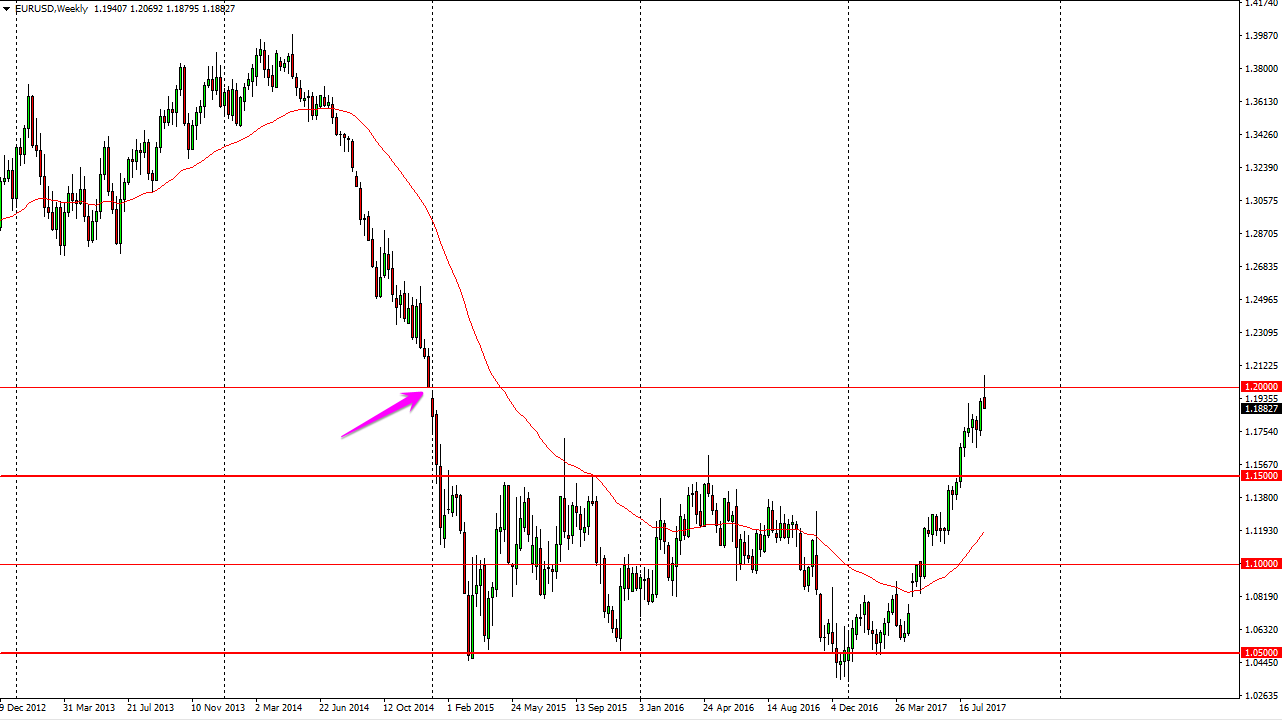

The EUR/USD pair has been extraordinarily strong over the last several weeks, and even when as high as the 1.20 level. When looking at the chart, it looks likely that we will pull back initially. I think that there are more than enough buyers underneath to shoot this market to the upside. The 1.15 level should be support, as it was previous resistance. I believe that initially the sellers will come back but I think the market will continue to favor the upside. Ultimately, I think it will take several attempts to break above the 1.20 level, but once we finally clearing on a weekly close, the market should then go to the 1.25 level above. Based upon the recent breakout, it makes sense that we get to that level.

Consolidation breakout

We had previously consolidated between the 1.05 level and the 1.15 level above. That’s 1000 pips, and it should extend for another thousand pips based upon basic technical analysis. With this, it’s likely that the market goes to the 1.25 handle above, which also coincides nicely with the 61.8% Fibonacci retracement level. Nonetheless, this market is a bit overextended so I think we could see a bit of choppiness initially, but eventually the buyers will come back in. I don’t think that this market will fall significantly, but if we did somehow break down below the 1.15 handle, that would be very negative. This is probably one of the easiest identifiable breakouts I’ve seen in some time, and therefore I think the rest of the market will be on board.

Look for the 1.1750 level to be initial support, and that might be as low as we go. Again though, I’m not willing to sell this market into we break down below the 1.15 handle, which seems to be very unlikely to happen this month.