EUR/USD

The EUR/USD pair initially tried to rally during the day on Wednesday, but then found the area above the 1.20 level to be resistive. As the Federal Reserve sounded a bit more hawkish than some people expected, the pair sold off. However, we are sitting on top of the daily trendline that should continue to be important, and I believe that if we can stay above there, the market will eventually break above the 1.20 level. Alternately, if we break down below the uptrend line, then we probably go looking towards the 1.17 level underneath. Longer-term, we have recently seen a breakout that suggested a move to the 1.25 handle, and even with this pullback, they technical analysis still suggests that the uptrend is very much intact.

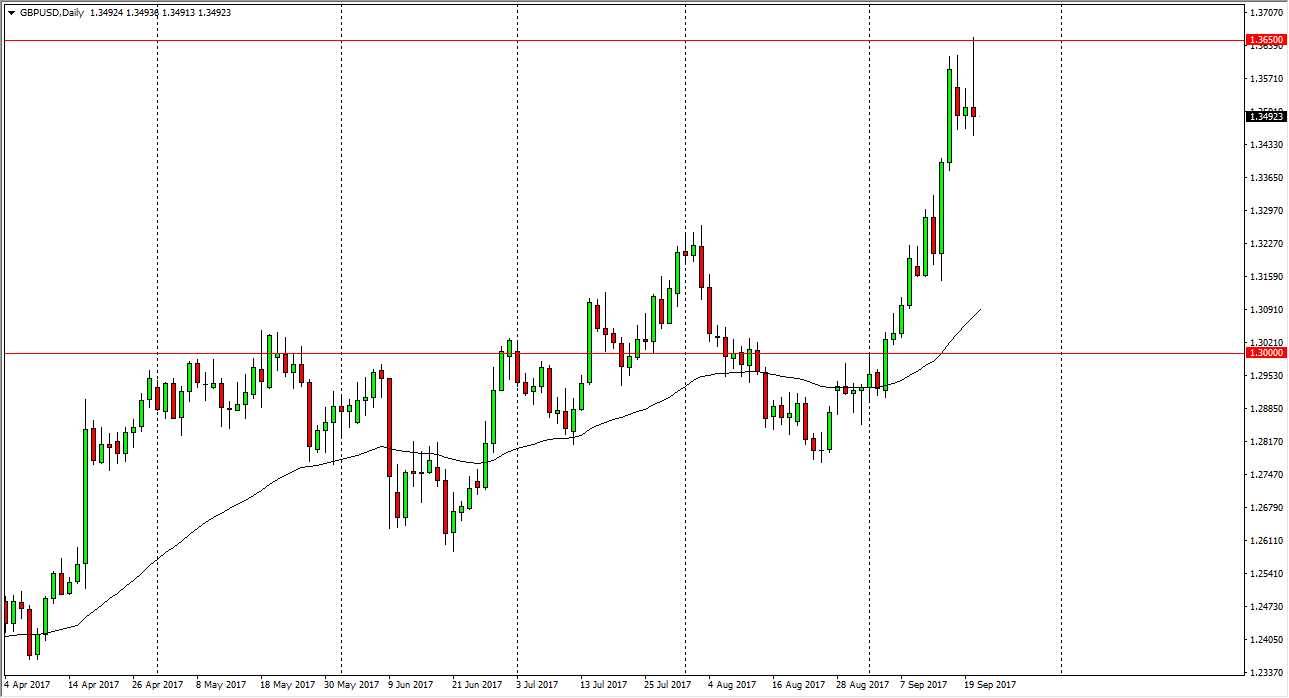

GBP/USD

The British pound initially took off to the upside during the day on Wednesday, but a slightly hawkish Federal Reserve send the market back around to form a shooting star. This is a classic cell signal at a major resistance barrier. Because of this, I suspect we could see a selloff, and a drop below the 1.3450 level could send this market looking for the 1.32 level. Alternately, a break above the top of the shooting star would be a very bullish sign and send this market much higher as it would not only break the top of the resistive shooting star, but would also clear the top of the gap from the Brexit vote. With all this in mind, I believe that this is somewhat of a binary trade, simply following the market as to which side of the candlestick for the Wednesday session that it breaks. I believe this is going to be a very important day for the British pound, and should lead the next move.