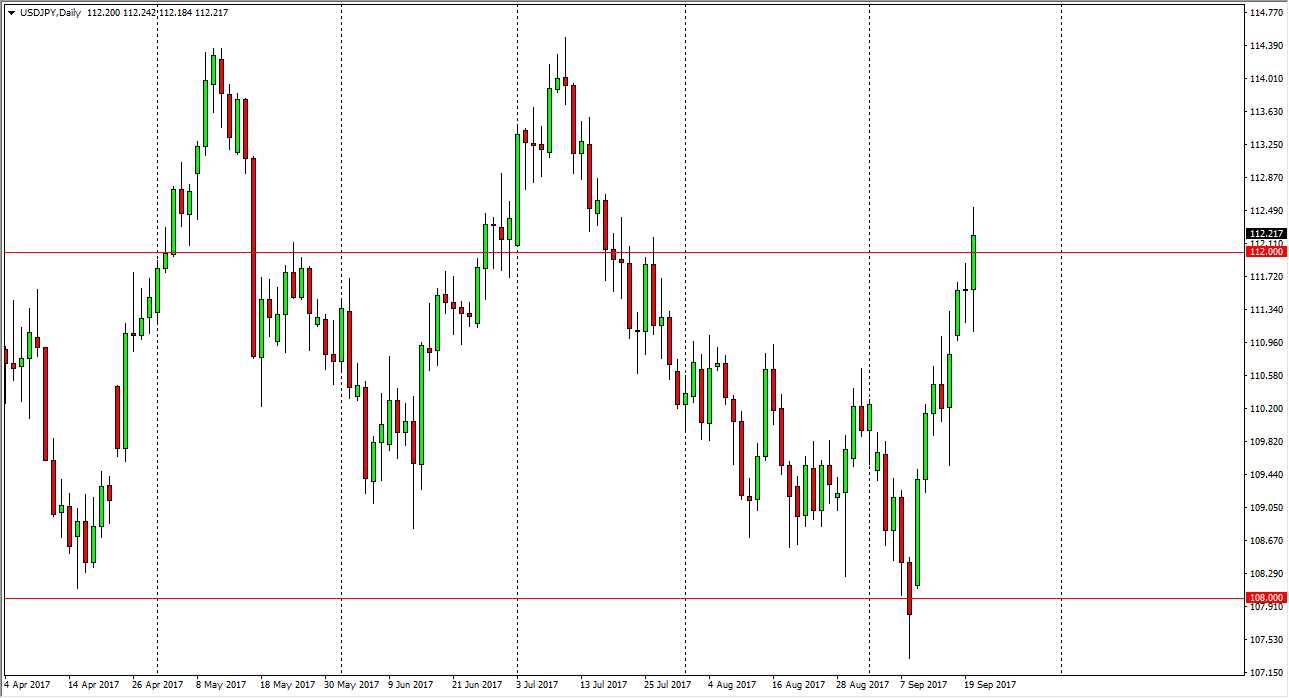

USD/JPY

The US dollar rallied a bit during the day on Thursday, breaking above the 112 level. The market has shown signs of life again, as the US dollar has picked up value against most currencies. This was mainly due to the Federal Reserve on Wednesday suggesting that they were going to continue to unwind in the balance sheet, and that of course is a very bullish sign for the US dollar. Breaking above the 112 level should send this market looking towards the 114.50 level which was the top of the recent consolidation area. I think pullbacks should more than likely be buying opportunities, and quite frankly they could be healthy as we have been a bit overbought. Ultimately, this is a market that will continue to see volatility but I believe that there is plenty of support underneath to keep this market afloat.

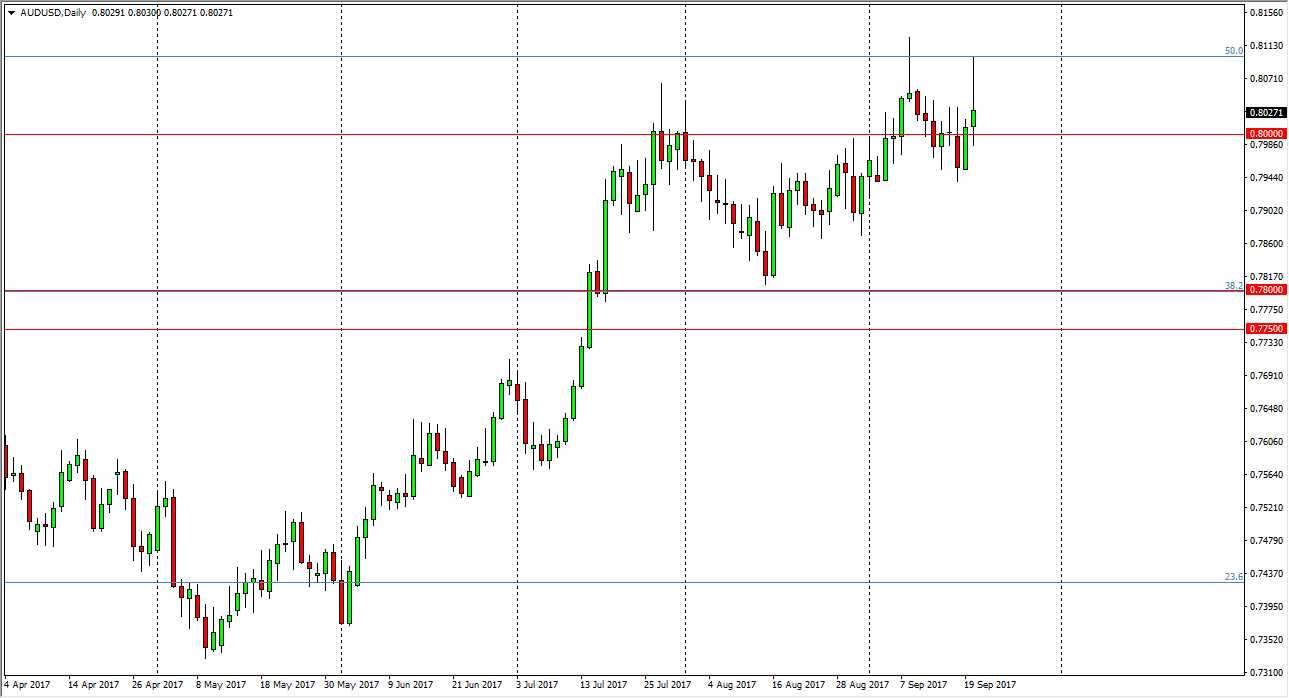

AUD/USD

The Australian dollar has fallen a bit during the day on Thursday, breaking below an uptrend line. I think that the market may go back towards the 0.78 level underneath, as the US dollar is favored over most currencies after the Federal Reserve has suggested that it was going to unwind its balance sheet. With this in mind, the gold markets have also rolled over a bit, breaking below the $1300 level. This is negative for the Australian dollar, I think we are going to see some softness, least in the short term. Because of this, I would anticipate that we will retest the breakout region below near the 0.78 handle, and that the next couple of sessions could be negative. Ultimately, I think that’s where the real decisions are made, but between now and then, I would expect that sellers will be very attracted to the Aussie.