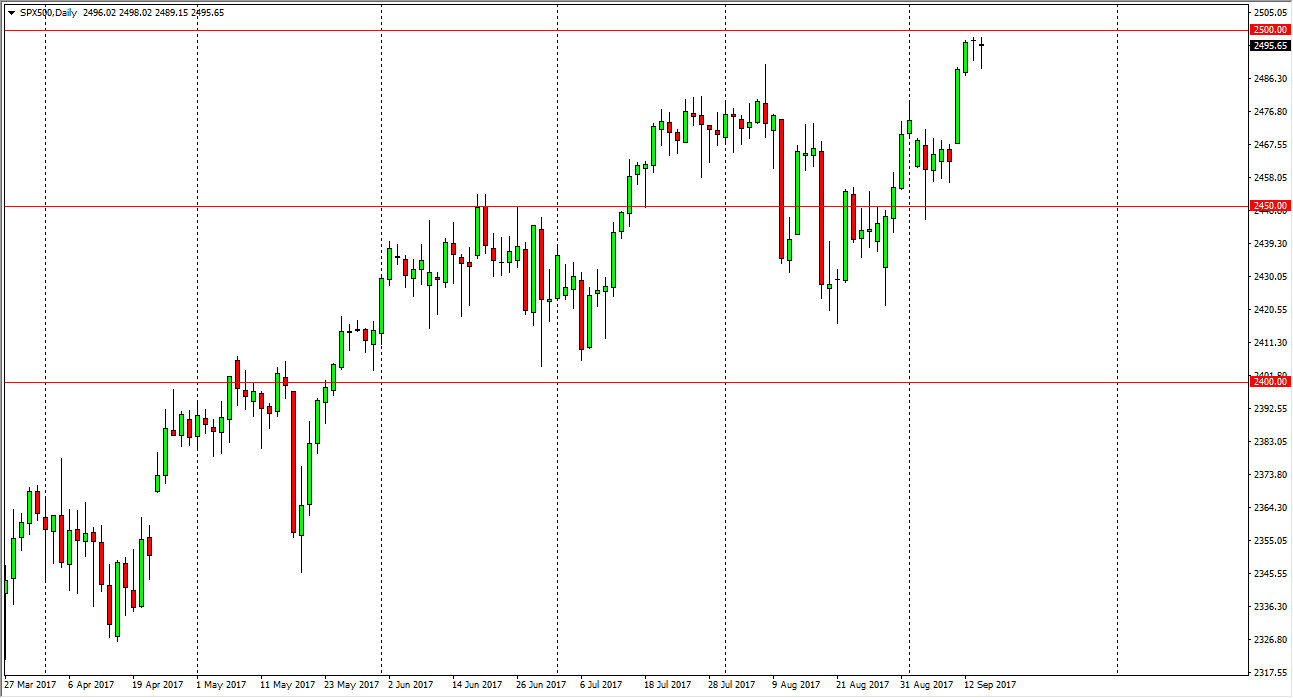

S&P 500

The S&P 500 has pulled back a bit during the day on Thursday, but found enough buyers to turn around and form a hammer again. This looks like a market that is trying everything we can to break out, and once we clear the 2500 level, the market looks ready to go much higher. Ultimately, I think that the market will give that break out, and once we do that, the market becomes more of a buy-and-hold scenario. I think pullbacks continue to find plenty of buyers, so looking at the market as one that you can buy on dips probably becomes the norm. I have no interest in shorting this market, I think that given enough time we will go to much higher levels. Obviously, there is a bit of hesitation due to the large, round, psychologically significant number, but given enough time it will be yet another hurdle that has been overcome.

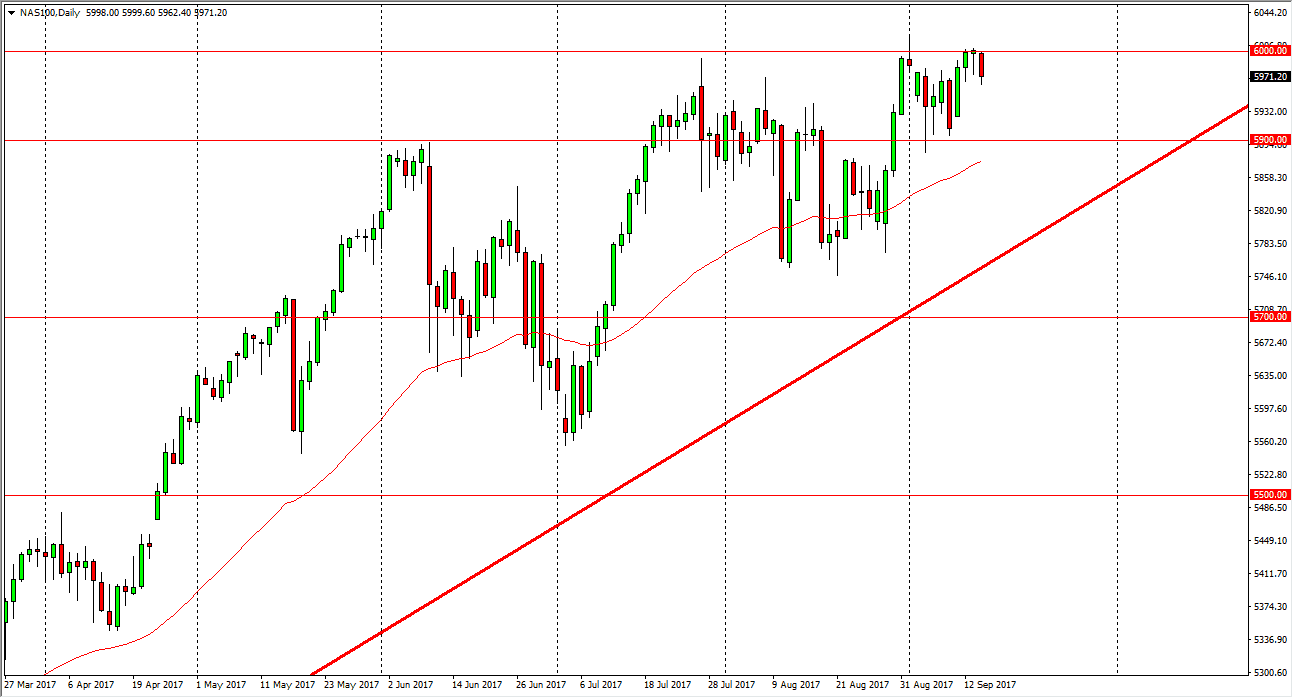

NASDAQ 100

The NASDAQ 100 fell during the day, breaking below the bottom of the hammer for the session on Wednesday, which is a very negative sign. However, there is plenty of support just below so I think we will eventually find buyers in this market and a break above the 6000 level would show that we are going higher. I think eventually that’s what happens, and I think that the “floor” in the market is the 5900 level. Ultimately, this is a market that I think continues to attract attention, especially considering that the Dow Jones 30 has already broken out to a fresh, new highs. Given enough time, all indices will move in the same direction, although the NASDAQ 100 looks likely to lag the other 2 major indices now. I have no interest in shorting.