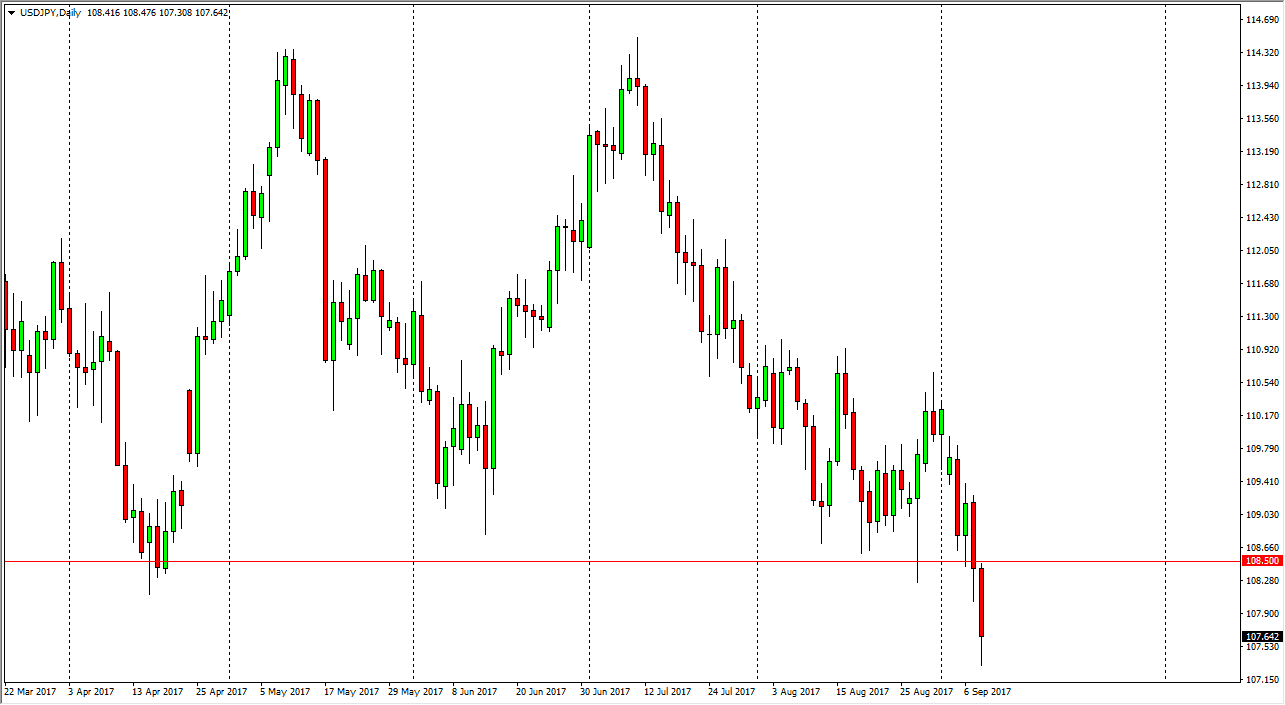

USD/JPY

The US dollar fell significantly against the Japanese yen during the Friday session, and more importantly, broke below the 108.50 level. This is a very important development, as it was the bottom of Major consolidation. Now that we have broken below there, I think that short-term rallies should offer selling opportunities as we can go lower, perhaps reaching towards the 105 level over the next several sessions. I don’t have any interest in buying this pair until we break above the 110 handle, which is something that I don’t expect to see. I think that the Federal Reserve is very unlikely to raise interest rates this year after the hurricanes, so having said that it makes sense that this market should continue to go to the downside.

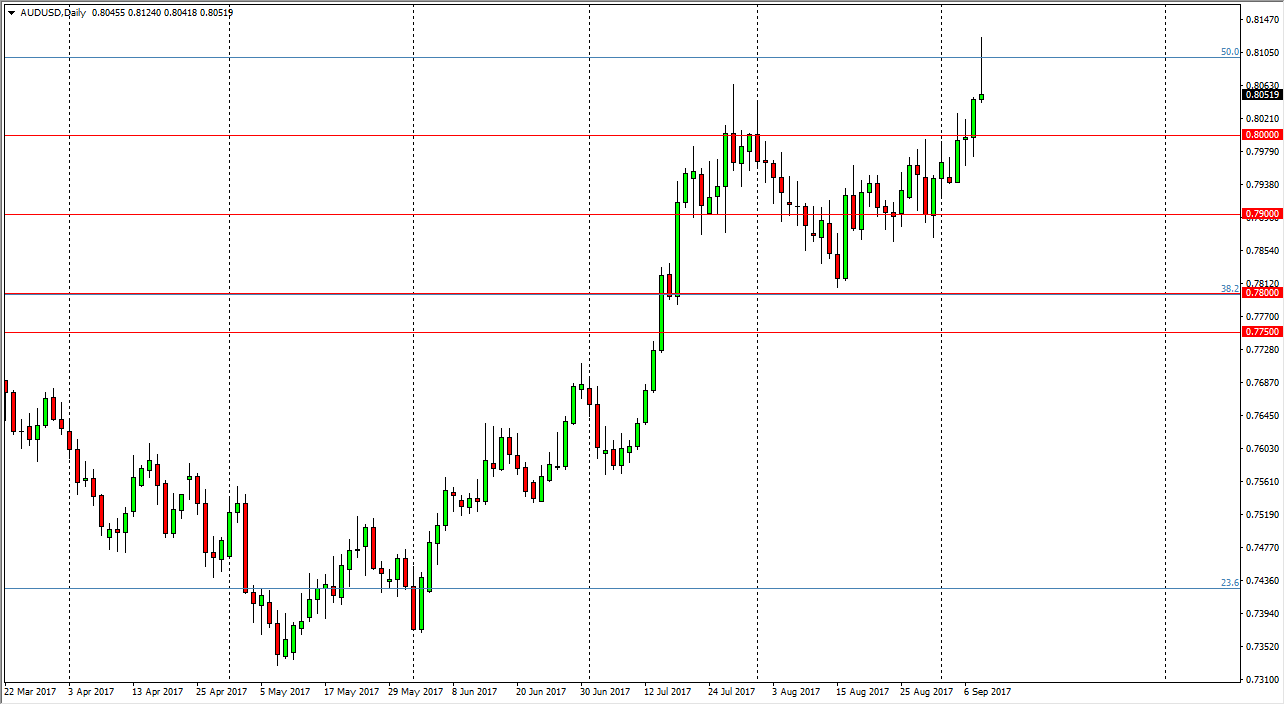

AUD/USD

The Australian dollar initially spiked higher during the day on Friday, turning around to form a shooting star. The 0.81 level has been massively resistive, as the 0.80 level is a fulcrum for decades going back. I think that the area that we have just tried to break through was a general range of resistance that is significant for the market. If we pull back from here, I would expect buyers to come into the marketplace, but I will wait for a supportive daily candle to get going forward. Alternately, if we break above the top of the shooting star, that’s a very bullish sign just waiting to happen, and if it does, I would expect that the market should go much higher. In the way, I think it’s only a matter of time before the Australian dollar continues to go to the upside, as the Federal Reserve looks very unlikely to raise interest rates. I’ve either buying a breakout, or a pullback to show signs of support.