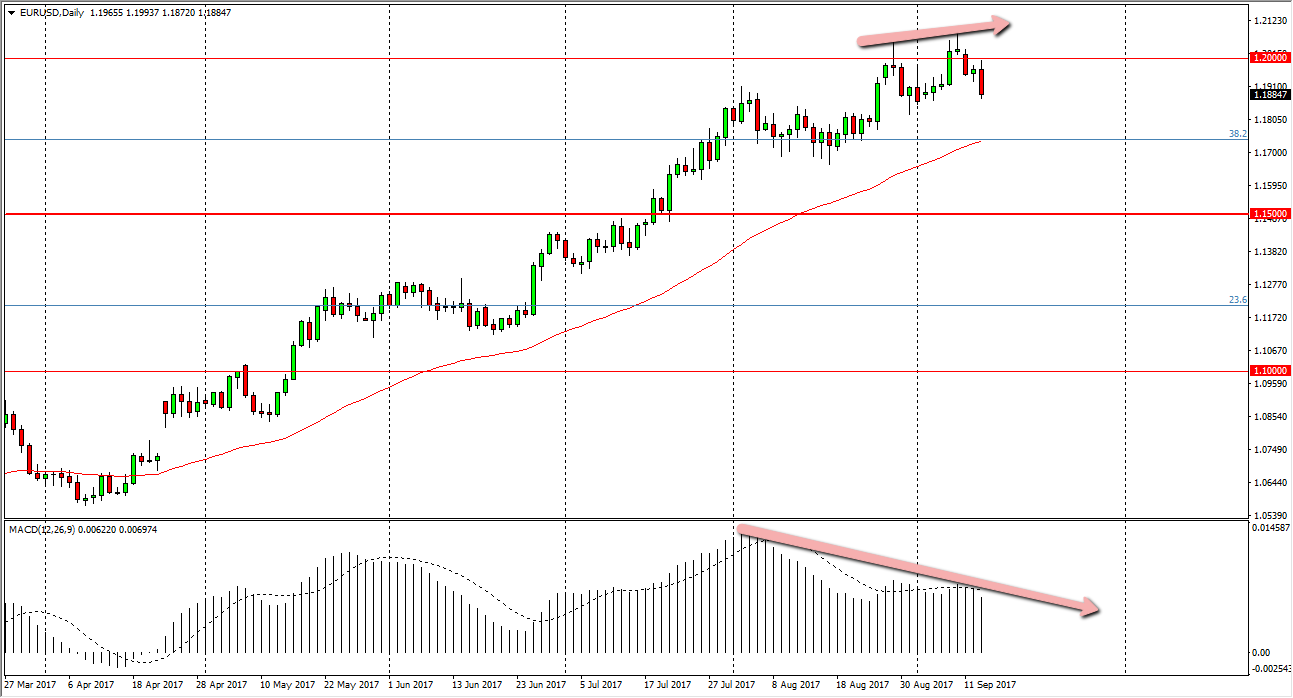

EUR/USD

The EUR/USD pair fell again on Wednesday after we attempted to break above the 1.20 level. Recently, I have mentioned that there is a bit of divergence going on, so I think that we will continue to see momentum to the downside. However, I do not expect this market break down significantly, and I believe that sooner rather than later people will come back into the market looking to pick up value. I suspect that the 1.18 level will be supportive, and at this point short-term charts could be used as an opportunity to pick up the EUR on the cheap. I also believe that we are still reaching towards the 1.25 level over the longer term, but it could take some time to get there obviously. I don’t necessarily want to short this market, but I do recognize that a pullback is probably needed.

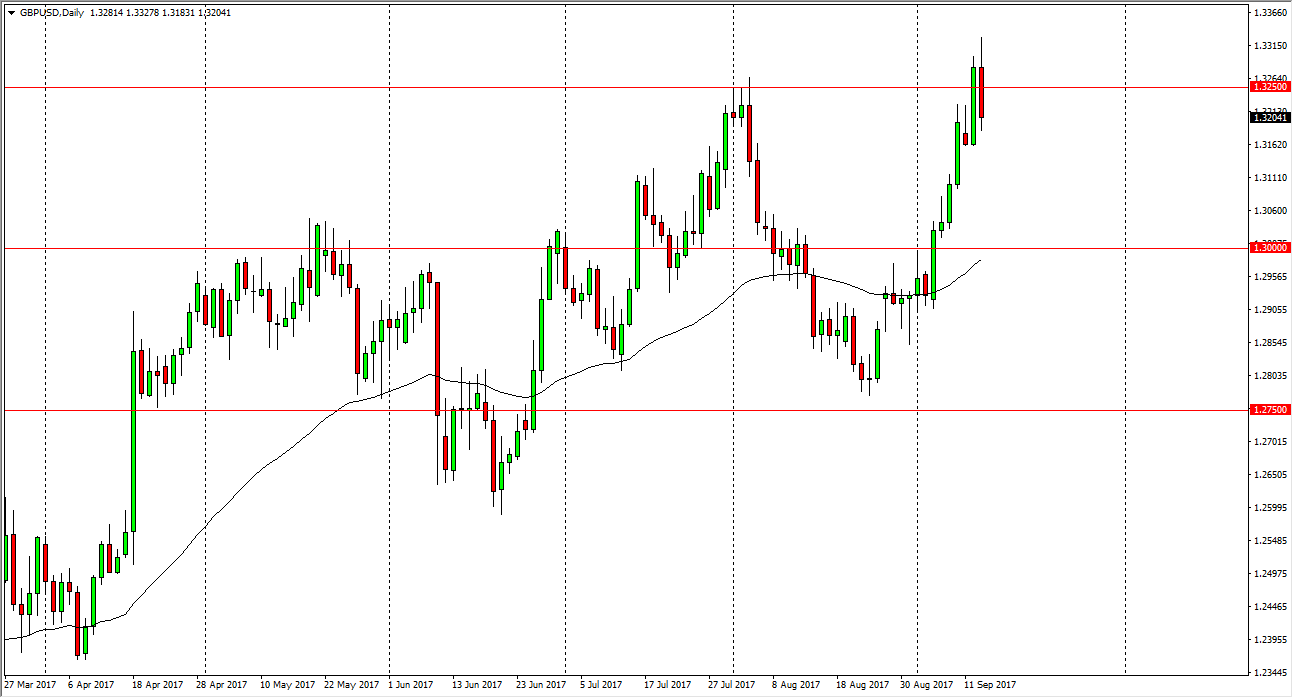

GBP/USD

The British pound initially tried to rally against the US dollar but struggled a bit. As we are now below the 1.3250 level, I think we will go looking for support underneath, which we are starting to see on short-term charts. A pullback is healthy, because we are bit overextended, so it makes sense that we continue to see buyers on short-term dips. Having said that, I believe that the market is going to continue to try to go higher, but we have the interest rate decision coming out of London today, and while there is no expected change, what people will be paying attention to is the Monetary Policy Meeting Minutes. If there’s any signs of hawkishness, I believe the markets will resume the uptrend, as the British pound has seen a significant amount of interest as of late. I don’t have any interest in shorting quite yet.