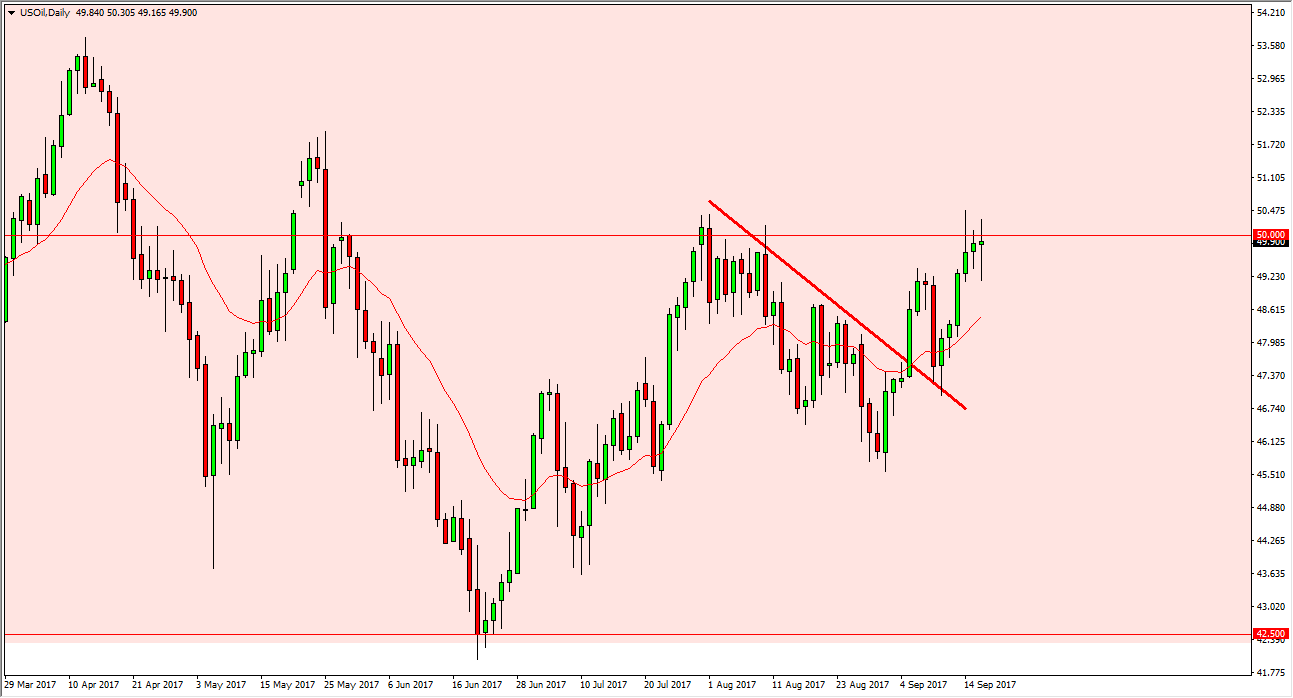

WTI Crude Oil

The WTI Crude Oil market went back and forth during the Monday session, as we broke above the $50 level, but then pulled back as it is an area that will continue to cause quite a bit of noise. I believe that if we can break above the $51 level, the market can go much higher, but in the meantime, I would also be concerned about the $49 level below. A breakdown below that level could send this market back towards the $47.50 level. There is a lot of noise in the market currently, and therefore I am a bit cautious about trading crude oil. For what it’s worth, the bread market looks ready to break out to the upside, and that could help WTI rally as well. The markets are a bit disjointed, but eventually we are going to have to decide.

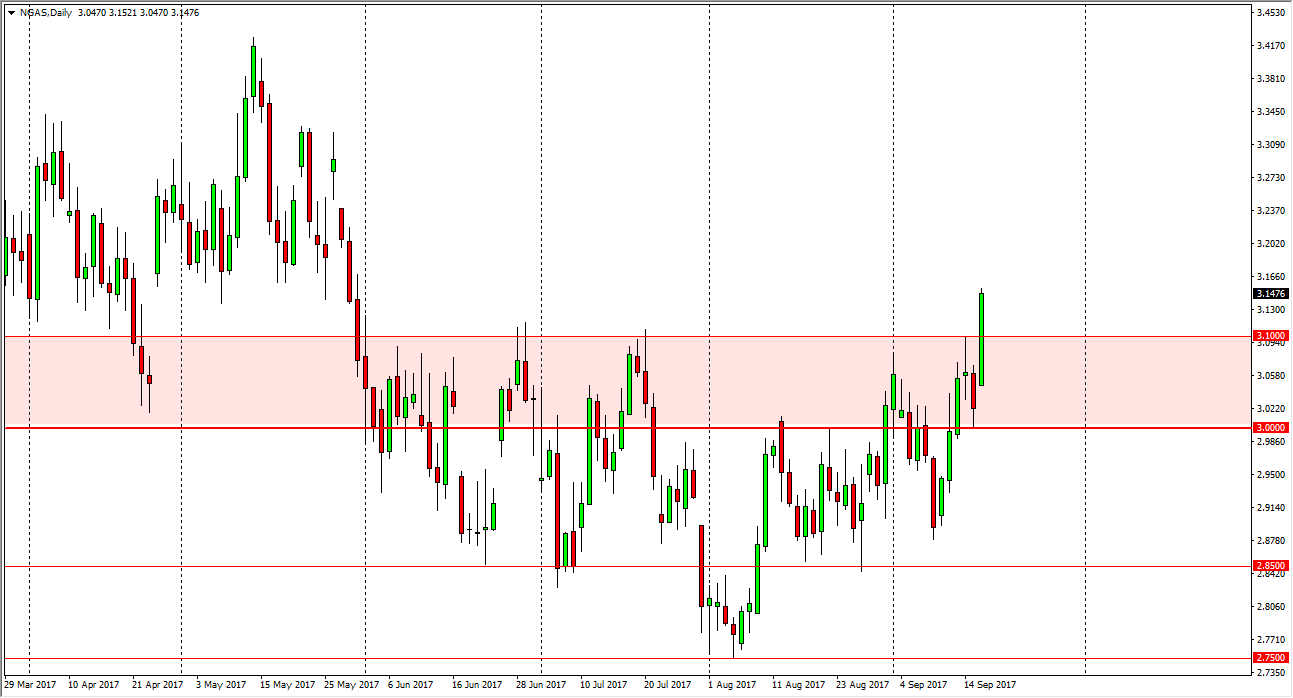

Natural Gas

The natural gas markets exploded to the upside, finally breaking above the $3.10 level. This is an area that has been reliable resistance going back to the end of May, and because of this, I feel that we have turned the corner. By breaking above the $3.10 level, I think that we are going to continue to see bullish pressure, but I do recognize that there is a lot of noise at the $3.20 level just above. Short-term traders will probably buy pullbacks, if we can stay above the $3.10 handle. If we were to break down below the $3.10 level, that would just continue the noise that we have seen recently, and therefore make this a market that would be almost impossible to deal with. In the short term though, looks as if the buyers are going to have their way in the natural gas paths.