S&P 500

The S&P 500 had another bullish session on Tuesday, as we continue to reach toward the 2500 level. It’s likely that we will continue to see resistance near 2500, so I think it’s only a matter of time before we pull back. I do believe that we eventually break out, but we may need to pull back to build up momentum in the meantime. If we were to clear the 2500 level on a daily close, I believe then it’s time to start buying for a longer-term move. In the meantime, I think short-term dips will offer buying opportunities as the market tries to build up the necessary momentum to break out for the longer-term move higher. I have no interest in shorting, I believe there is more than enough interest underneath to keep this market afloat.

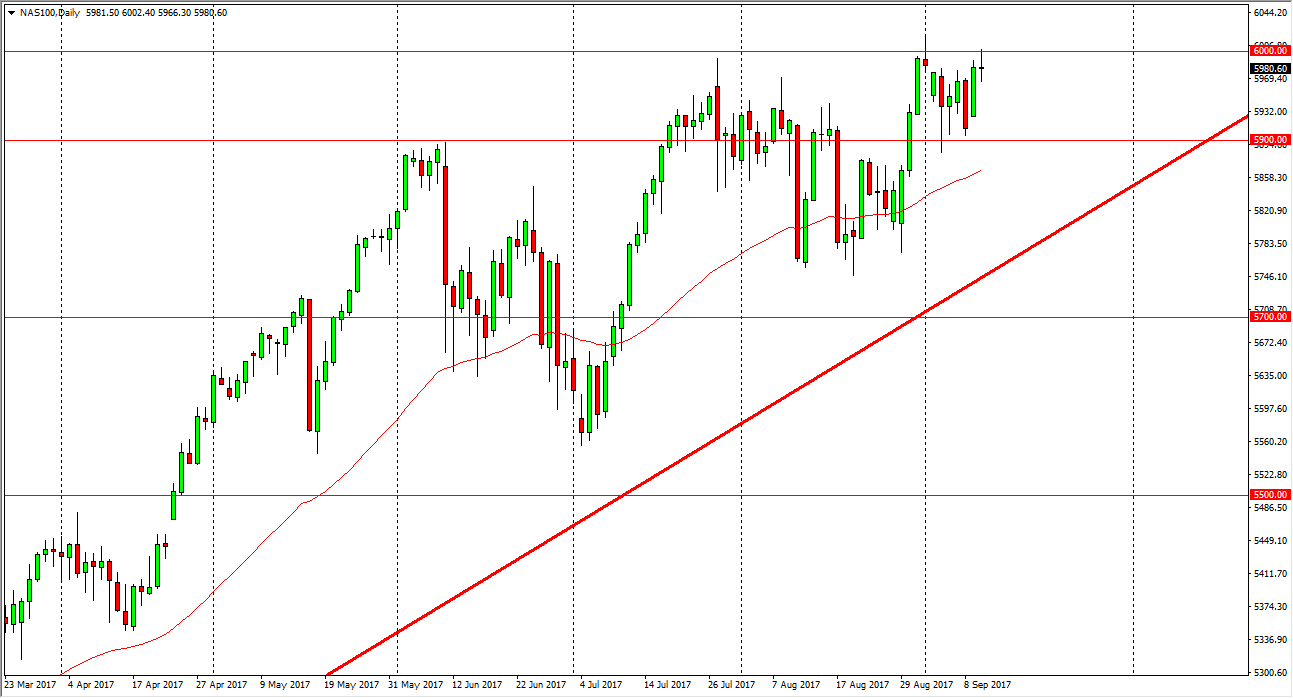

NASDAQ 100

The NASDAQ 100 had a volatile session but the most important thing on this chart is that we continue to find resistance at the 6000 level. While I think a pullback is coming, I believe it short term in nature, and that we will more than likely find buyers below 2 continue the overall consolidation as we try to build up enough momentum to finally clear the 6000 level definitively. Buying dips on short-term charts will probably be the best way to go, just as a daily close above the 6000 handle would be reason enough to start buying. I have no interest in shorting the NASDAQ 100, I believe that the longer-term trend is going to continue to go higher, so therefore patience will be needed but should be rewarded for the buyers of this index. Once we break above the 6000 handle, it becomes more of a “buy-and-hold” scenario.