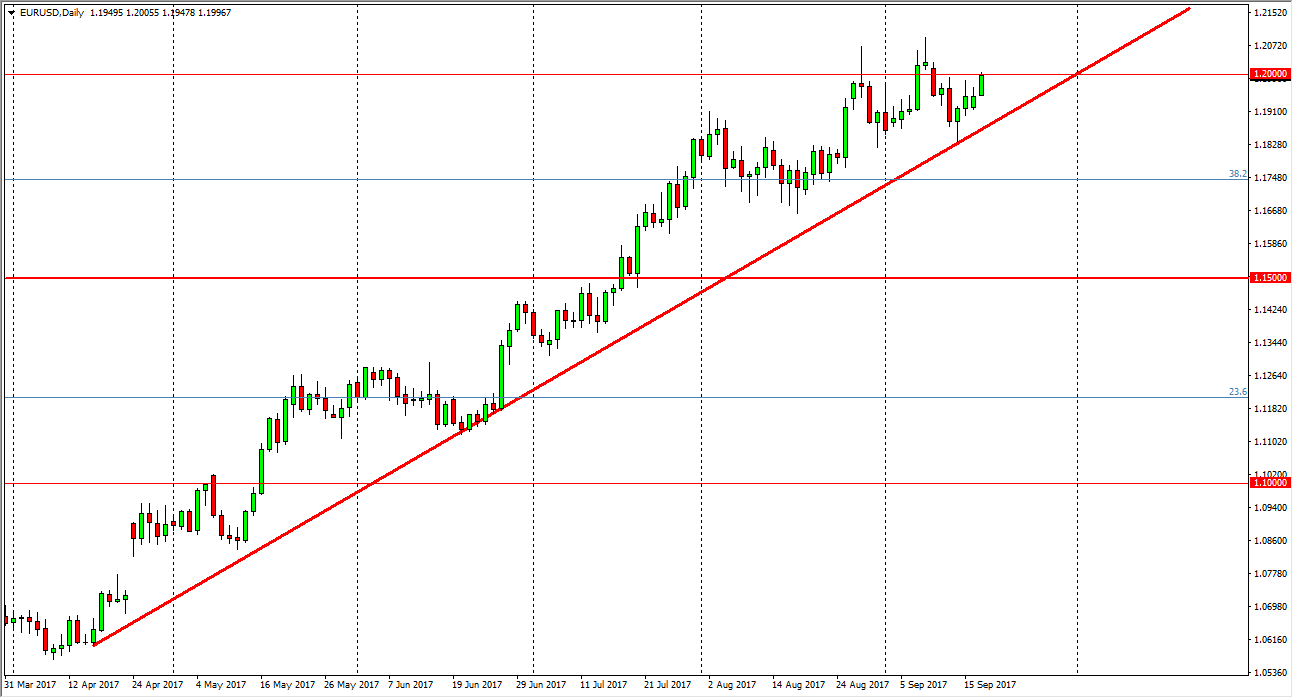

EUR/USD

The EUR/USD pair had another positive session on Tuesday, testing the 1.20 level yet again. However, I think that some traders would’ve been a bit hesitant to get involved in the market ahead of the Federal Reserve meeting and statement today. I believe that the Federal Reserve will probably be dovish, after the significant damage done by a pair of hurricanes, and a third one on its way. Because of this, it’s likely that this pair will end up going higher given enough time. I also recognize that the longer-term target based upon the previous consolidation area is the 1.25 level, and a mix of easy Federal Reserve monetary policy and the ECB stepping away from quantitative easing could be the catalyst to drying this market much higher over the longer term.

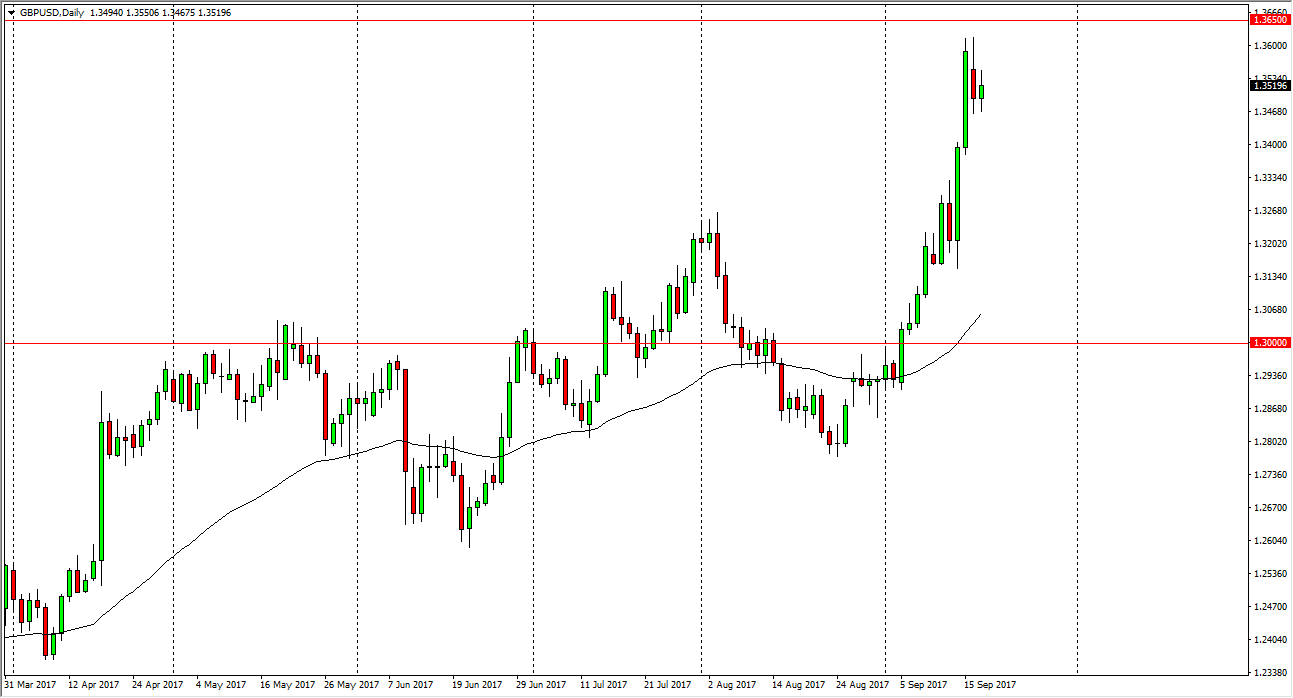

GBP/USD

The British pound gained a little bit during the day, but quite frankly we are overextended to say the least. The Federal Reserve may be able to push this market for the vital 1.3650 level based upon its dovish actions. That level is where the market gapped lower after the Brexit vote, and that means that it is a psychological turn in the markets attitude. If we can break above that level and close above it on a daily chart, that would be an extraordinarily bullish sign. In the meantime, I think there’s plenty of support below and a pullback should be looked at as value. I believe that longer-term, the British pound should continue to strengthen against the US dollar but we may have just gotten ahead of ourselves in the short term. However, a break above the resistance at the 1.3650 level forces me to go long as it’s such an obvious buying opportunity and signal.