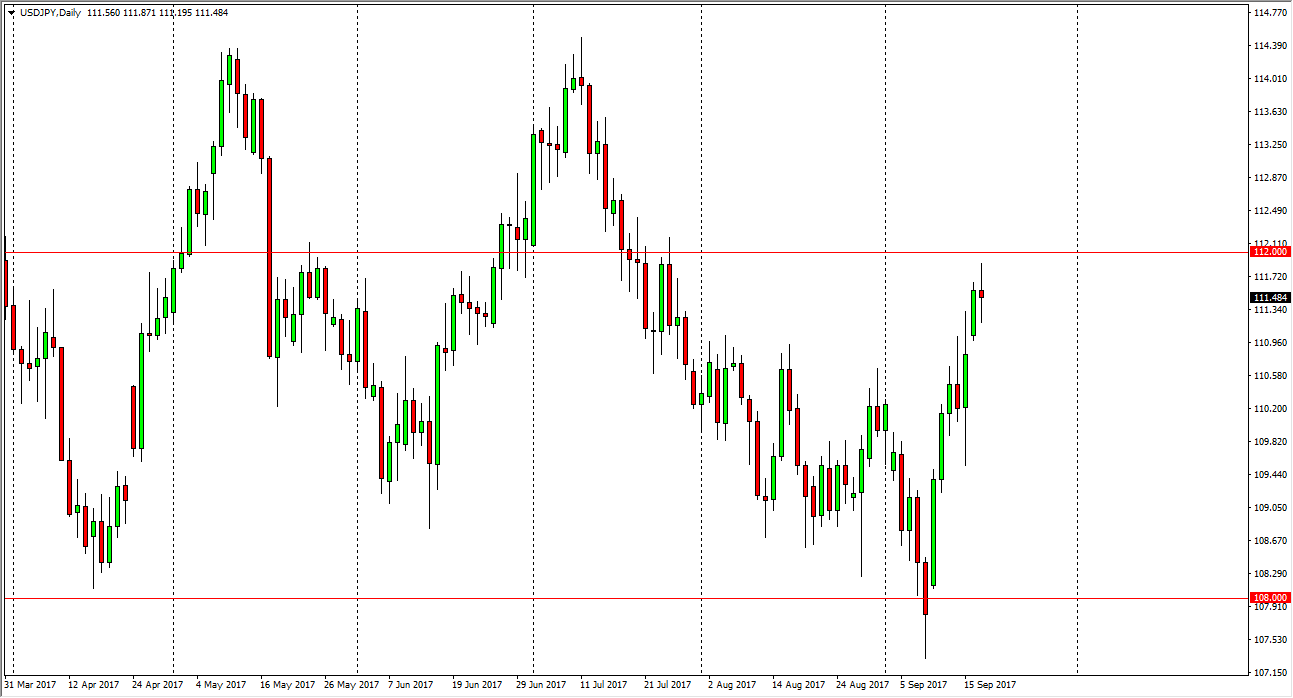

USD/JPY

The US dollar had a volatile session on Tuesday against the Japanese yen, testing the 112 level. That’s an area that has been important in the past, so it’s not surprising that we could not break above it. Beyond that, the market has been a bit overextended, so I think that it’s likely that a pullback could be coming. This will be especially true today, as the Federal Reserve will release a statement after the interest rate announcement. The statement will be very important, as it could give us an idea as to what the monetary policy will be going forward. Remember, the hurricane has done significant damage in the United States, and could very well kind the hands of the Federal Reserve and the short-term, perhaps sending this pair lower. Alternately, if we break above the 112 handle, we probably go back towards the 114.50 level.

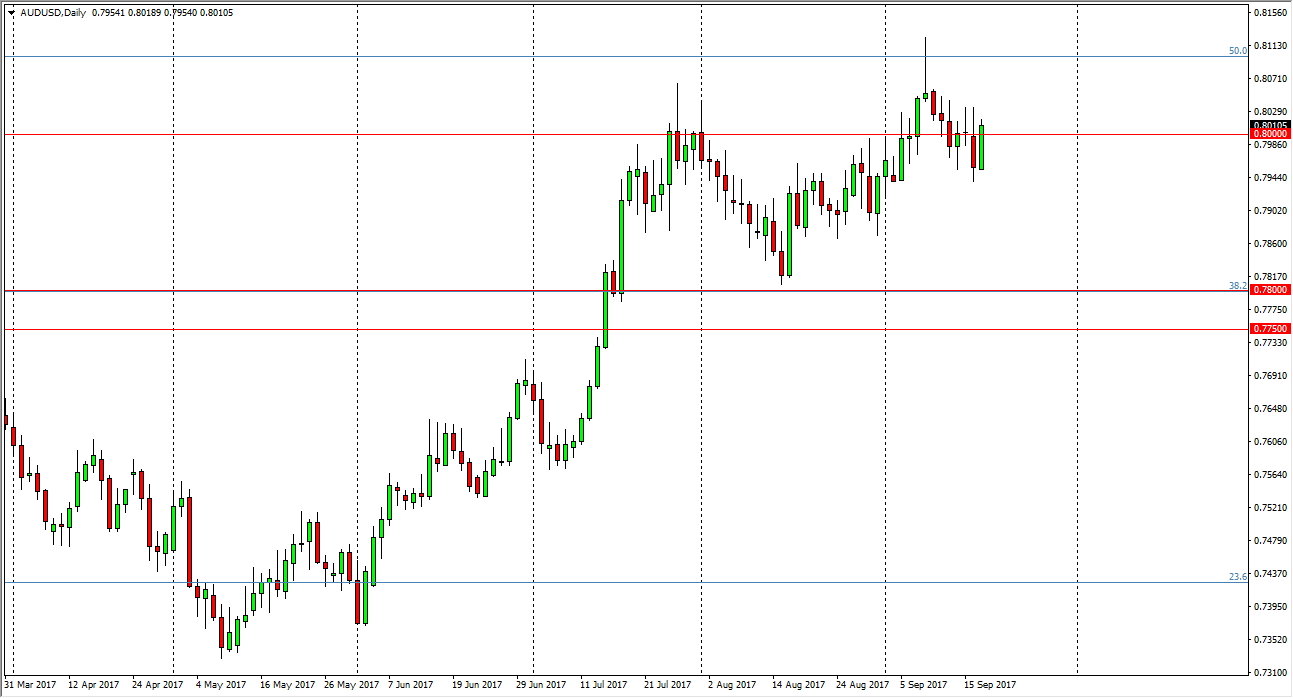

AUD/USD

The Australian dollar had a bullish session, breaking above the 0.80 level during the day. For me, if we can break above the 0.8050 level, the market will probably test the highs again. I believe that longer-term, this market probably goes higher but it needs a bit of help from either the Federal Reserve, or the gold market, or even both. Today could be the day that it gets the help he needs. In the meantime, I would suspect that pullback should be buying opportunities and the 0.78 level underneath should offer significant support. If we were to break down below that level, I think that there is a “zone” of pressure to the upside extending down to the 0.7750 level. We had recently broken out of a significant consolidation area, and that area was the previous resistance, thereby making it a likely candidate for buyers to return.