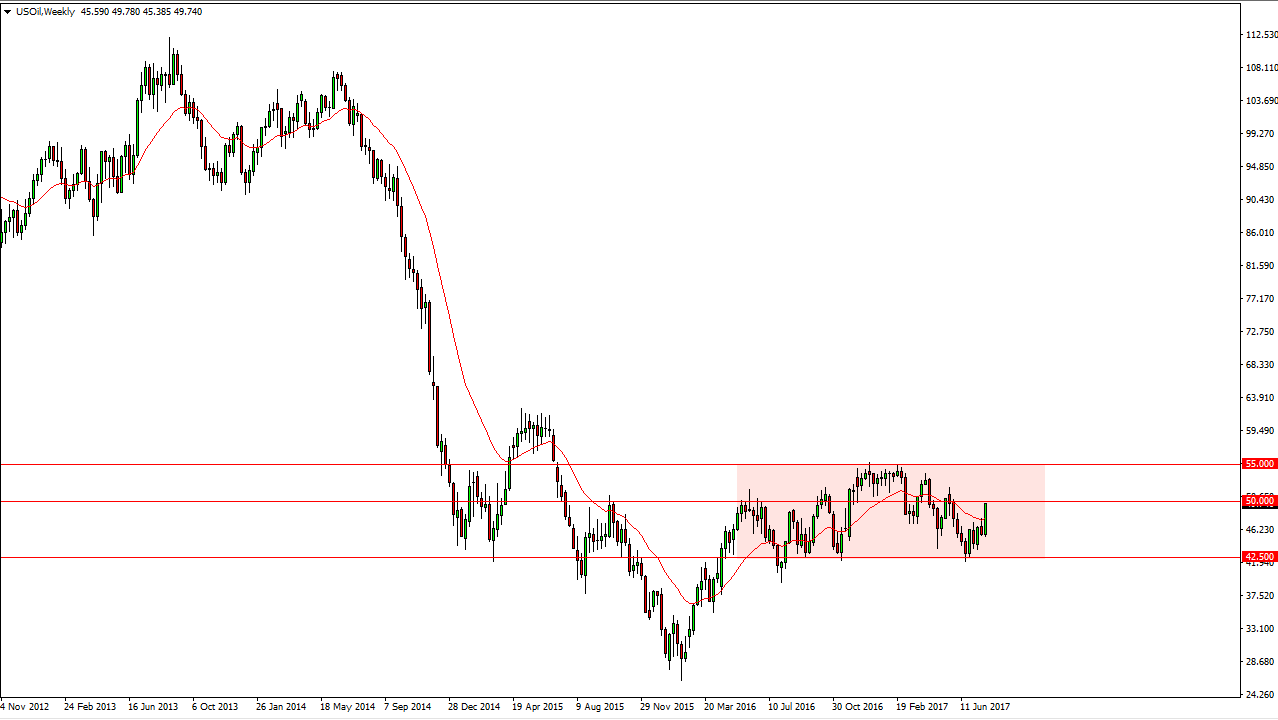

The WTI Crude Oil market has bounced significantly during the month of July, using the $49.50 support level yet again. When you look at the longer-term charts, you can see that we are approaching the $50 level, and that of course is an area of significant resistance. If we break above there, then we will probably go looking for the $55 level, and I should mention that the last week of July featured a very bullish candle. Ultimately, I think that the market is consolidating overall as the battle between OPEC and non-OPEC drillers continues. After all, OPEC continues to announce cuts, while on the other hand there is a concern about lack of demand and of course the Americans, Canadians, Mexicans, and several other countries are more than willing to fill the void. Because of this, I think we are simply bouncing around in general.

Back and forth

I think that the market continues back and forth, but we could see a bit of bullishness in the early part of the month. And exhaustive candle could be a selling opportunity, and I would be very surprised if the market broke above the $55 level. After all, we have been below there since April 2015. Because of this, I think that the beginning of the month looks bullish, while by the end of the month the sellers will return for whatever reason. However, the one caveat I would suggest is that if we fail at the $50 level, perhaps we just turn around and sell off right away. Longer-term, I still think that there is a massive overhang when it comes to the crude oil market, and therefore I am a bit cautious about buying in them much more comfortable selling, although the month that we just got through was rather bullish.