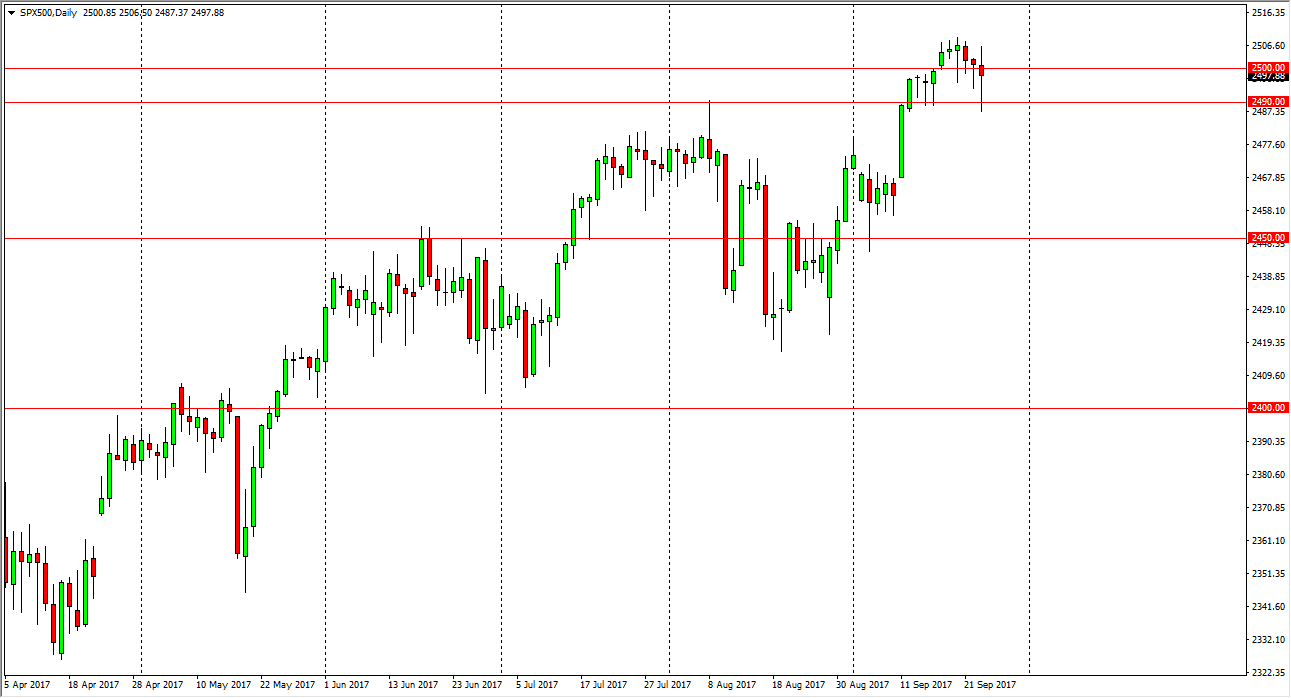

S&P 500

The S&P 500 had a very volatile session on Monday, as we reached towards the 2490 level but found plenty of support there. By turning around completely, it looks as if we are still in the “buy the dips” mentality that we have seen for so long, and it looks very likely that the market is ready to continue going higher. A lot of that negativity was due to comments coming out of North Korea, and essentially would have been written off as noise more than anything else. Ultimately, the market looks as if it is ready to continue going higher, and now I think this session should be looked at yet another example of the stubborn bullishness in this market. Given enough time, I believe that we will see a fresh, new high.

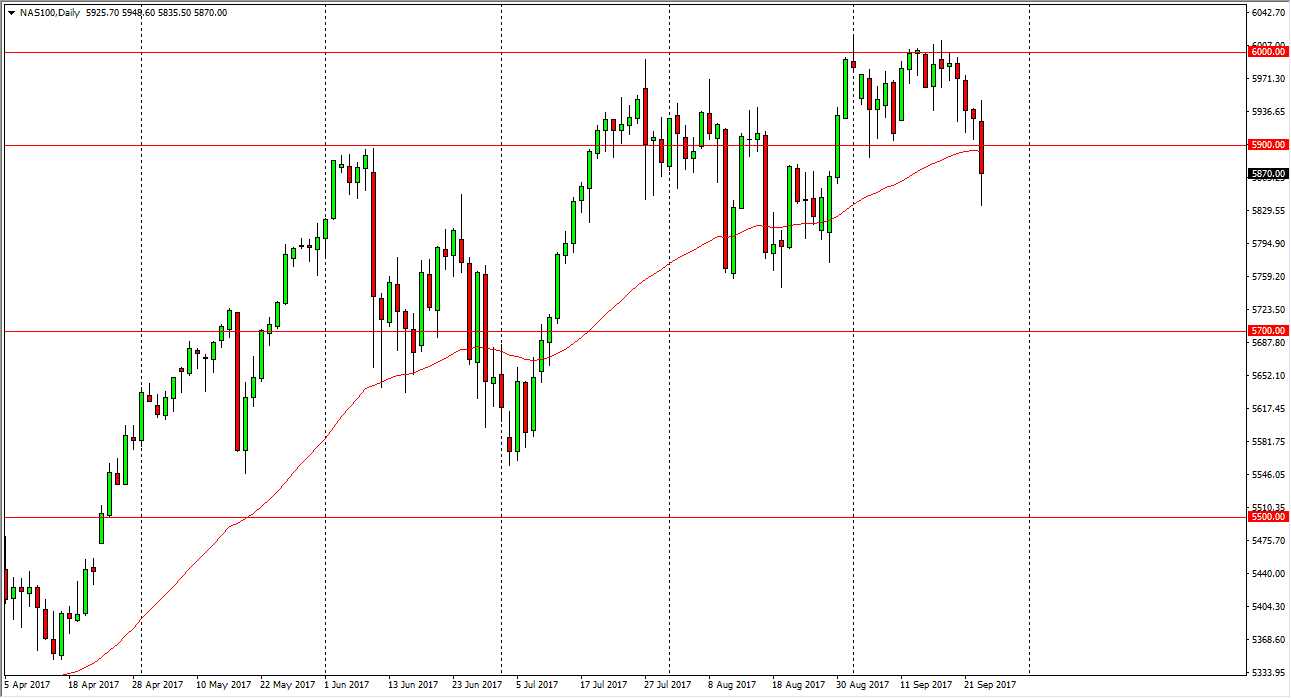

NASDAQ 100

The NASDAQ 100 initially tried to rally but then broke down below the 5900 level. We had an extraordinarily bearish candle formed for the day, but we have rallied a bit towards the end of the day. I believe that the NASDAQ 100 is still going to be bullish longer-term, but I believe it will be a laggard when it comes to US stock indices. I believe that the S&P 500 and the Dow Jones 30 both will move quicker to the upside as we continue to see a rotation out of the tech stocks, and into industrials. I believe that if we can break above the 6000 level, that is a longer-term resistance barrier that given they move above would be a very positive move in this market, and I think would signal that we are going to see another leg higher. I think it’s going to be much more difficult to break out in this market, but eventually the buyers should do so.