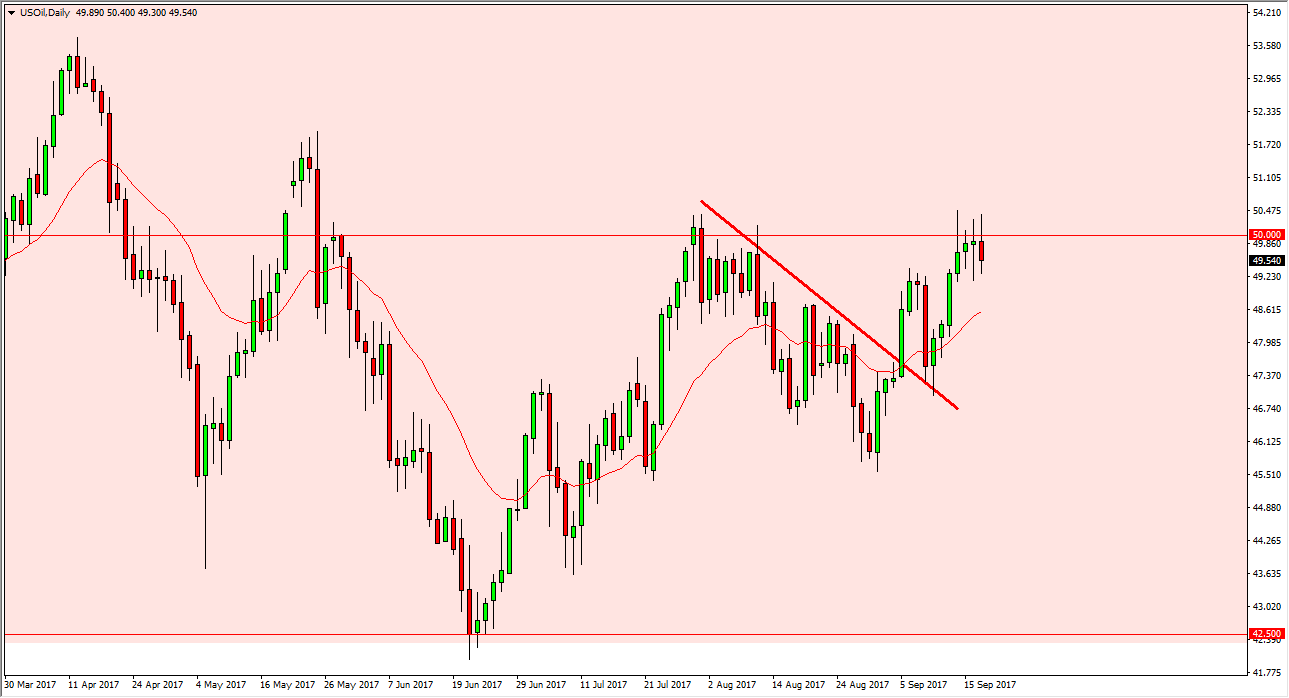

WTI Crude Oil

Today should be an interesting session for the WTI Crude Oil markets, as we have a couple of things to pay attention to. We obviously have the Crude Oil Inventories announcement, which of course is a major influence on this market. We also have the Federal Reserve interest rate announcement, but more importantly the statement that follows. The statement should give us an idea as to how monetary policy of the Federal Reserve will be, and that greatly influences the value of the US dollar. If the US dollar falls due to a dovish tone, that should help crude oil rally. I suspect that the Federal Reserve may be a bit hesitant to sound hawkish due to the recent hurricanes, so we have the opportunity to see real volatility in this market. If we break down below the $49 level, I think we go to the $46.50 handle. However, if we break above the $51 level, we could go towards $54 over the longer term.

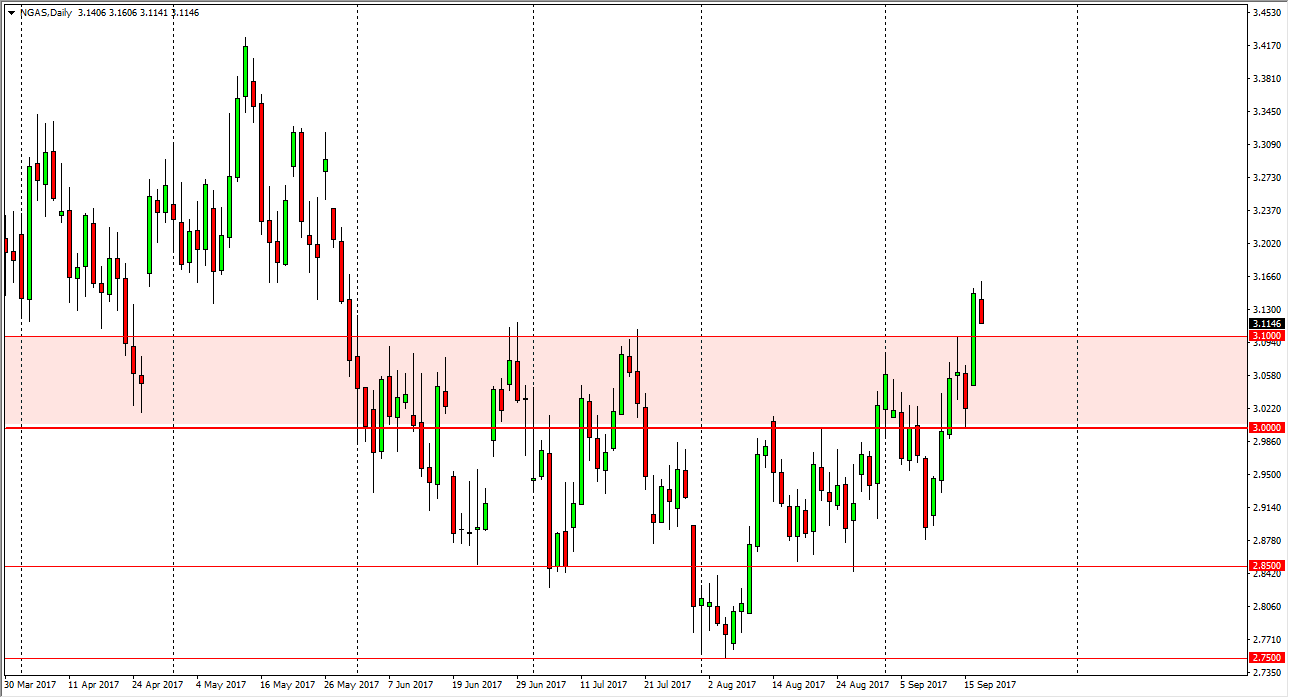

Natural Gas

Natural gas markets continue to be volatile, but we have just broken above a significant resistance barrier. I believe the buyers will return somewhere closer to the $3.10 handle, and that that point if we saw some type of supportive candle, I think it is a buying opportunity. Granted, I believe that longer-term we have a cyclical oversupply issue, but it looks as if the buyers are going to win the argument for the time being. I believe that the market will go looking to higher levels, perhaps as high as $3.35 based upon the recent consolidation break out. I also believe that longer-term sellers are still involved in this market, and it would take nothing short of a minor miracle to wipe out supply. Because of this, short-term buying as possible, and likely.