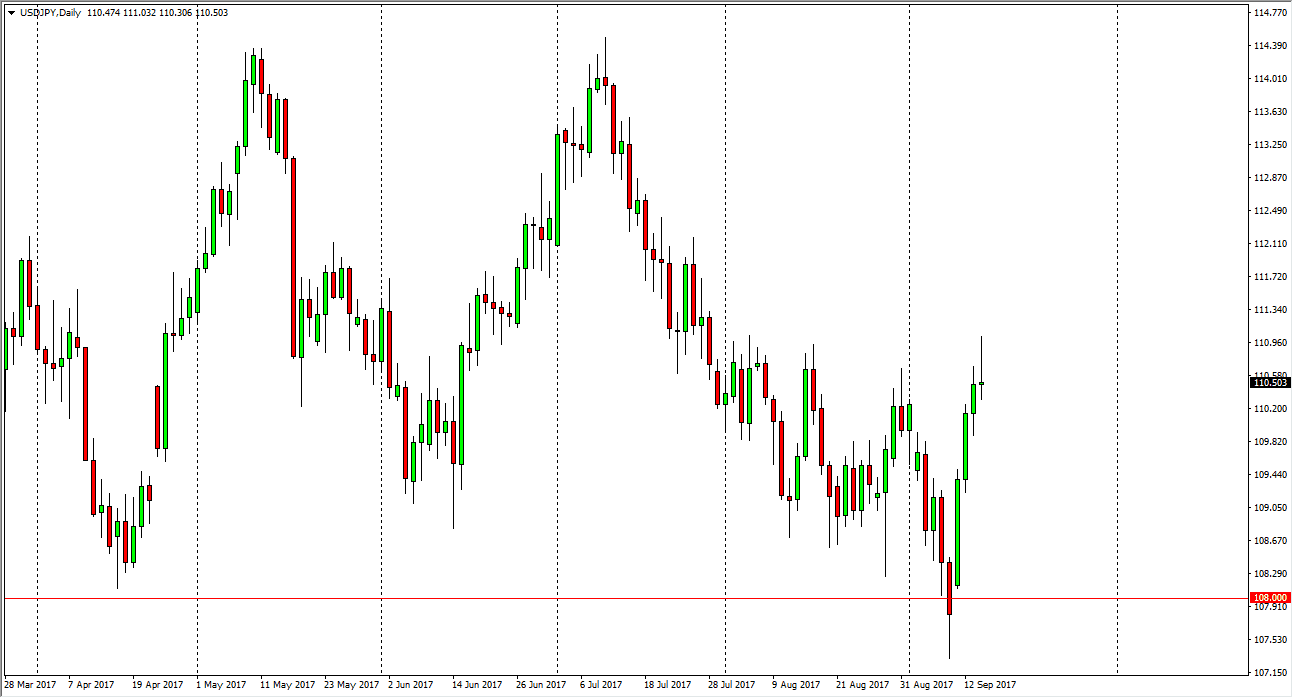

USD/JPY

The US dollar initially rallied against the Japanese yen during the day on Thursday again, but found enough resistance at the 111 level to turn around and form a shooting star. A break below the daily candle is a negative sign, and probably leads to a pullback. I think a pullback is necessary, but I do recognize that we break above the 111 level, then the market should continue to go much higher. Most of the selloff in this pair was due to North Korean tensions, so keep that in mind as well. I believe that given enough time, the buyers will continue to push higher, but a pullback may be necessary over the next session or so as we have gotten far ahead of ourselves.

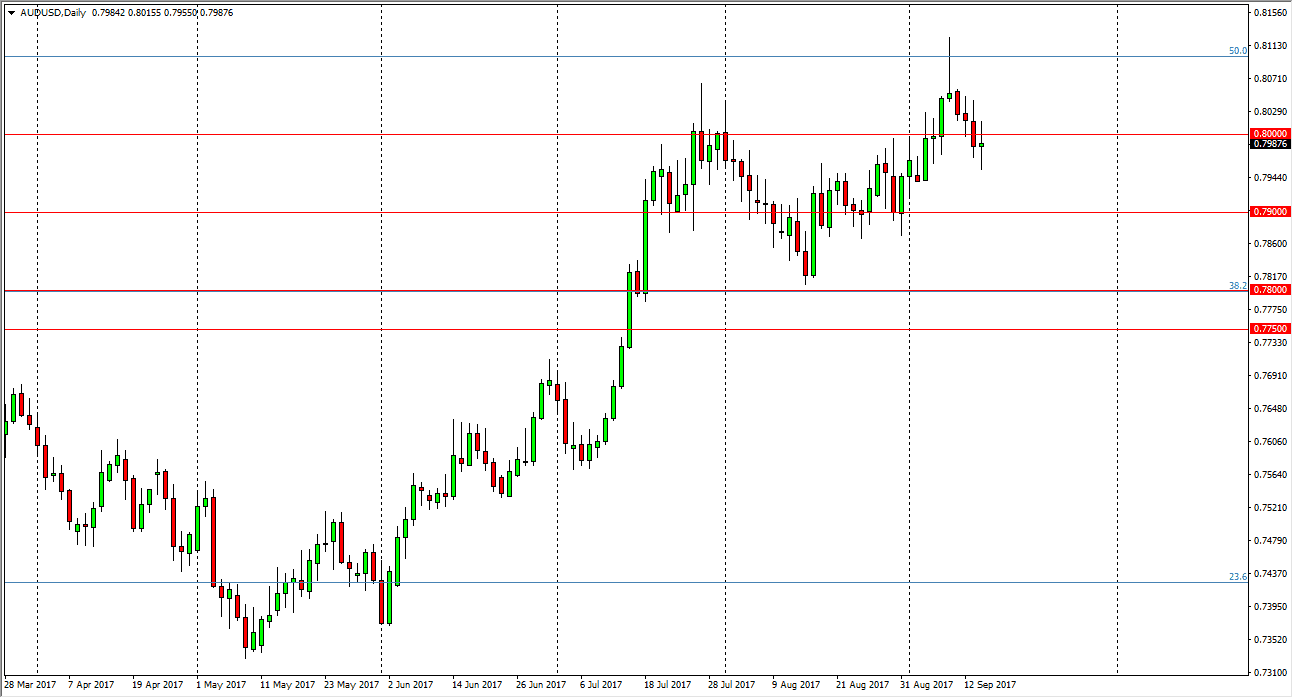

AUD/USD

The Australian dollar went back and forth during the session on Thursday, as we continue to dance around the 0.80 level. If we can break above the top of the candle for the session on Thursday, I feel that the market will go looking towards the 0.81 level above. Alternately, if we break down below the candle for the session, we could go looking for support at the 0.79 level, but nonetheless I do believe that the longer-term uptrend is still intact, and that we are simply trying to build up enough momentum to go higher. If gold rallies, that should give us just enough momentum to continue going higher as well. I have no interest in shorting, because I see a massive “floor” in this market somewhere near the 0.78 handle, and therefore I think any breakdown in this pair will be short-lived at best. Longer-term, I think that the market will probably go looking towards the 0.90 level, but that may take months to get to.