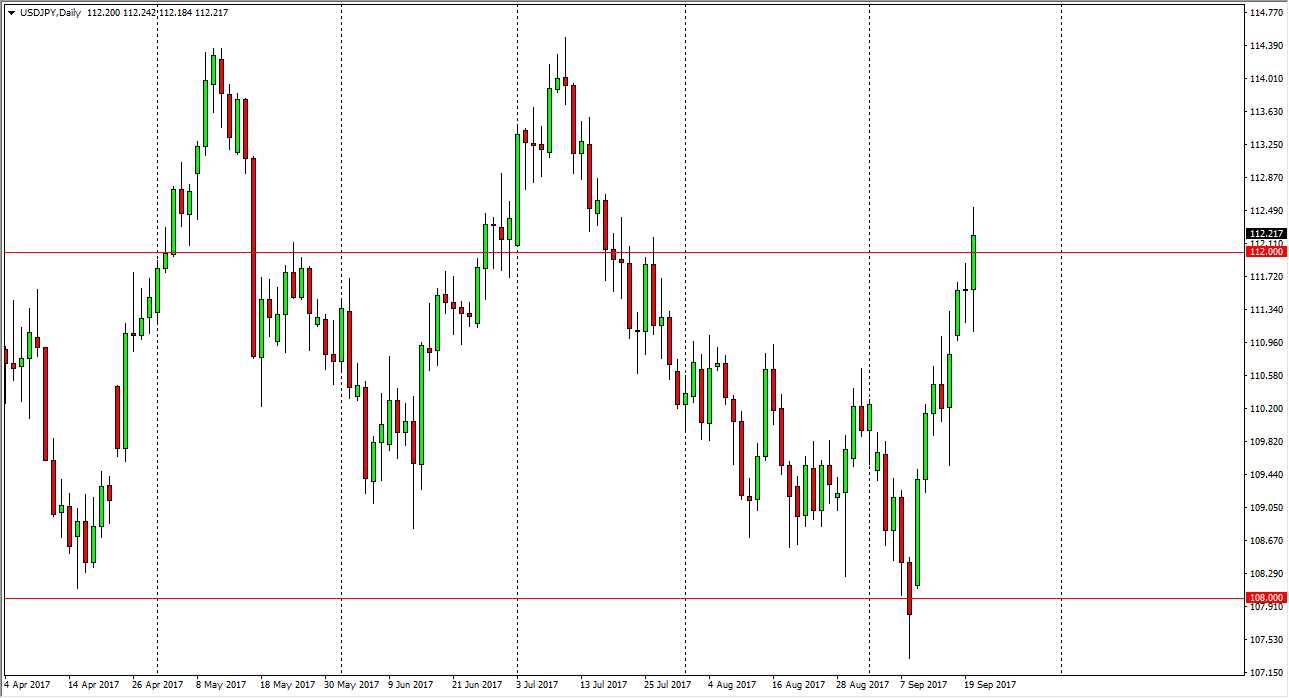

USD/JPY

The US dollar initially fell against the Japanese yen as we had been a bit overextended, but after somewhat hawkish comments coming out of the Federal Reserve, we broke above the 112 level. I now think that the market probably goes looking towards the 114 handle above, perhaps the 114.50 level. With this in mind, I think that it is only a matter of time before the buyers come in and pick up pullbacks, as the market has yet another reason to go higher. The longer-term consolidation looks likely to continue, but if we can break above the 115 level, this market should go much higher. I have no interest in shorting, least not now, and I believe the pullbacks will continue to offer value.

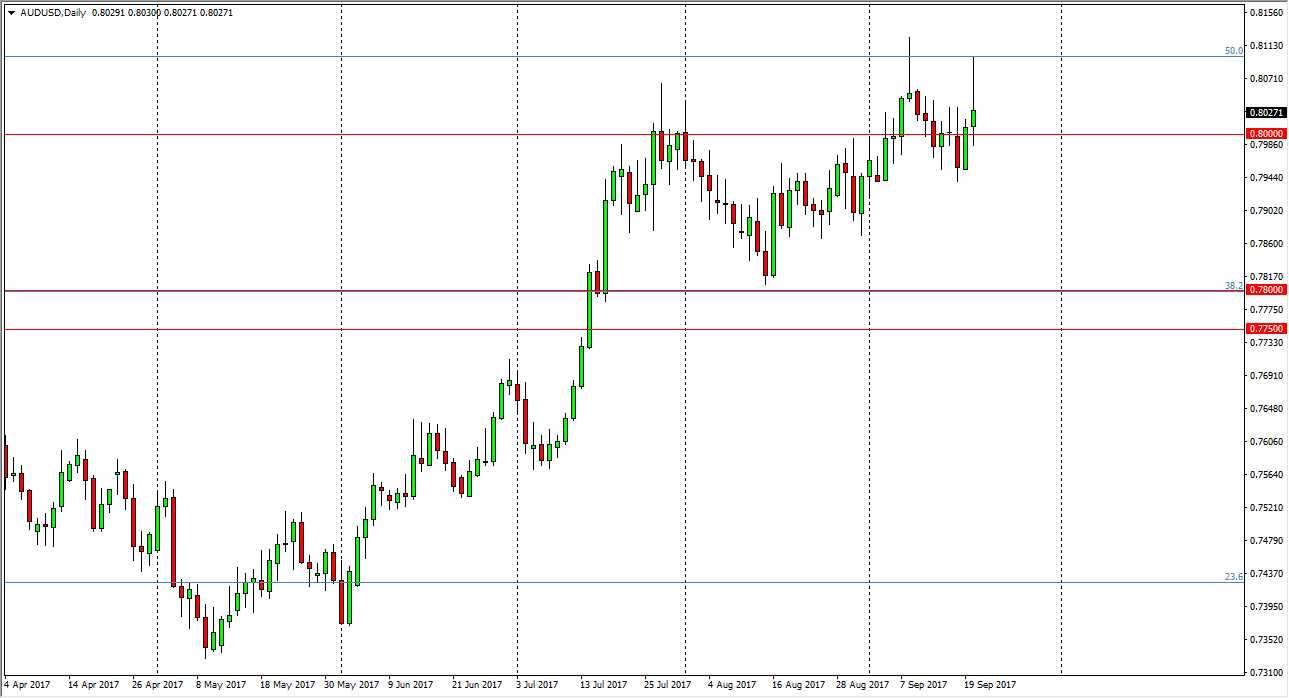

AUD/USD

The Australian dollar initially tried to rally during the day, but found enough resistance above to turn around and form a shooting star. That’s an interesting candlestick, because quite frankly gold markets are falling as well. I think that the Australian dollar could roll over, and the previous shooting star suggested that we had reached some type of short-term top. Now, we have formed a shooting star at a lower level and that could be signs of trouble. Nonetheless, we are at the 0.80 level which has been a fulcrum for price over the last several decades, so I think that this will continue to be a very choppy market, and volatile to say the least. The 0.7750 level underneath continues to be my “floor” in the market, so if we can stay above there, I still believe that there are plenty of buyers willing to jump in. Alternately, if we make a fresh, new high, then it’s time to start buying this pair. I think we are you need help from the gold markets though, which is probably asking a bit much.