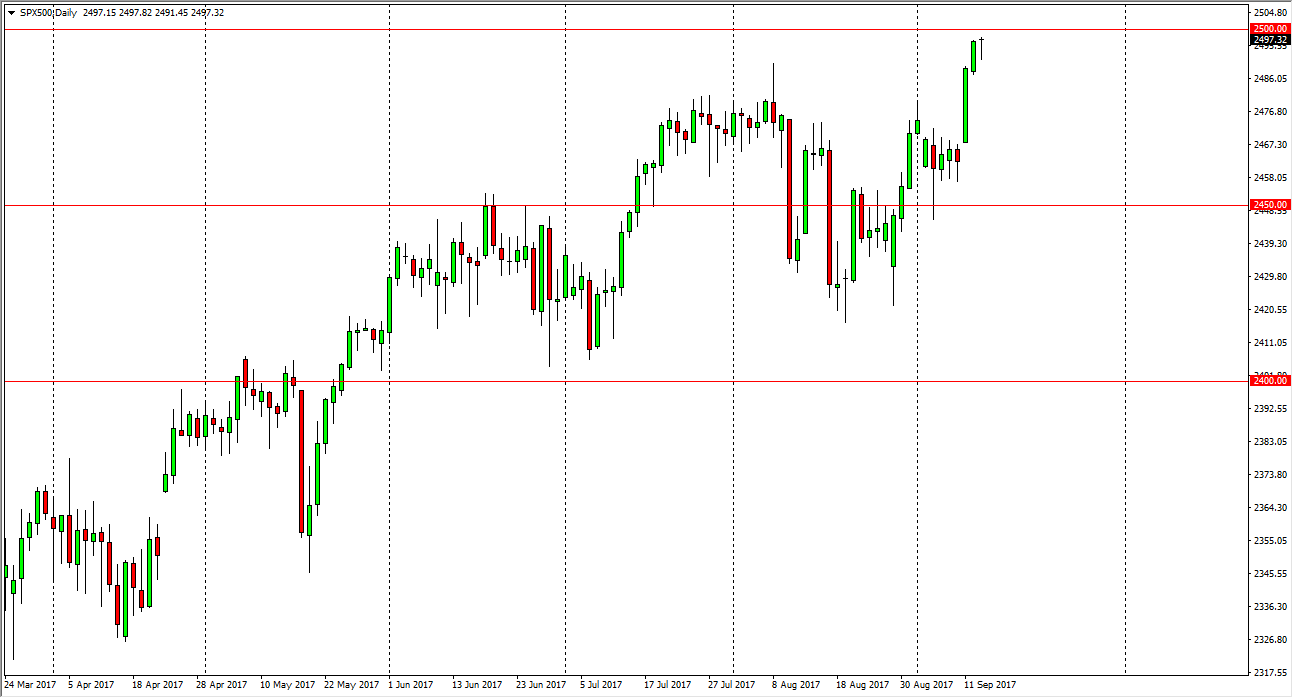

S&P 500

Somehow, the S&P 500 found even more bullish pressure during the session on Wednesday. We initially fell, as one would expect as the 2500 level offers a significant amount of psychological pressure. However, we ended up forming a hammer, and it makes sense now that buyers are looking to test that level. If we can close above the $2500 level in the S&P 500, that should signal the next leg higher. Pullbacks of this point should be buying opportunities, and I have no interest in shorting this market due to the extraordinarily bullish pressure that we have seen over the last several days. I believe there are multiple areas were buyers will step in on a dip. With this, I anticipate that we will begin the next leg higher rather soon.

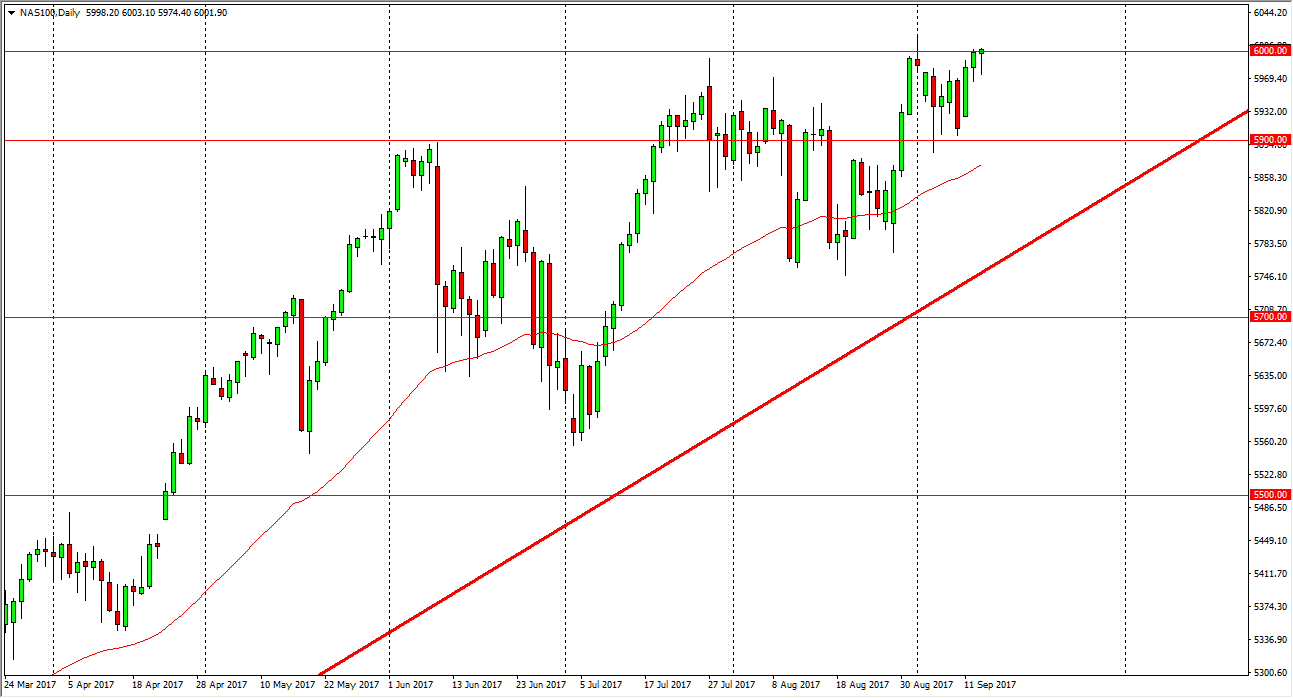

NASDAQ 100

The NASDAQ 100 closed above the 6000 level for the first time on a daily chart during Wednesday’s trading. The hammer that formed suggests that we are going to break out to the upside, and I think it’s only a matter of time before the buyers push this market to fresh, new highs. Remember, we had broken above the 6000 handle a couple of weeks ago, but found sellers in that region. The market has been grinding its way to the upside for some time, and I think that’s going to continue to be the case going forward. With this in mind, I am a buyer of dips, and I recognize of this market is not ready to fall for any real length of time. Those dips offer value the traders will be taken advantage of, and I believe that the “floor” in the market is at least as high as 5900, if not higher. This market looks ready to take off.