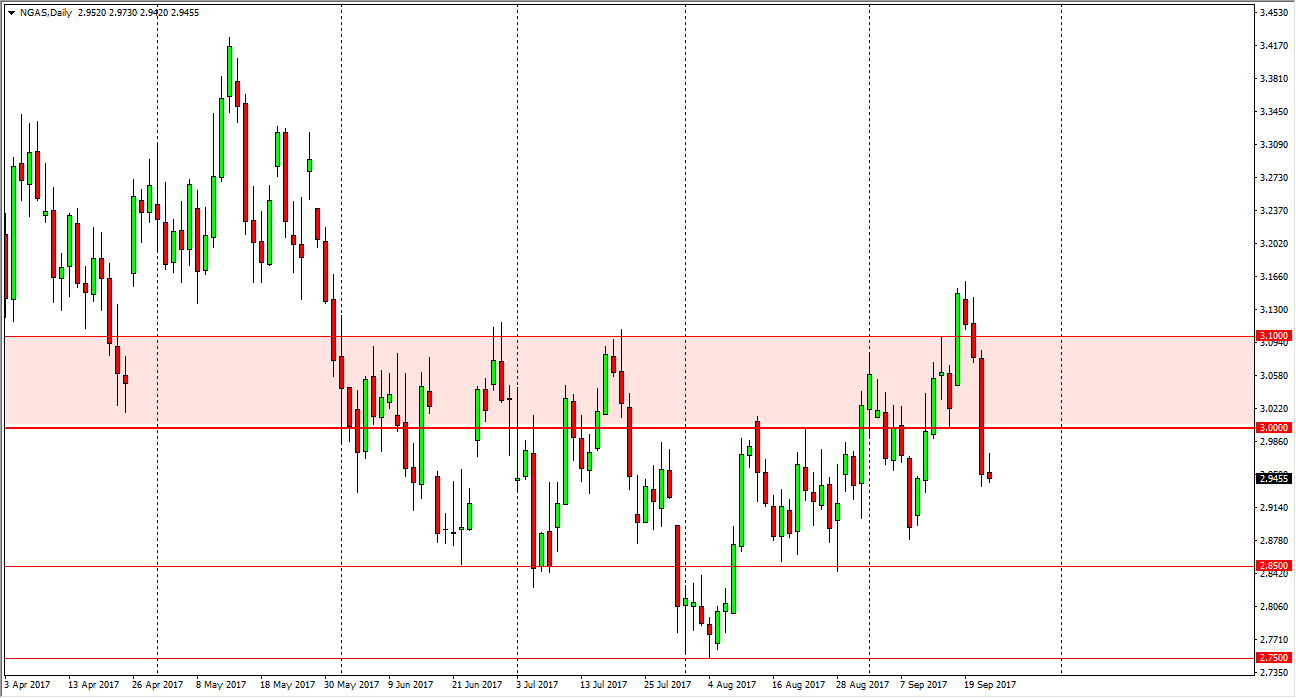

Natural Gas

On the other hand, there’s natural gas. It his completely cratered as of late, and the little bit of a rally that it had on Friday was turned around to form a shooting star. This is almost always a very negative sign at the end of the move lower, and I think we’re going to go looking for the $2.85 level. Ultimately, there should be plenty of support in that area, and I think that the volatility continues. However, if the inventory number can’t pick up after a couple of massive hurricanes in the United States, I’m not really sure when it can. Ultimately, this is still a “sell rallies” type of market, the question is when to do it. We had recently broke above the $3.10 level, which had everybody thinking massive breakout. However, that has clearly failed at this point, and the sellers are firmly in control.