By: DailyForex

The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 10th September 2017

Last week, I saw the best possible trade for the coming week as long of Gold, and short of the U.S. Dollar. The result was nicely positive: GOLD/USD rose by 1.02%.

This past week has been dominated by two major factors: continuing tension over Korea, and a historically very powerful hurricane, Hurricane Irma, which has caused massive destruction in the Caribbean region and is currently heading towards Florida. It is feared that even if loss of life is minimal thanks to safety precautions, evacuation and sheltering, the economic damage of such a powerful hurricane passing right over all of Florida could be vast, and it seems to be this fear which has helped damage the U.S. Dollar over recent days. At the time of writing, there are signs that the impact may not be as bad as the worst-case scenario, with the hurricane’s intensity seeming to drop somewhat, and its track veering westwards, suggesting that the eastern part of the state, including Miami, may be spared from the brunt. If the damage is much less than expected, the U.S. Dollar may enjoy a relief rally, at least for a day or two.

The news agenda this week will probably be dominated by the impact of Hurricane Irma upon the continental United States, and some key U.S. economic data due at the end of the week.

Following the current picture, I see the highest probability trade this week as long of Gold, Euro, the British Pound, and the Japanese Yen, and short of the U.S. Dollar. All these assets are in long-term bullish trends against the U.S. Dollar.

Fundamental Analysis & Market Sentiment

The major sentiment dominating the market, at least at the start of this week, will be concern over the impact of Hurricane Irma upon the U.S. mainland. If the impact is extremely destructive, this suggests continued declines in the U.S. Dollar and the U.S. stock market.

Fundamental factors will come more to the forefront towards the end of the week as key retail sales, inflation, and unemployment data are released in the U.S. The Bank of England will also be giving its monthly guidance which is likely to affect the British Pound, which has been dominant in the Forex market over recent days.

Technical Analysis

U.S. Dollar Index

This pair printed a large bearish candlestick, with a low which exceeded the 14-month low price. The price closed near the low of the candle, which is another bearish sign. There is a clear long-term bearish trend and the price has carved out new resistance above, while closely following a dominant bearish trend line. The resistance level at 12012 has been rejected, holding almost to the pip.

Gold

Last week this pair again printed a strongly bullish candlestick closing near its high, after breaking out past a key resistance level at $1326.42. However, the price is now at an area under $1400.00 which has capped the price for the past 4 years. I highlighted this last week, and forecasted that a continued bullish movement was likely to happen, which was correct. It looks as if the price has at least a little further to rise, but it may be capped between $1375.00 and $1340.00.

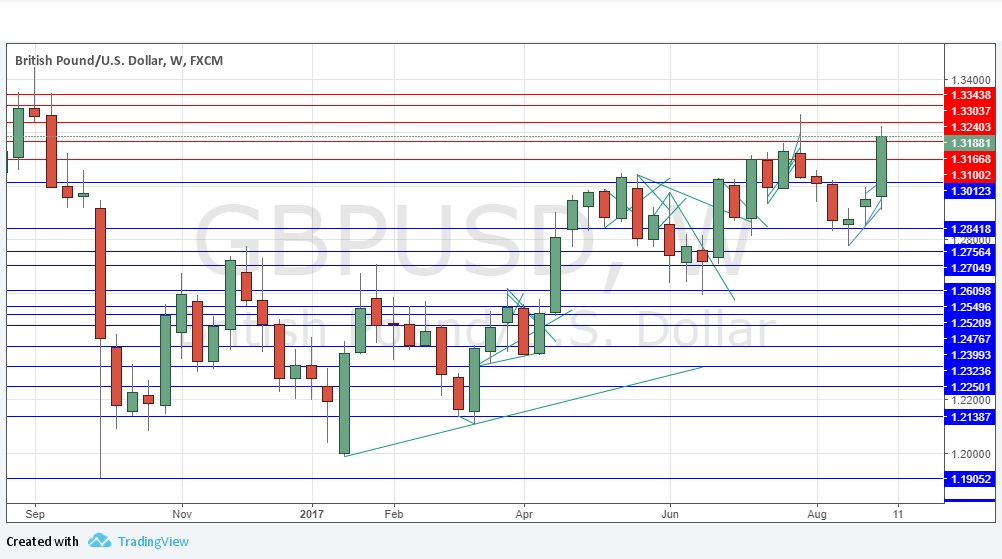

GBP/USD

This was one of the standout pair of the week, rising by more than 1.8%. There was a large, very strongly bullish candle closing near its high. Although the price may be capped by the 1-year high printed a few weeks ago at 1.3268, a further rise seems likely over the coming week.

USD/JPY

This was the major standout pair of the week, falling by more than 2.17%. There was a large, very strongly bearish candle closing near its low. The price is close to a new 1-year low, and traded below its long-term range. Although the price may be held by the support level at 107.66, and the trend has been relatively slow, a further fall seems likely over the coming week.

Conclusion

Bullish on the JPY, GBP, Euro, Gold; bearish on the U.S. Dollar.