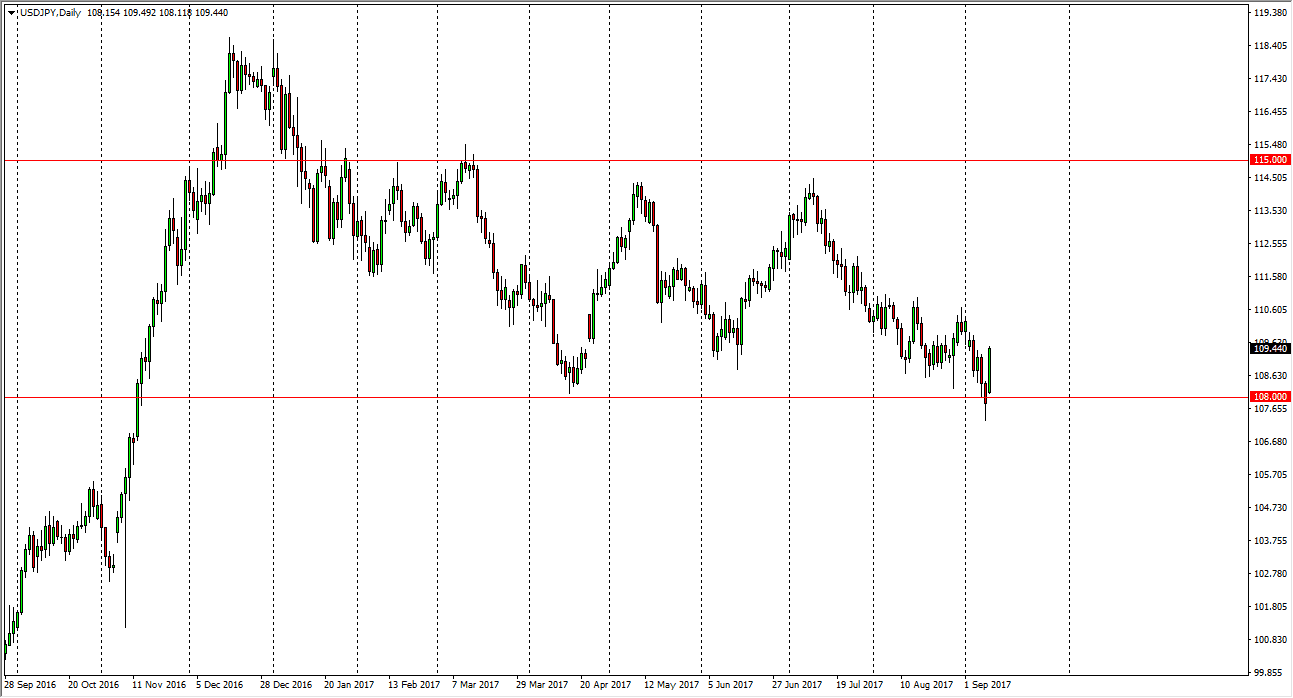

USD/JPY

The US dollar rallied on Monday, using the 108 level as support. It now looks as if we are going to reenter the previous consolidation area, but I think we need to clear the 111 level to feel comfortable. There is a lot of noise in this market, and a lot of what has been driving this pair lower has been fear of an escalation in the North Korean situation. As the weekend was relatively quiet, the Japanese yen sold off against most currencies, the US dollar included. Also helping the US dollar was the hurricanes have not caused as much damage at once feared. Because of this, I believe that the market will continue to find buyers on dips, but keep in mind that it wouldn’t take much to have people scared again and shorting this pair. With these issues, expect a lot of volatility.

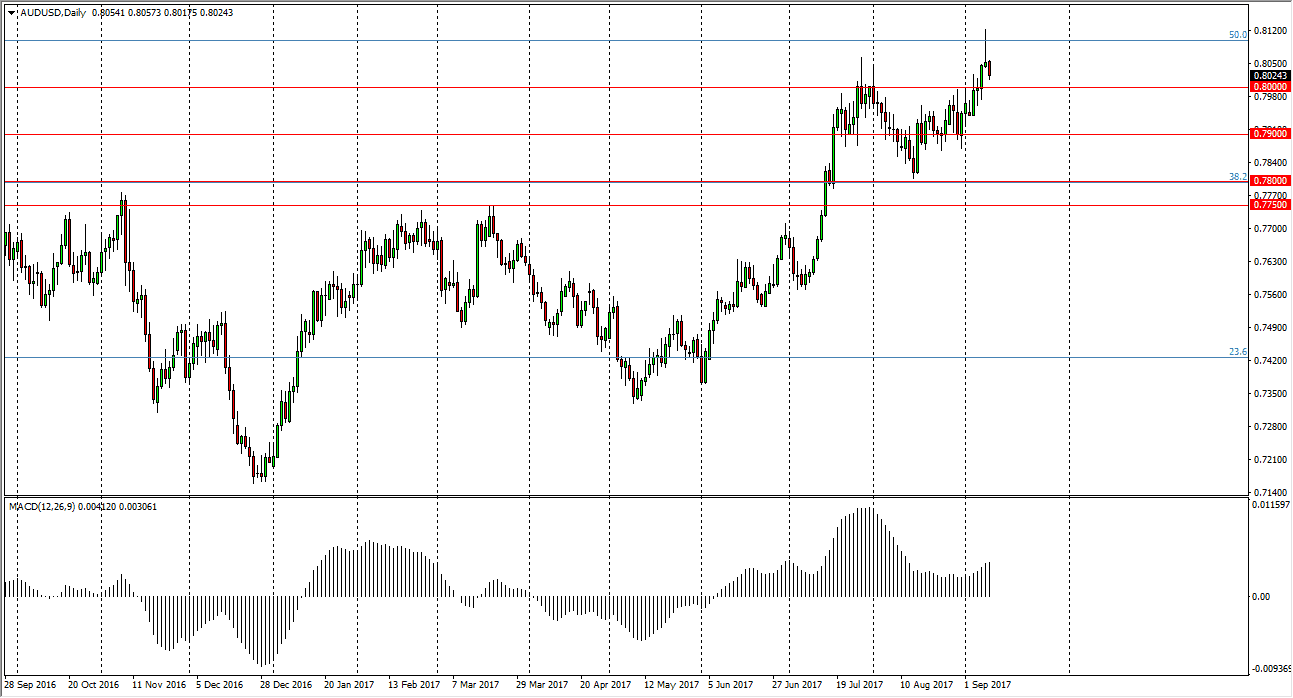

AUD/USD

The Australian dollar fell on Monday, breaking towards the 0.0 level. I believe that if we break down below that level, the market will go quite a bit lower. The 0.78 level would be my first target. I think that the divergence that we see between price action and the MACD could be a warning. Quite often, this ends up being a nice selling opportunity. I don’t necessarily think that the market is going to roll over completely, but I recognize that there is a significant amount of trouble just ahead, and gold markets have not exactly performed stringently during the session. Gold rolls over, I don’t see the reason the Australian dollar will continue to go higher. The shooting star from Friday was a wicked one, and suggests that we could be running into a bit of exhaustion. The US dollar had a strong day on Monday against most currencies, and we could be seeing a bit of a relief rally for the greenback.