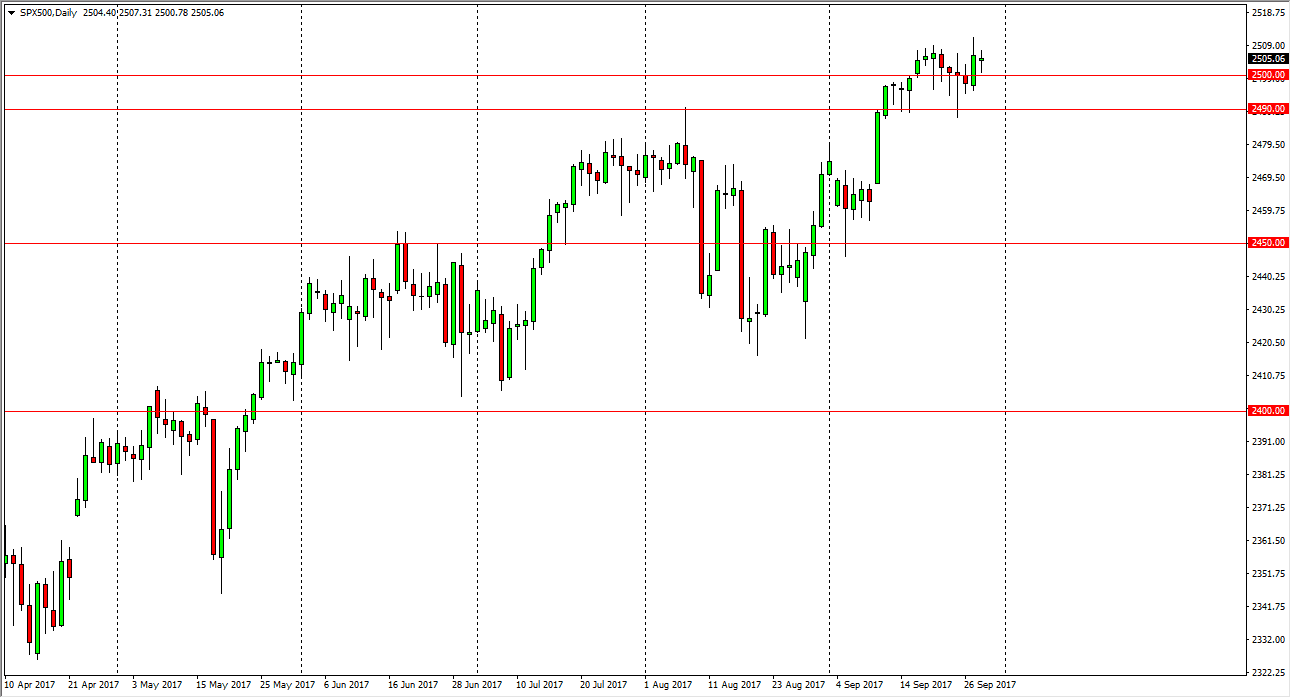

S&P 500

The S&P 500 initially fell during the session on Thursday, but found enough support at the 2500 level to turn around and form a hammer. The hammer of course is a bullish sign, and a break above the top of the candle should send this market looking for the highs again. I believe that this is a “buy on the dips” mentality that we are continuing to see, as we have formed a bit of a base near the 2490 level. By breaking above the 2500 level, that is a bullish sign and I think we continue to go much higher. I have no interest in shorting this market, as I believe that the markets continue to find plenty of reason to go higher and of course there is quite a bit of automated algorithmic trading that continues to look at these dips as value. Longer-term, I’m looking for 2450.

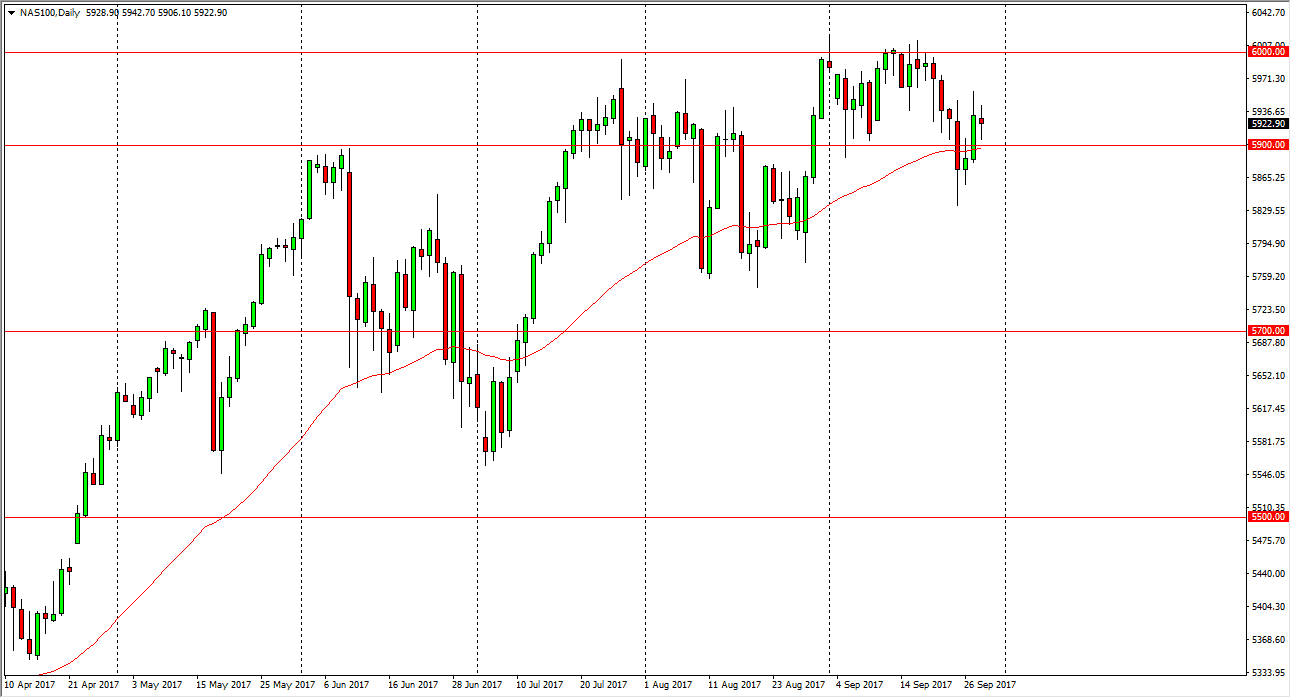

NASDAQ 100

The NASDAQ 100 initially fell but turned around to form certain amount of bullish pressure as we formed a hammer. The 5900 level is supportive, and a break above the top of the candle should send this market towards the 6000 handle, as the market continues to be bullish, but it does lag a little bit, as there has been a sector rotation from the technological sector into the industrial sector. I believe that eventually we will go looking for the 6000 handle, and then finally break above it. Once we do, the NASDAQ 100 should continue to explode to the upside. We are forming a little bit of an ascending triangle, and therefore I think that the move based upon the potential measurement could send this market looking for the 6200 level.