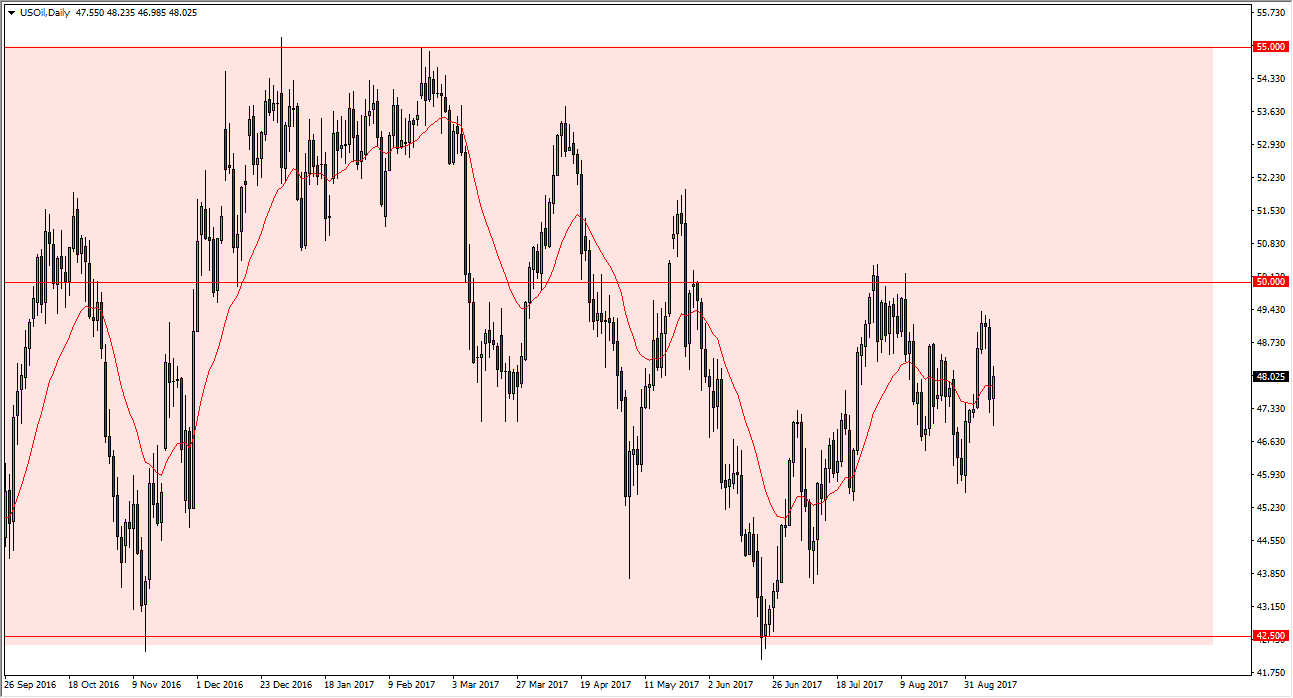

WTI Crude Oil

The WTI Crude Oil market initially fell on Monday, but turned around to form a hammer as word got out that disruptions weren’t going to be as big of an issue with demand, and that of course helped the market. By doing so, it looks as if we could go looking for the $49 level next, and then eventually $50. I think that the $50 level will be rather resistive though, so I’m not looking for a breakout immediately. A break below the bottom of the range for the day would be very negative, perhaps sending this market down to $46. Don’t get me wrong, I’m still bearish of this market longer term, but I realize a little bit of a relief rally is probably in order.

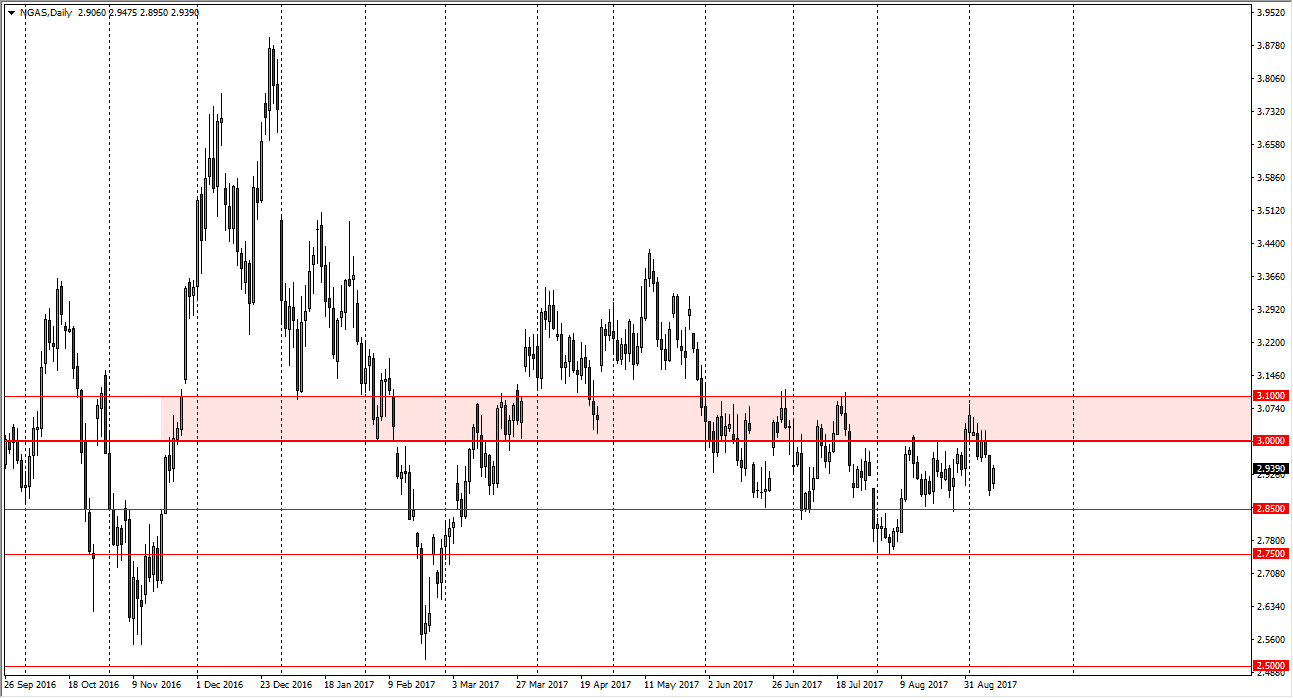

Natural Gas

Basically, the same thing could be said for the natural gas markets, as we got a small bullish candle after a gap higher on Monday. However, I still believe that the $3 level begins a major resistance barrier, and for several months, we’ve been able to short this market near that level and eventually collect our profits. I think that’s probably going to remain the same story for this market, so therefore I’m looking at this as an opportunity to short the natural gas markets closer to the $3 level again. There seems to be plenty of supply in that range, which makes a bit of sense as that is where some of the larger companies become profitable. Because of this, I am a seller, but at higher levels in this market. Ultimately, I believe that we break below the $2.85 level and go looking for the $2.50 level. Until then, I suspect that it will continue to be relatively choppy.