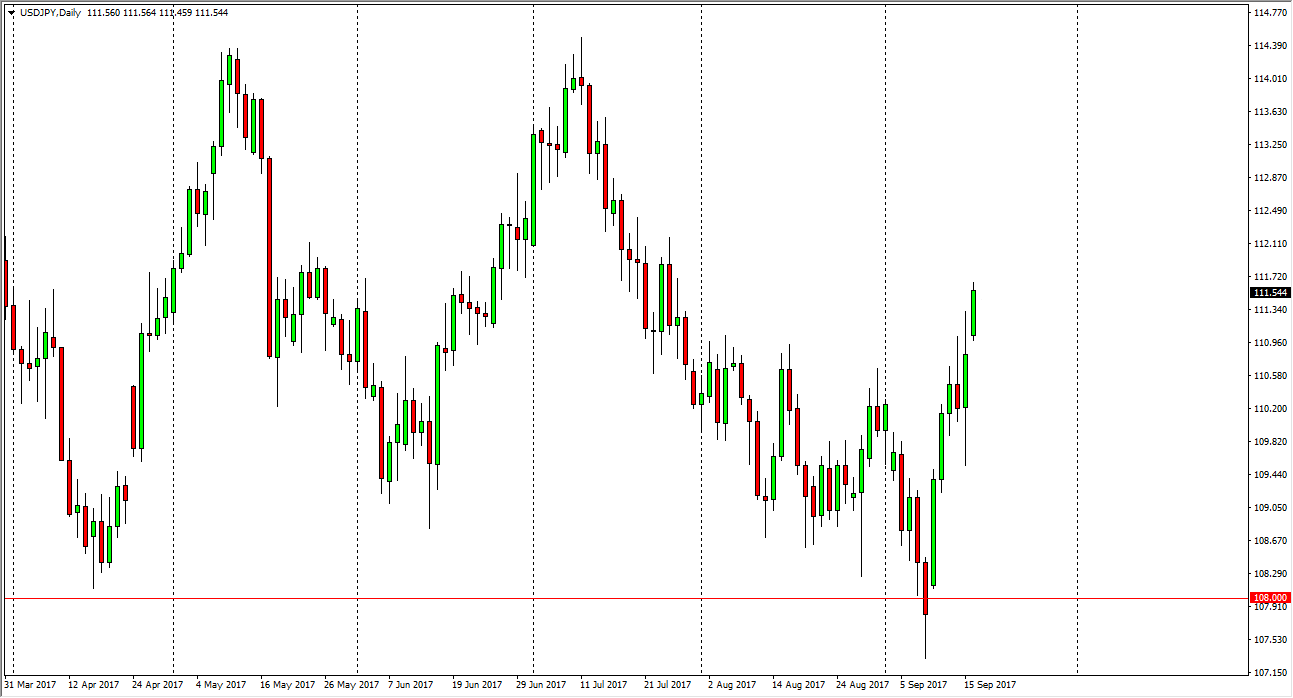

USD/JPY

The US dollar continues to rally against the Japanese yen, as we gapped higher at the open on Monday, and then rode towards the 111.50 level. I think a pullback from here is only going to be a buying opportunity, and I believe that the 111 level will be support. Ultimately, the market could go as high as 114.50 level, and if the stock markets do well, I think this pair will also. I don’t have any interest in shorting, the pair looks to be recovering from the “risk off” trade that we had recently seen due to North Korea. Ultimately, this is a market that is trying to form a longer-term base with the 108 level being the fulcrum point.

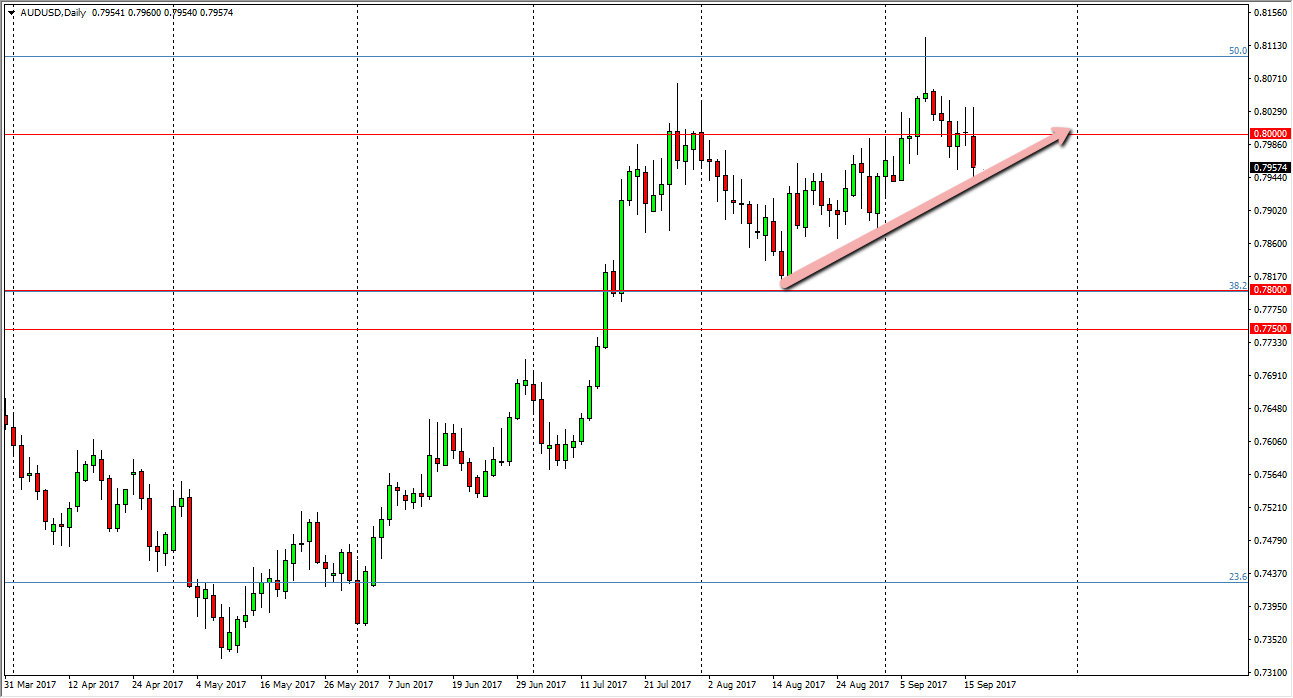

AUD/USD

The Australian dollar initially tried to rally during the session, but found the area above the 0.80 level to be far too resistive to continue going higher. Because of this, we get up forming a rather negative candle, and I believe that the trendline just below should continue to offer support. With that being the case, I think that a supportive candle in this area would be an excellent opportunity to try to build momentum towards the breaking above the 0.80 handle. However, keep in mind the gold markets have a major influence on this pair, and if they continue to fall, we will probably go looking for support closer to the 0.78 handle. If we can make a fresh, new high, then it becomes more of a buy-and-hold situation, and I do think that eventually we do breakout. However, in the meantime it looks as if we are going to be a momentum building mode, and that causes volatility and choppiness. A little help from the gold markets would be great for the Aussie.