EUR/USD

The EUR/USD pair rallied a bit during the day on Thursday, using the uptrend line as support. However, there is a lot of resistance at the 1.20 level above, so it’s likely that we will continue to see a lot of back and forth short-term choppy trading. If we break down below the uptrend line, we could drive down to the 1.1750 level, but quite frankly I should assume that the uptrend is still intact until we break down. If we do break to a fresh, new high, then I think the market eventually goes to the 1.25 level above. The longer-term move could happen due to the market breaking out of a 3-year consolidation area, as that would be the measured move. However, if we start to break down and more importantly, get below the 1.1750 level, the market could find its way to the 1.15 level next and possibly even lower.

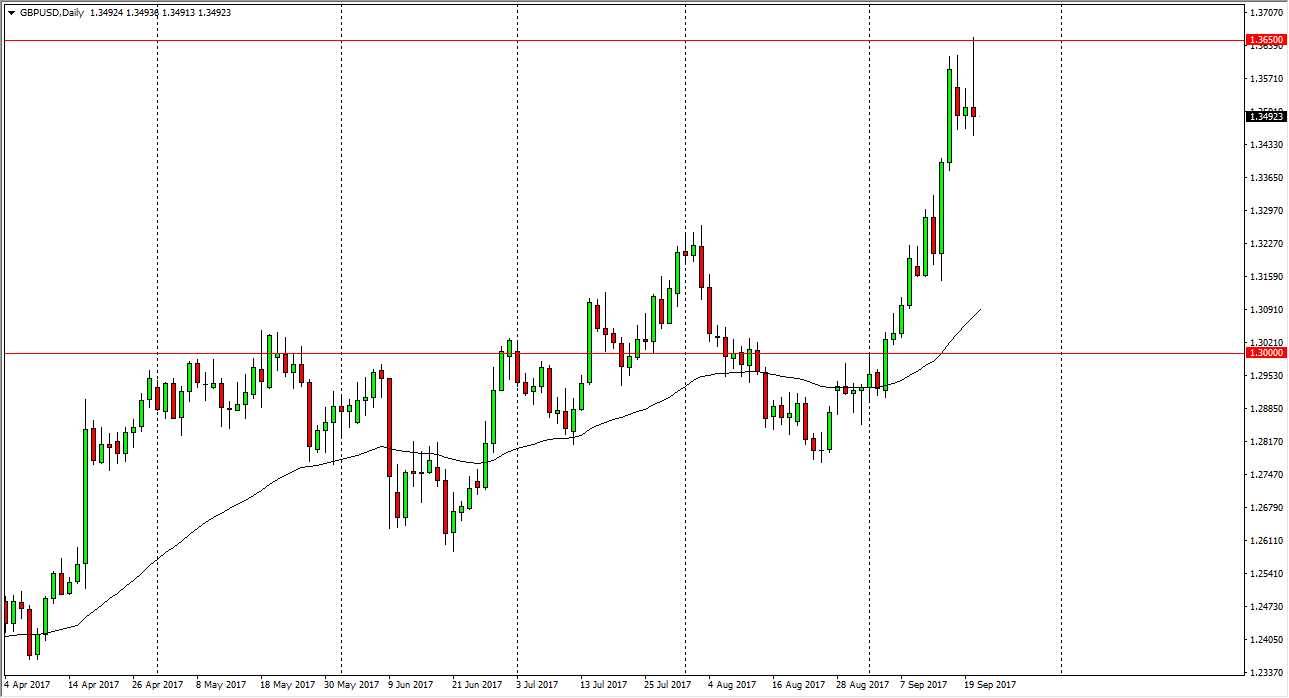

GBP/USD

The British pound rallied during the day, but still faces a significant challenge to break above the 1.3650 level. We formed a shooting star during the session on Wednesday, and that signifies a significant amount of resistance. Beyond that, we also have the gap from several months back when the British decided to leave the European Union. Because of this, break above the 1.3650 level on a daily close would be an extraordinarily bullish sign. In the meantime, I think there is probably risk of large amounts of volatility so I am a bit hesitant to put money to work. I would consider buying this market on a pullback that show signs of support, but probably a little closer to the 1.3250 level. Expect a lot of choppiness, but ultimately, I think we will eventually break out.