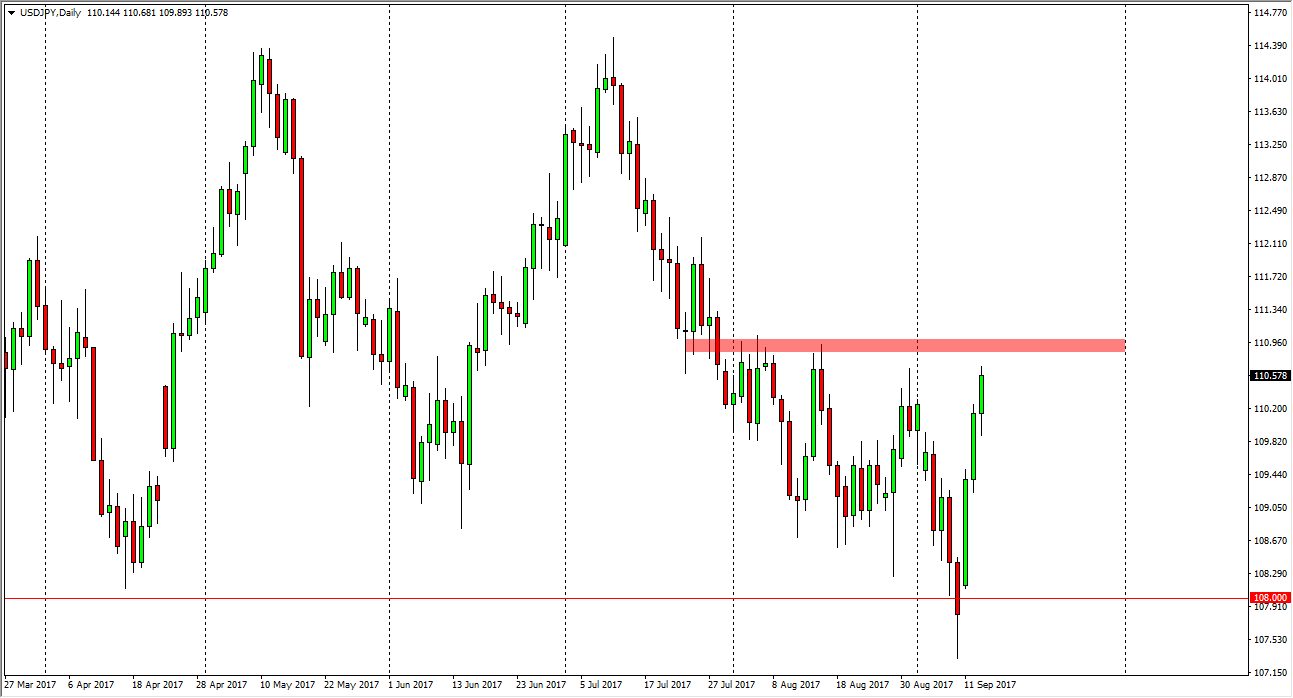

USD/JPY

The US dollar rallied yet again against the Japanese yen on Wednesday, as we now look set to test the vital 111 level. If we can break above there, the market should continue to go higher. However, I recognize that we are bit extended at this point, so a pullback could be coming. Longer-term, I think we may rally beyond the 111 level, but the pullback might be necessary to build up the required momentum to do that move. Remember, much of the selloff was due to risk appetite falling after the North Korea situation. I believe given enough time, the markets will go back to focusing on economic fundamentals, and deal less with the political noise. However, keep in mind that it wouldn’t take much to get people scared again.

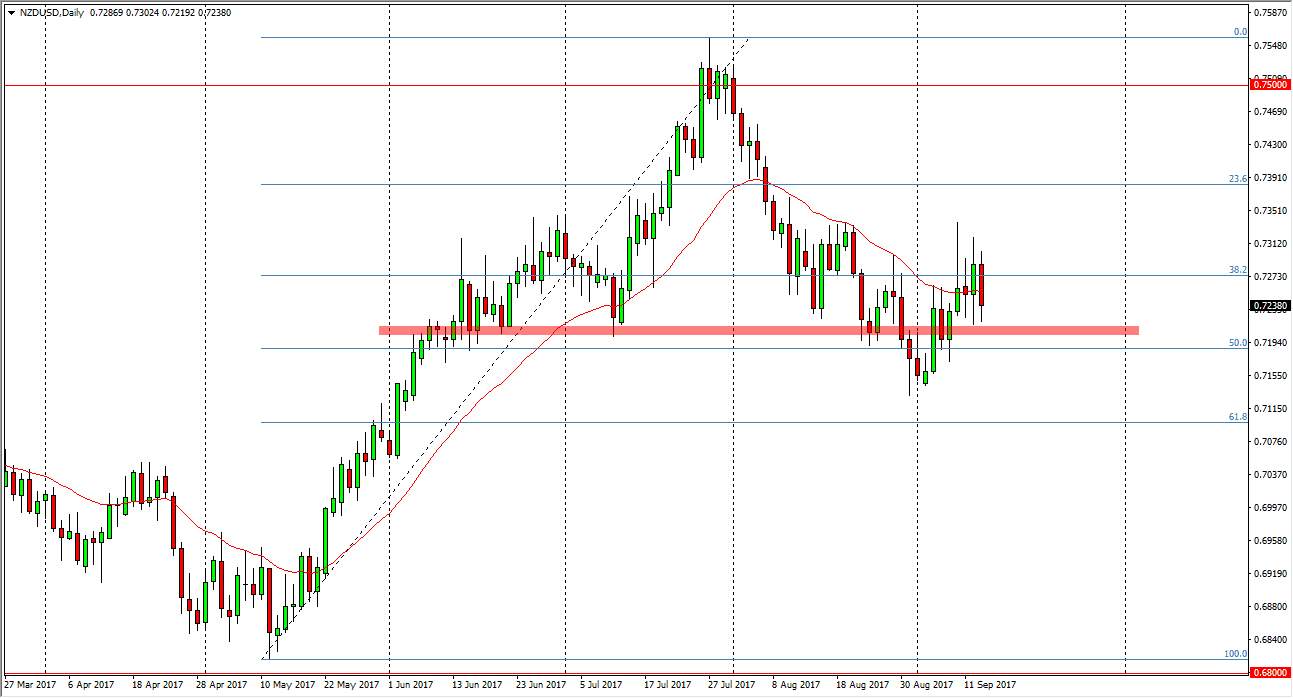

NZD/USD

The New Zealand dollar fell precipitously during the trading session on Wednesday as well, as it was announced that there is hope for a tax deal after all in the United States. This was less about the New Zealand dollar that it was about the US dollar, but quite frankly we are a long way from some type of agreement. Because of this, I look at this is a buying opportunity as the 0.72 level has held so far. When you look at the chart over the last several weeks, we have seen quite a bit of interest in this area, so I’m looking for more consolidation, meaning that we should rally from here. I’m not looking for a major move, but I do recognize that the status quo will probably be kept. With this, I don’t have any interest in shorting, least not yet and I believe that the buyers will come back after this knee-jerk move during the US session.