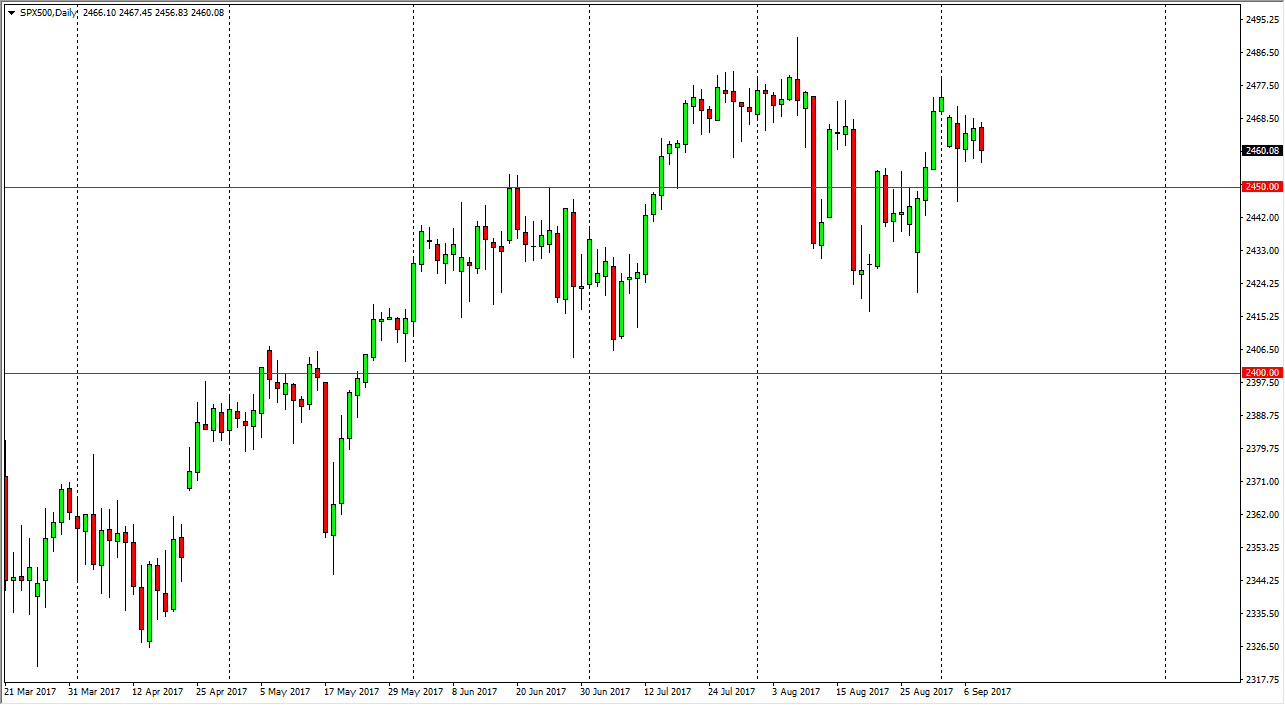

S&P 500

The S&P 500 fell a bit during the day on Friday, as we continue to consolidate in a tight range above the 2450 handle. Ultimately, this is a market that has play of support just below, and it makes sense that buyers would come back into the marketplace. I think the market should then go to the 2500 level, where we should see plenty of resistance. If we can break above the 2500 level, it signifies the next leg higher. If we break down below the 2450 handle, the market could very well go looking towards the 2425 level after that. Ultimately, the market is still bullish but I think traders are waiting to see what the damage from the hurricanes will be. With this, I expect volatility but eventually I would anticipate that buyers should return.

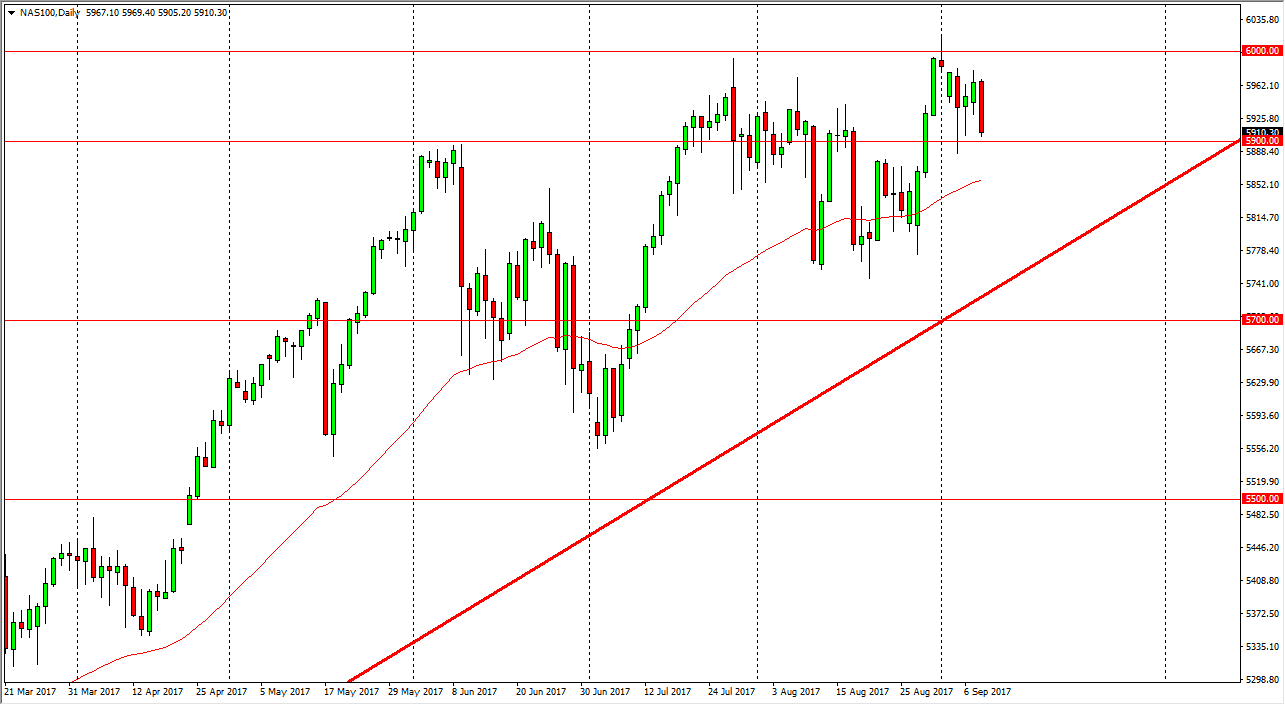

NASDAQ 100

The NASDAQ 100 broke down significantly during the day on Friday, reaching towards the vital 5900 level. This is an area that should offer a bit of support, so buyers could return. However, if we break down below here, there is an uptrend line below that should also offer support for this market. I think the given enough time, the market should continue to see buyers come and as we are in a strong uptrend, but it appears that perhaps a pullback is coming. The pullback should offer value the people are willing to take advantage of, and with this being the case, I suspect that waiting for a supportive candle is probably the best way to go. I have no interest in shorting, as the uptrend has been so reliable over the longer term. Simply waiting for a reason to go long has been the best way to play this market for some time, and should continue to be.