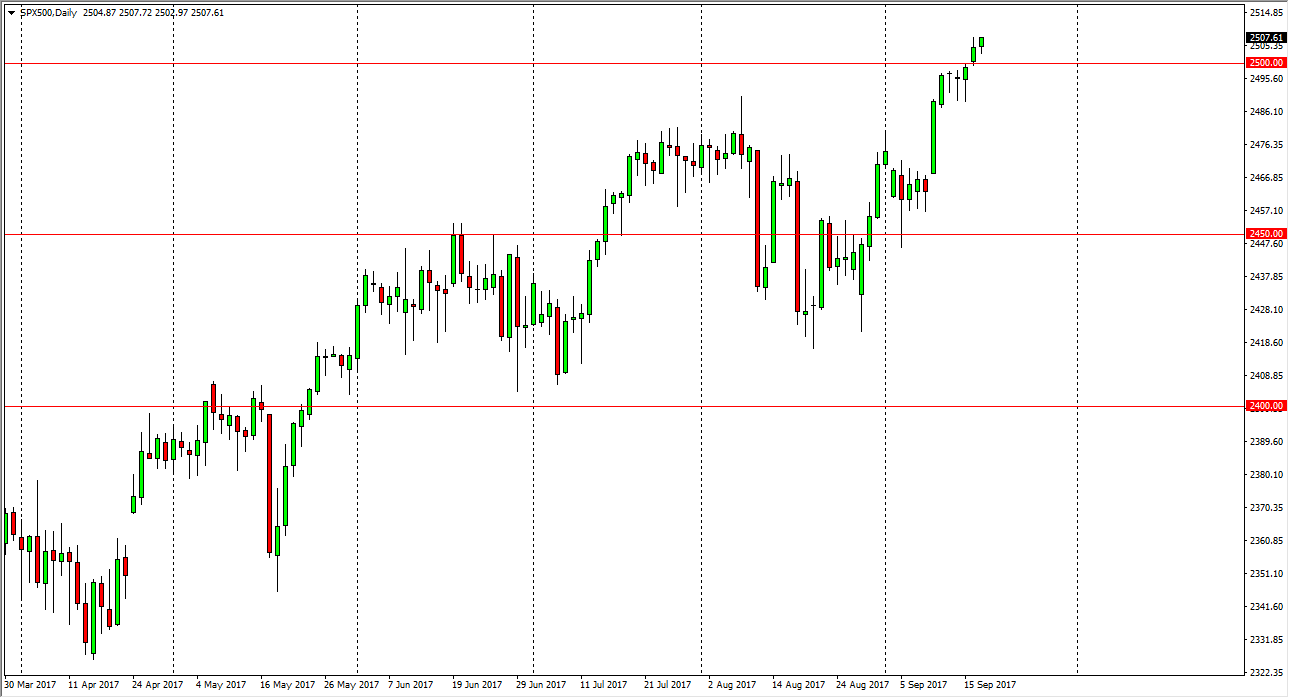

S&P 500

The S&P 500 was choppy during the session on Tuesday, as we continue to find buyers every time we pull back. The 2500 level underneath is supportive now, as it was previously resistive. Because of this, I believe it’s only a matter of time before the market goes higher, and the Federal Reserve having an interest rate announcement and ultimately a statement today will have a significant amount of influence on the market. I believe that if the Federal Reserve sounds even remotely dovish, that should send the markets much higher. I believe that the volatility ahead is something to pay attention to, but I believe the dips will continue to be buying opportunities as there is plenty of support underneath and extending down to at least the 2480 level.

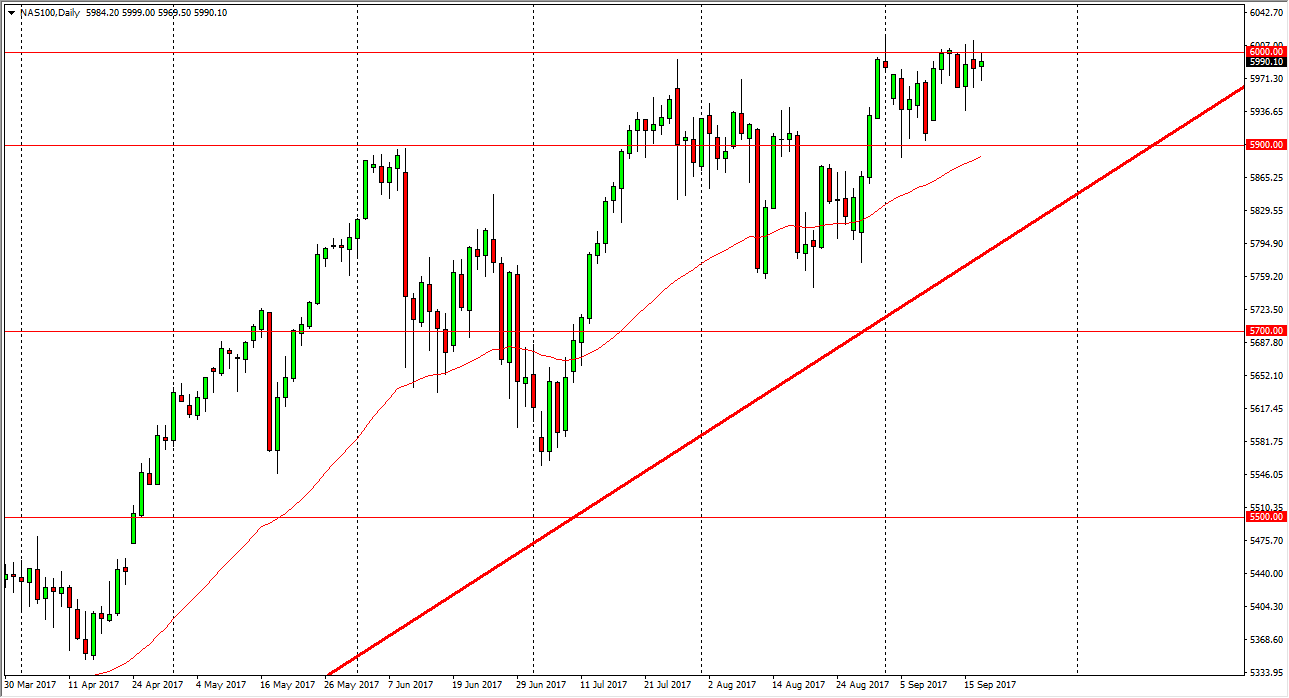

NASDAQ 100

The NASDAQ 100 is back and forth during the session again on Tuesday as the 6000 level continues to be very difficult for the market to overcome. This being the case, this is a market that could explode to the upside, but need some type of catalyst. That catalyst could be the Federal Reserve today, and even if it isn’t, it appears that we are trying to form some type of ascending triangle, and I believe that the market should continue to try to break higher, and the dips are opportunities to pick up value. I believe that the 5900-level underneath is massive support, and I do not expect to see this market break down below there anytime soon. Ultimately, once we break above the 6000 level, I feel that the NASDAQ 100 is going to go looking for the 6100 level. However, the NASDAQ 100 is obviously a laggard to both the S&P 500 and the Dow Jones 30 currently.