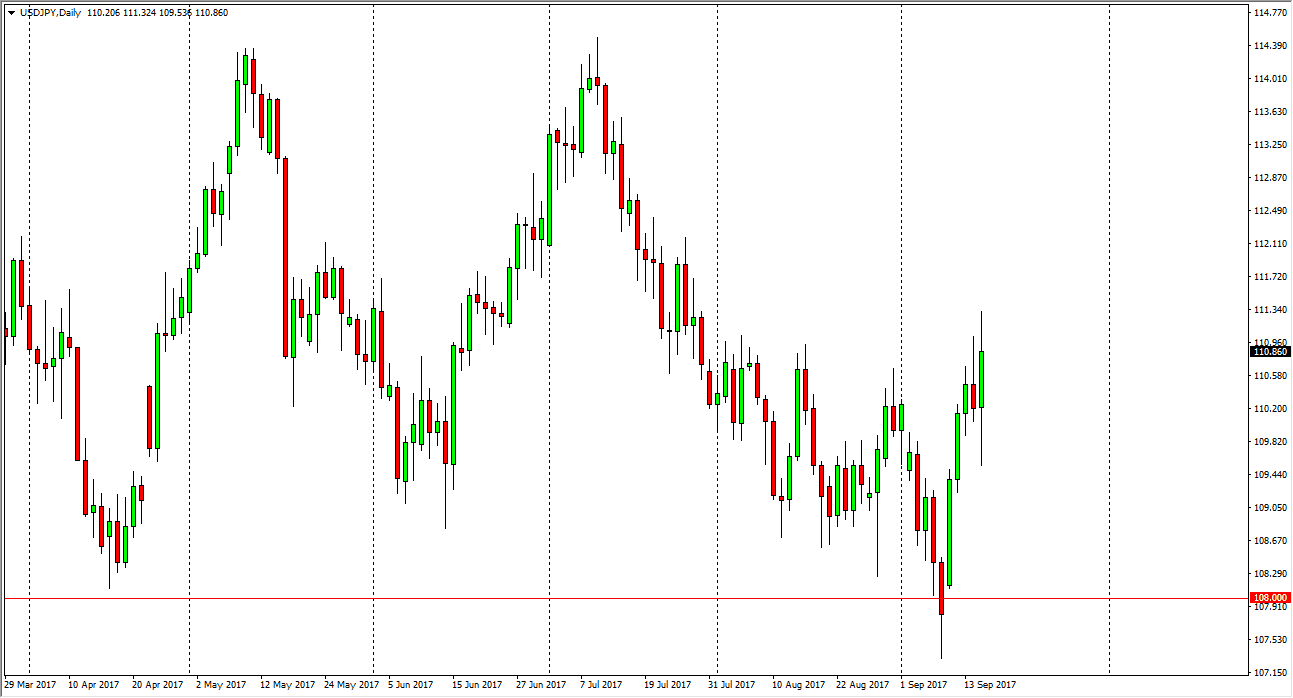

USD/JPY

The US dollar rallied against the Japanese yen during the trading session on Friday, as we have seen a significant amount of volatility during the Asian session. However, by the time America got to work, the “risk on trade” had been back in vogue. Because of this, looks as if we are getting ready to try to break out, and he move above the 111 level should send this market looking for the 114.50 level above. With that being the case, I like the idea of buying short-term dips, and I believe we could go as high as 114.50 over the longer term. I don’t have any interest in shorting, I believe that there is a lot of noise between here and the 108-level keeping this market higher. What really sold me on the idea of going long is the fact that the negative reaction to the North Korean launch was so muted.

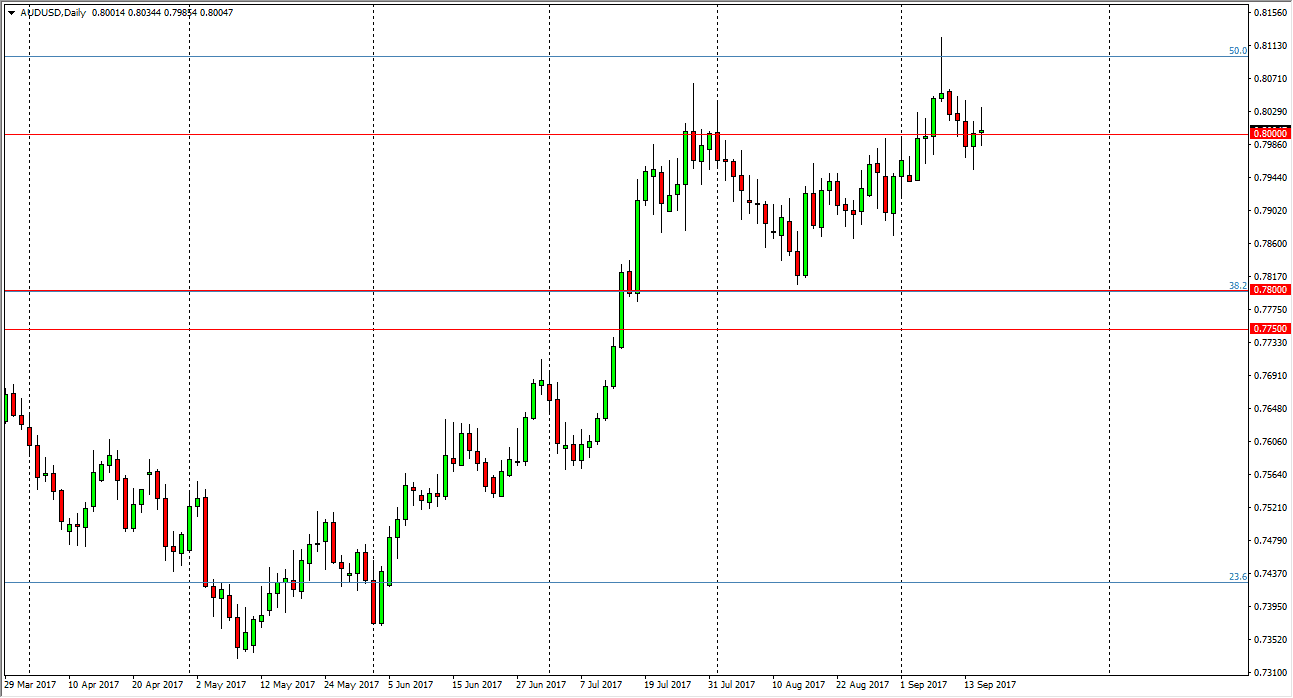

AUD/USD

The Australian dollar had a volatile session, initially rally during the day on Friday but turned around to form a shooting star. Because of this, we could get a bit of negativity but I believe that eventually the buyers will return. The 0.0 level is vital on longer-term charts, and I believe it’s only a matter of time before the buyers get involved and push this market as high as the 0.90 level. Ultimately, I think that the market should continue to see volatility, but the longer-term trader will probably hang on to the Australian dollar, especially if we get some sort of bullish pressure in the gold markets, which can have a massive effect on the Australian dollar going forward, as we should see plenty of help in that scenario. I believe that there is a “floor” in the market near the 0.78 handle.