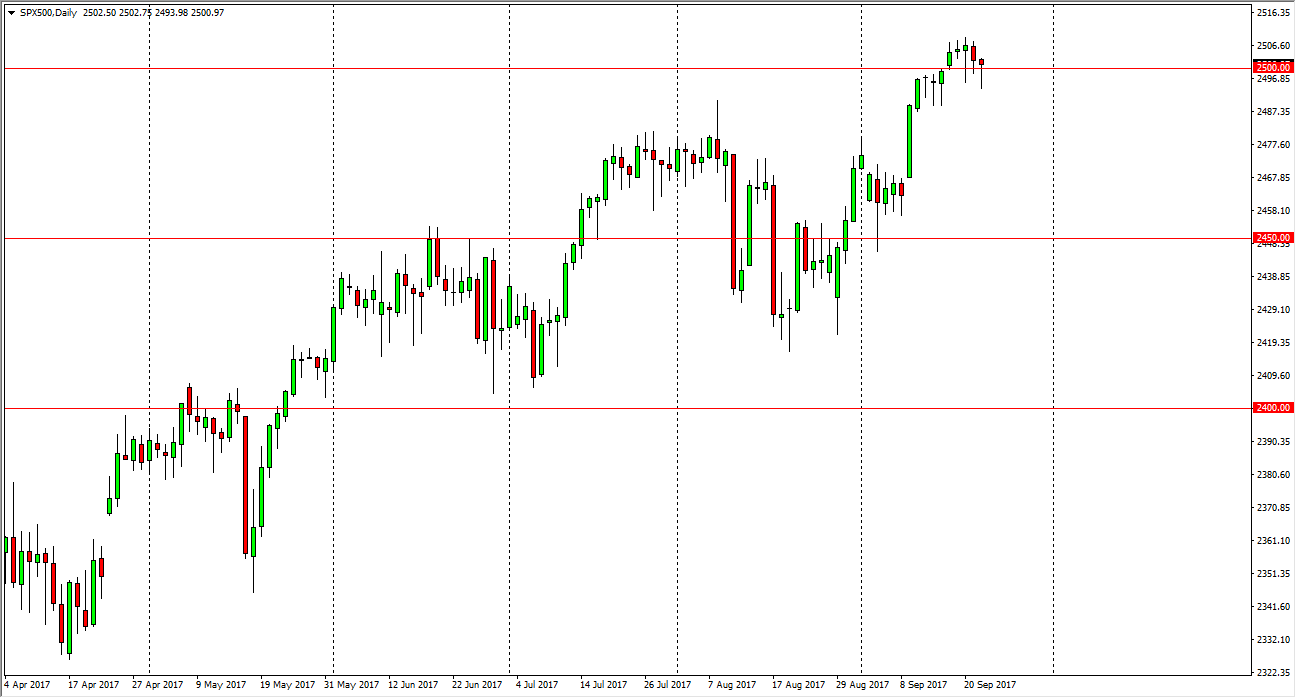

S&P 500

The S&P 500 initially trying to fall on Friday but found enough buyers underneath the 2500 level to turn things around and form a nice-looking hammer. Because of this, I believe that the buyers are trying to make a stand here, and that we will more than likely find buyers of dips, and of course momentum to the upside. If we can break above the 2510 level, then I think we are free to go much higher. Recently, we have seen quite a bit of volatility, but that looks to me like position sizing and perhaps momentum building work being done by traders. I believe that we will eventually go looking for the 2525 handle above, and that pullbacks continue to offer value the traders are willing to take advantage of.

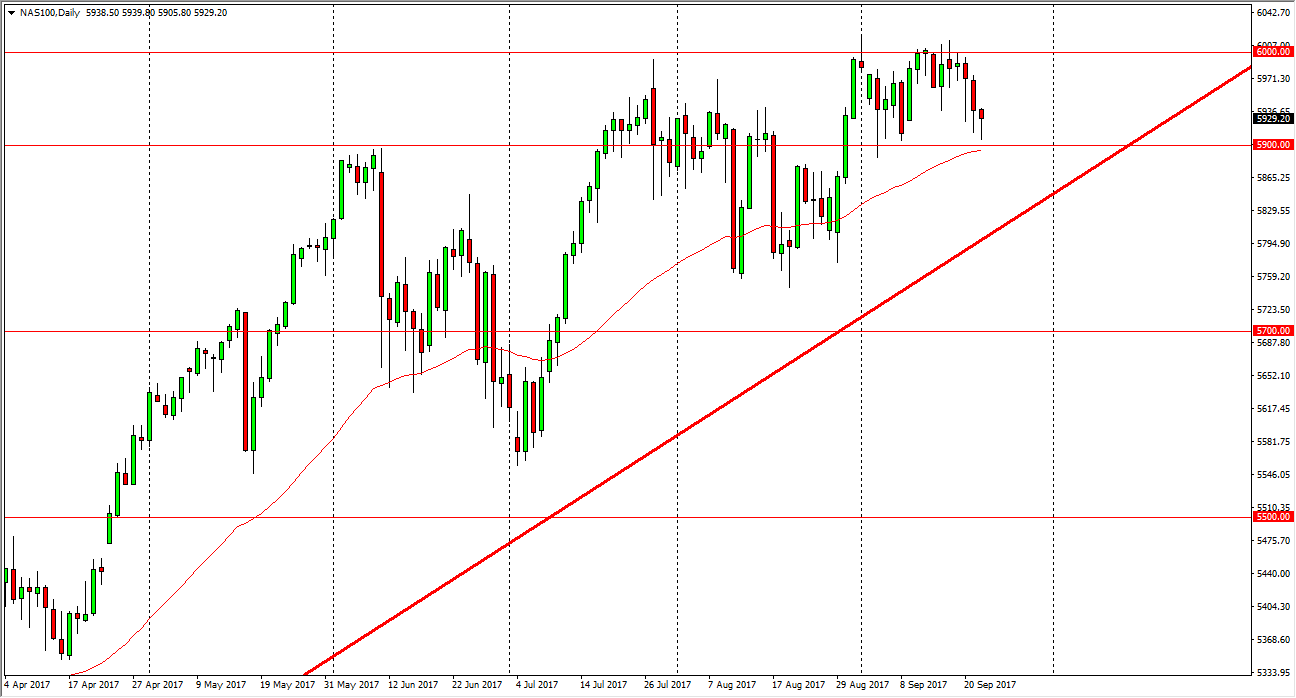

NASDAQ 100

The NASDAQ 100 initially fell on Friday but found enough support just above the 5900 level to continue to push this market higher later in the day. We have the 50-day exponential moving average just below, and the fact that we ended up forming a hammer tells me that the market is probably going to attempt to reach the 6000 level again. Eventually, we should build up enough momentum to break that significant barrier. In the meantime, I think that buying dips continues to be the way going forward as we are trying to build up more momentum. Once we get that momentum, then it becomes more of a “buy-and-hold” scenario. In the meantime, you should be thinking about value, and what lower pricing offers. There is a massive uptrend line below, and of course the 5900 level has offered significant support recently. I like this market, but it could be a trade that you need to be very patient with.