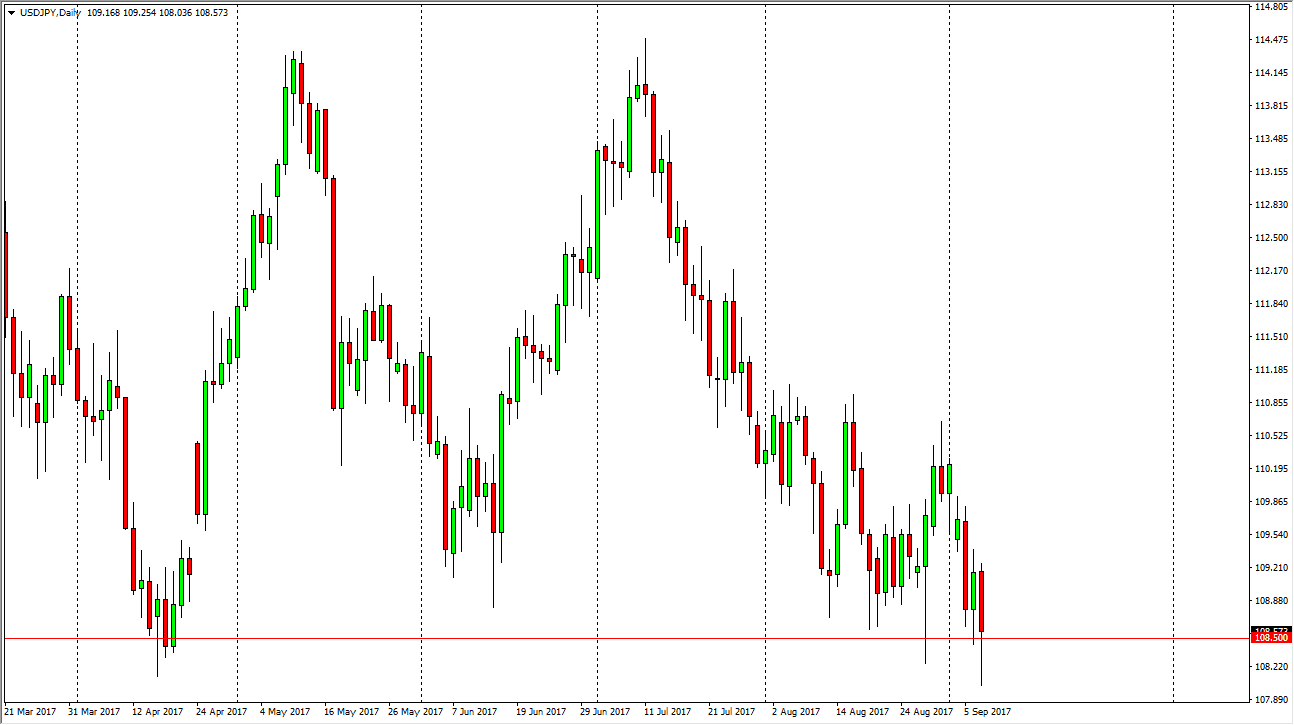

USD/JPY

The US dollar fell precipitously against the Japanese yen and of course several other currencies around the world, and as we broke down below the 108.50 level, that was a very bearish sign. At the end of the day, it looks as if the area is trying to hold, but the fact that we broke through it for so long during the session tells me that it is probably only a matter of time before we break down. If we break below the bottom of the range for the session on Thursday, I feel that the market probably goes down to the 105-level next, as it is a large, round, psychologically significant number. Rallies at this point will be selling opportunities or at least ignored until we can break above the 110 handle.

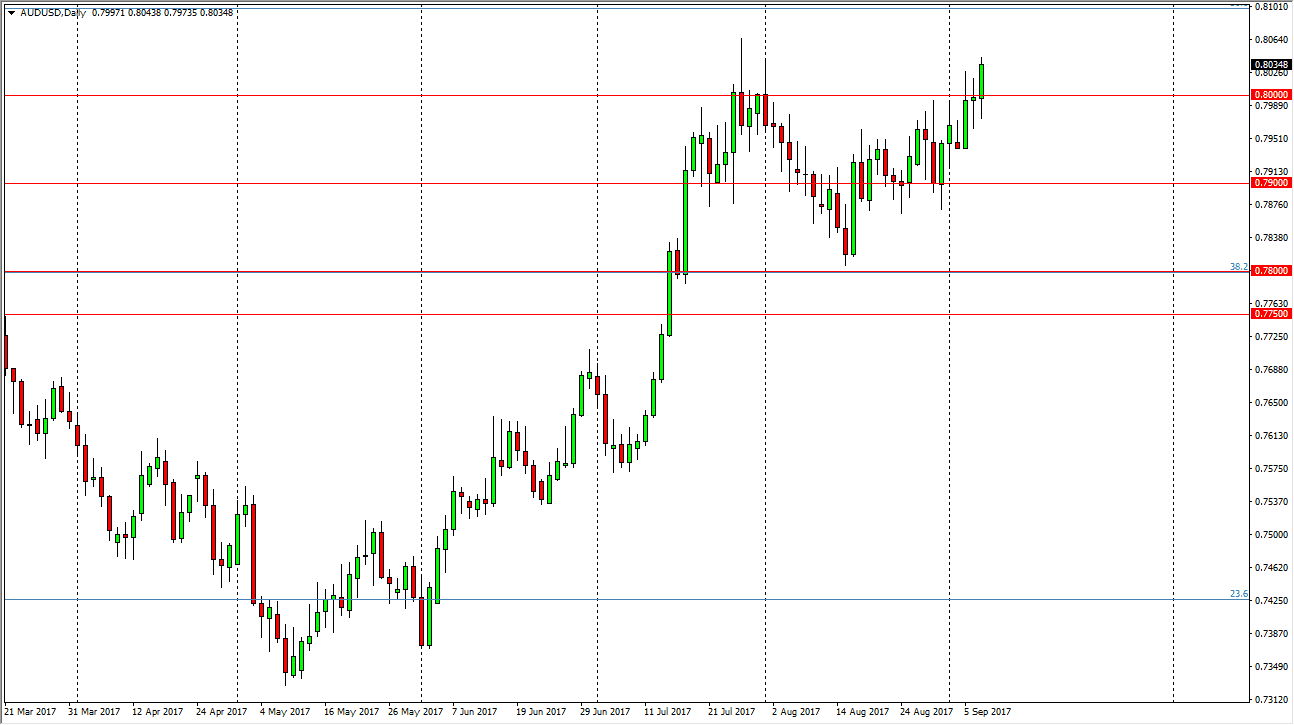

AUD/USD

The Australian dollar initially fell during the trading session on Thursday but managed to break above the 0.80 level, and is doing something that I have not seen it do yet: close above that level. Because of this, I am bullish of this market and I think that the breakout is imminent. Longer-term, I anticipate that this market will go looking for the 0.90 level, and then eventually parity. Nonetheless, I would expect a lot of noise, but I think a lot of what we are because the market acknowledging that the hurricanes hitting the United States will make it almost impossible for the Federal Reserve to raise rates with any type of velocity. I think that short-term pullbacks will be buying opportunities, and that being the case I think that adding small positions in various bits could be the best part of this market as we can build a large core position. Selling isn’t a thought.