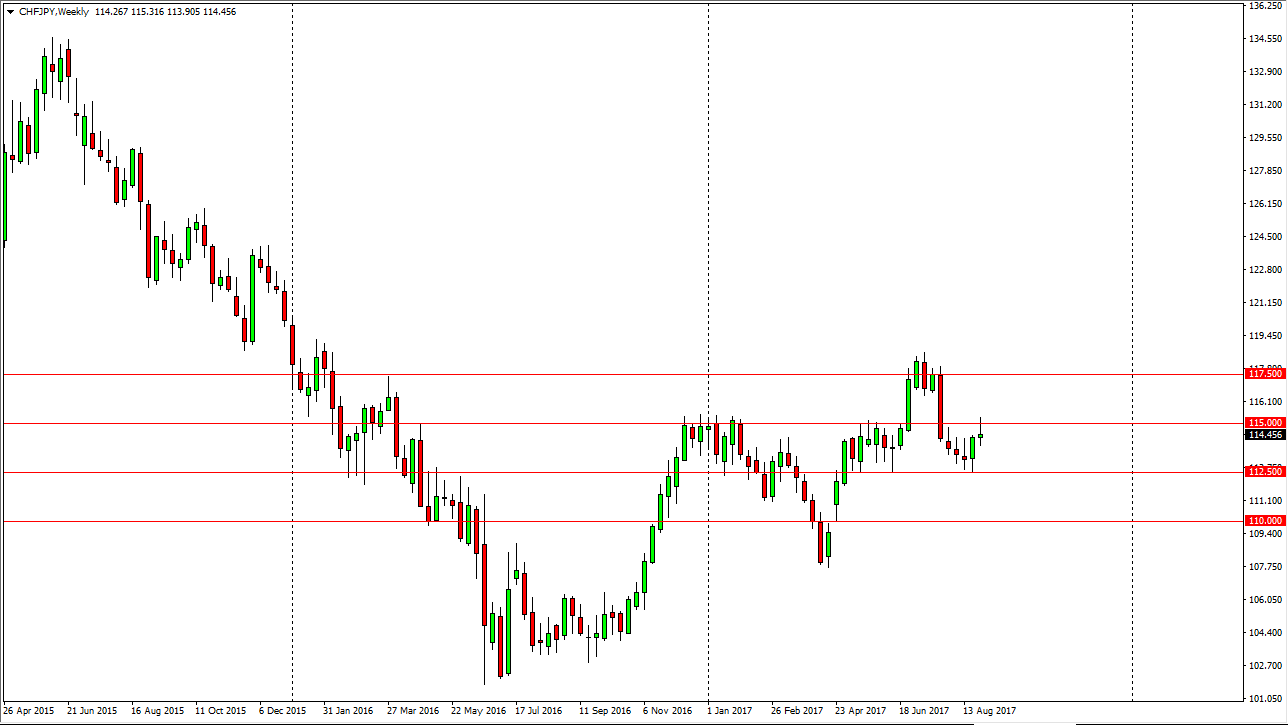

The Swiss franc and the Japanese yen both have been in favor over the last couple of months, so this pair will be vital to pay attention to if you choose to play a risk appetite type of trade. When you look at this chart, you can see that the 112.50 level has offered a significant amount of support. Currently, the 115 level is offering a significant amount of resistance. If we can close above that level on a weekly candle, it’s likely that we will then go to the 117.50 level. That area offered a significant amount of resistance, but a retest of that area would be a very bullish sign for the Swiss franc.

The alternate scenario

The alternate scenario of course is that we fall towards the 112.50 level. That would entail quite a bit of consolidation over the next several weeks, which is something that we could conceivably get. A breakdown below the 112.50 level would be very negative and have this market looking for the 110 handle underneath. We had a massive gap in that region, and that of course is always attractive for traders to try to reach. It is because of this that we could very well see bearish pressure come to bear in this market. However, I think a lot of this is going to come down to the risk appetite of traders around the world, as although the Swiss franc is considered to be a safety currency, it’s considered to be a little bit “riskier” than the Japanese yen, by a small bit.

If North Korean tensions flare up, I suspect that counterintuitively the Japanese yen will gain. In other words, this market will fall as people pay back loans and Japanese yen that the use the margin the financial markets. If things stabilize, then we should continue to go higher.