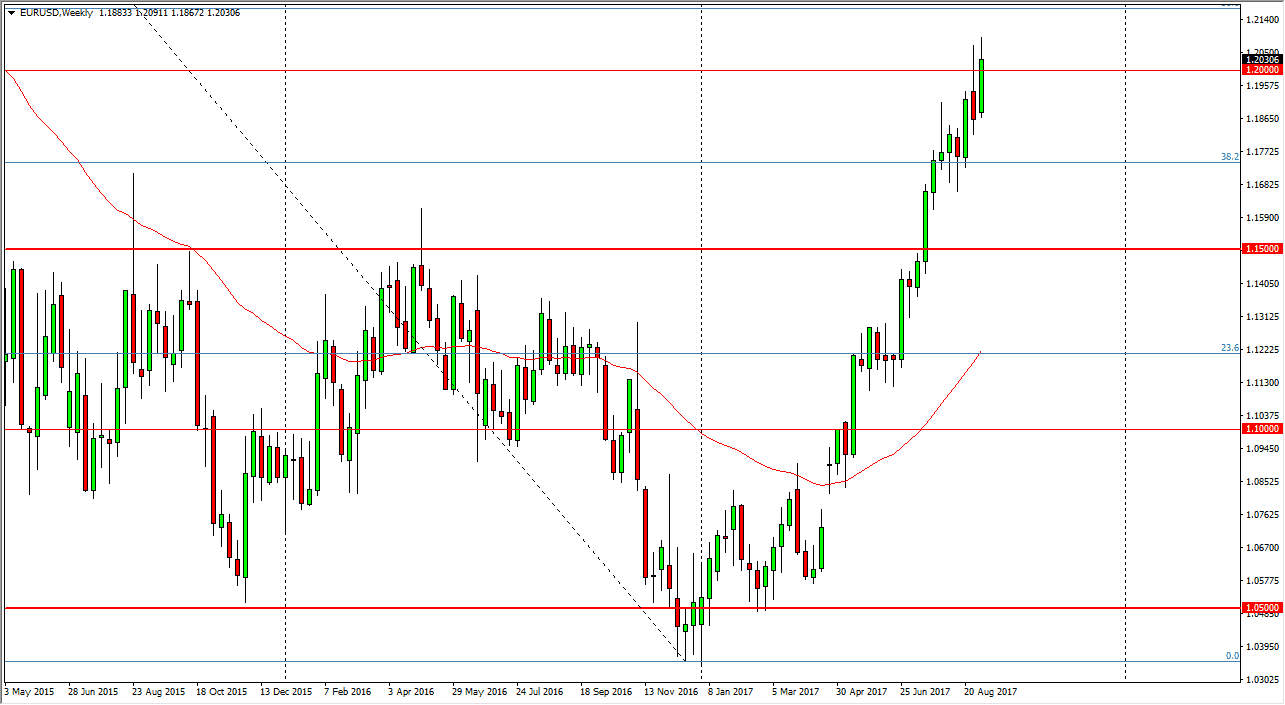

EUR/USD

The EUR/USD pair rallied during the week, breaking above the 1.20 level. By closing above that level, it’s a very bullish sign and I think that short-term pullbacks will probably be buying opportunities. However, be careful, as we are most certainly overextended. I believe that eventually we go to the 1.25 handle.

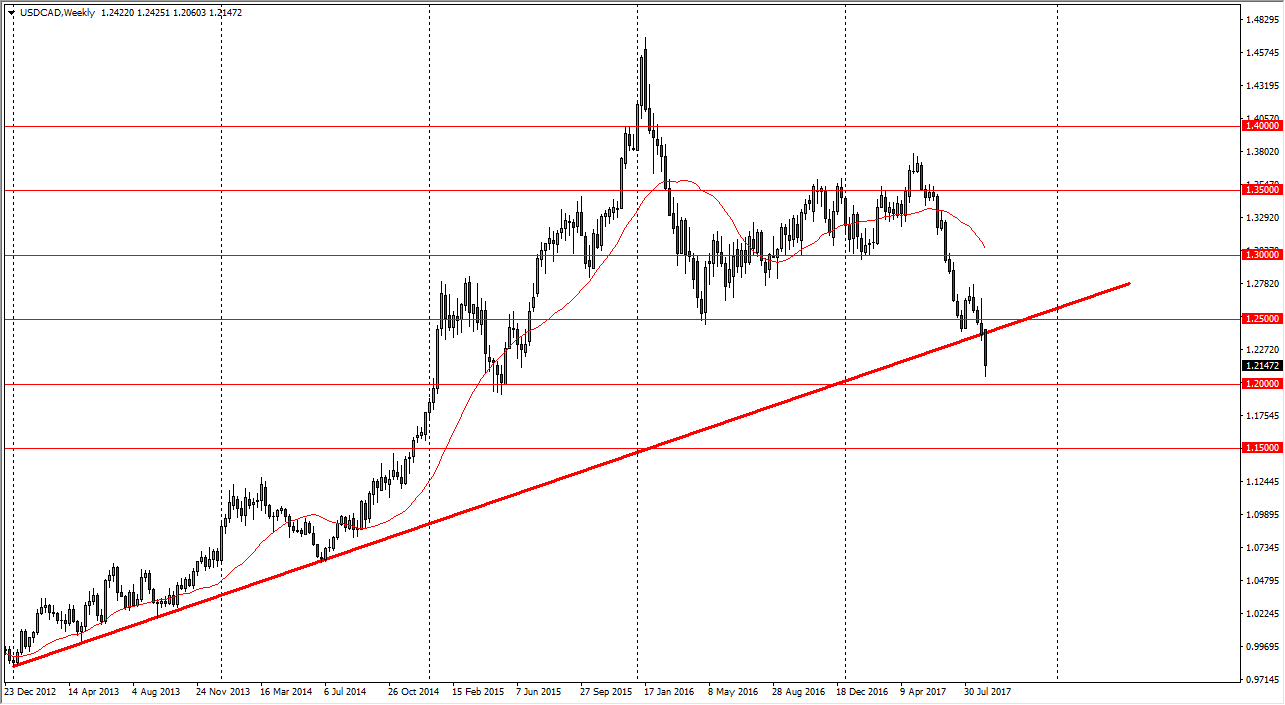

USD/CAD

The US dollar broke below the trendline against the Canadian dollar during the week, and it now looks as if the 1.20 level will be the next major support barrier. However, I think we may get a little bit of a short-term bounce, offering a better selling opportunity. Eventually we will break down below the 1.20 level, and go looking for the 1.15 handle.

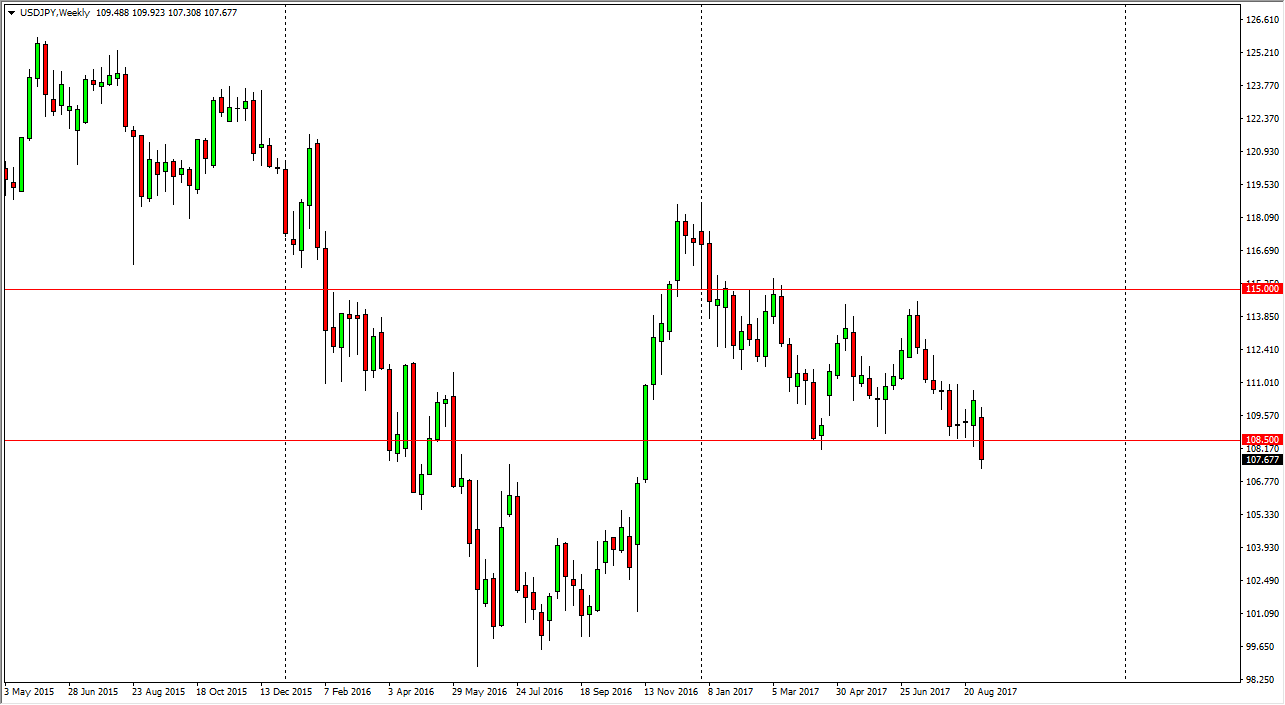

USD/JPY

The US dollar broke down during the week, slicing below the 180.50 level against the Japanese yen. Because of this, the market looks likely to continue to go lower, perhaps looking for the next psychologically significant level at the 105 handle. I think short-term rallies should be selling opportunities, as the market is clearly broken down below a major support barrier.

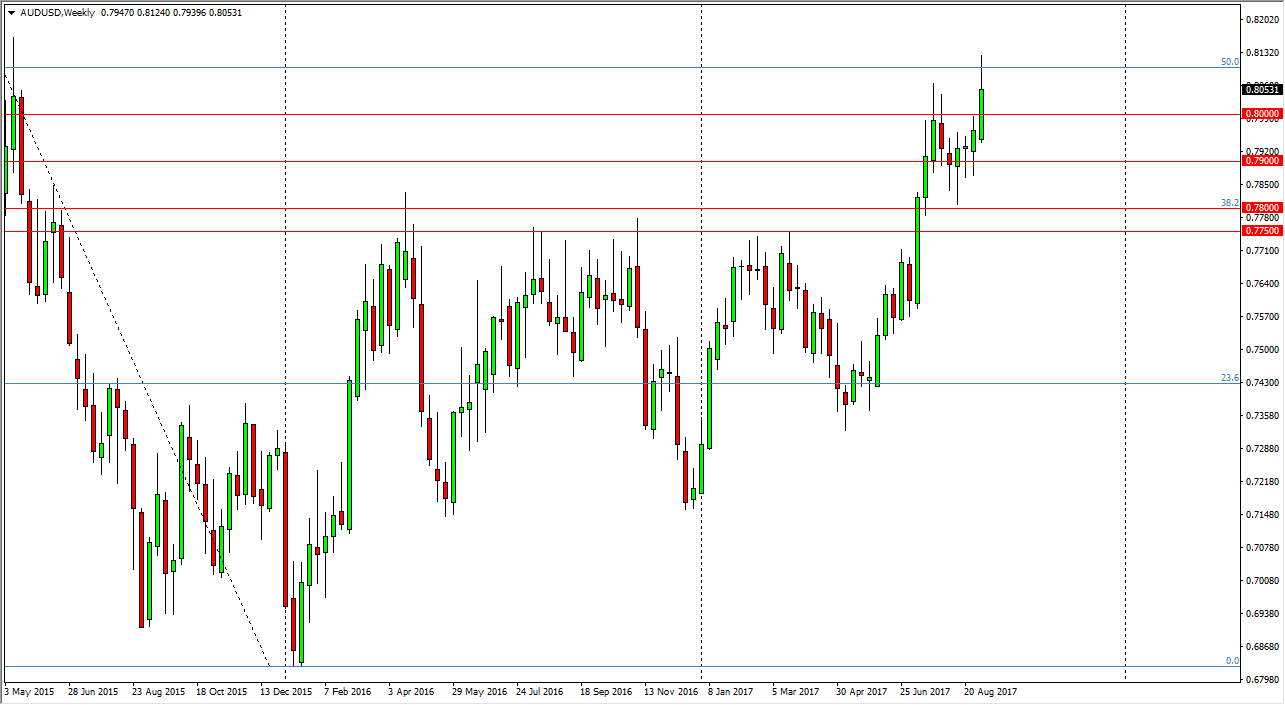

AUD/USD

The Australian dollar rallied during the week, slicing through the 0.80 handle. Now that we have closed above that level, it’s likely that the market will continue to go higher, and short-term pullback should be buying opportunities. I believe that break above the 0.80 level signifies that we are ready to go much higher.