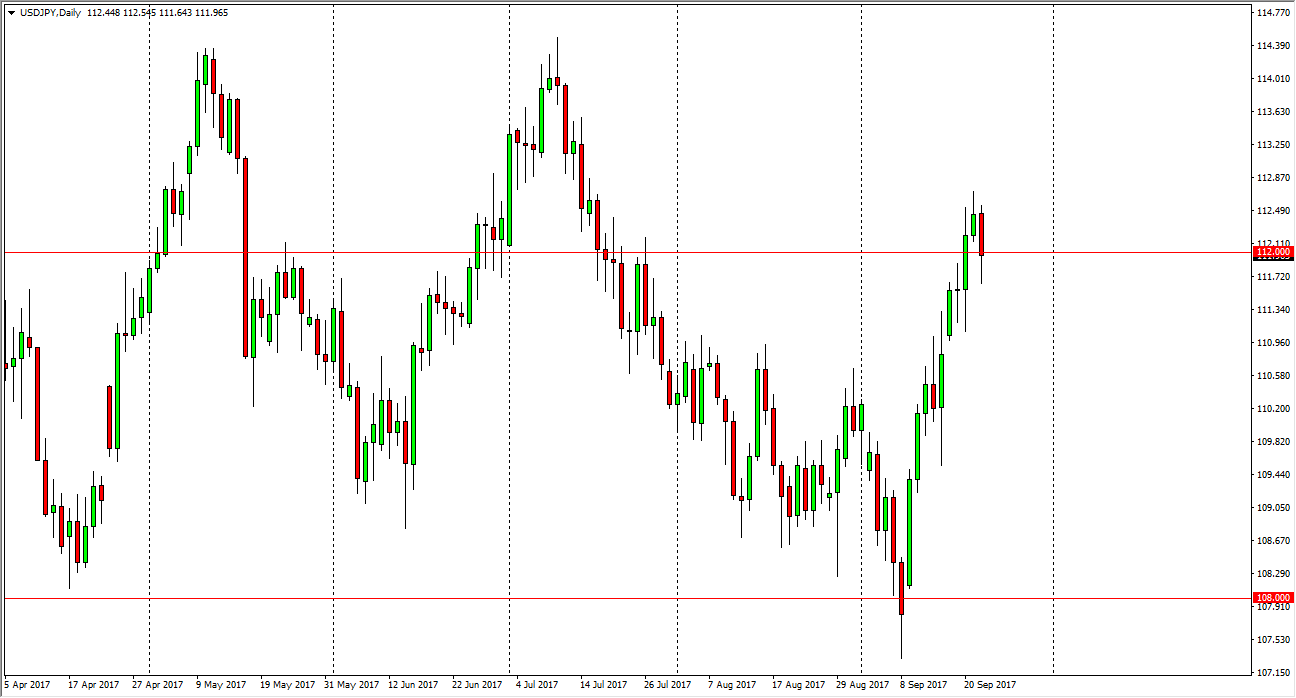

USD/JPY

The US dollar fell against the Japanese yen initially on Friday, but has seen a bit of support just below the 112 level. I find this interesting, because it was resistive in the past, and although we are bit overextended, I believe that the buyers are coming back. I think that there is a simple trade waiting to happen, and that is if we can break above the 112 level, we probably go higher. However, if we were to break down below the bottom of the candle for the session on Friday, I think we may go looking towards 111 for support. I don’t have any interest in shorting this market, the explosion to the upside has been rather impressive, and with the Federal Reserve looking to shrink its balance sheet, I think we are going to continue to see the US dollar gain strength in this market, perhaps reaching towards the 114.50 level above.

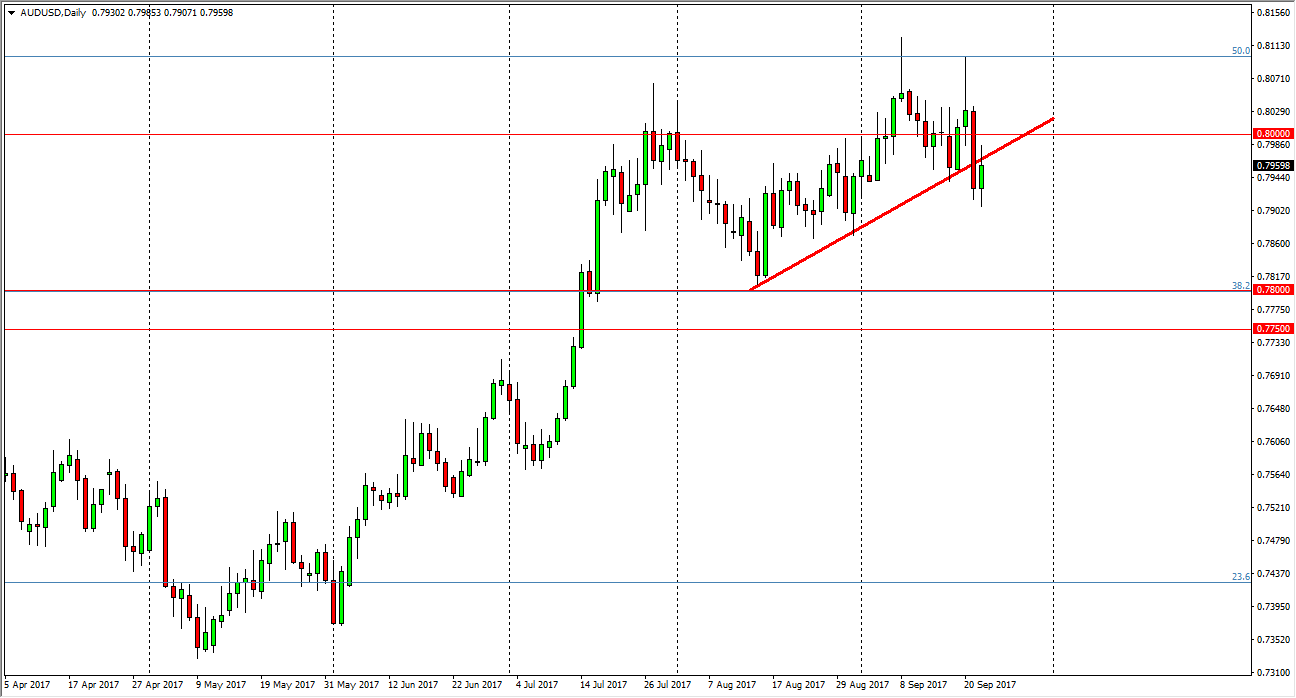

AUD/USD

The Australian dollar has tried to rally on Friday, but gave back quite a bit of the gains towards the end of the day. I think that the Aussie is about to roll over, and there have been a couple of shooting stars above that have given us an idea as to the directionality of this market. I think that the 0.78 level below should be supportive though, so I’m not looking for any type of serious breakdown, rather a pullback to attempt to build up enough momentum to go higher. I believe that there is a strong zone of support between 0.78 and 0.7750 underneath. Any type of supportive candle in that area could be good buying opportunity, but in the meantime, I think this market is continuing to struggle with the idea of 0.80 being broken.