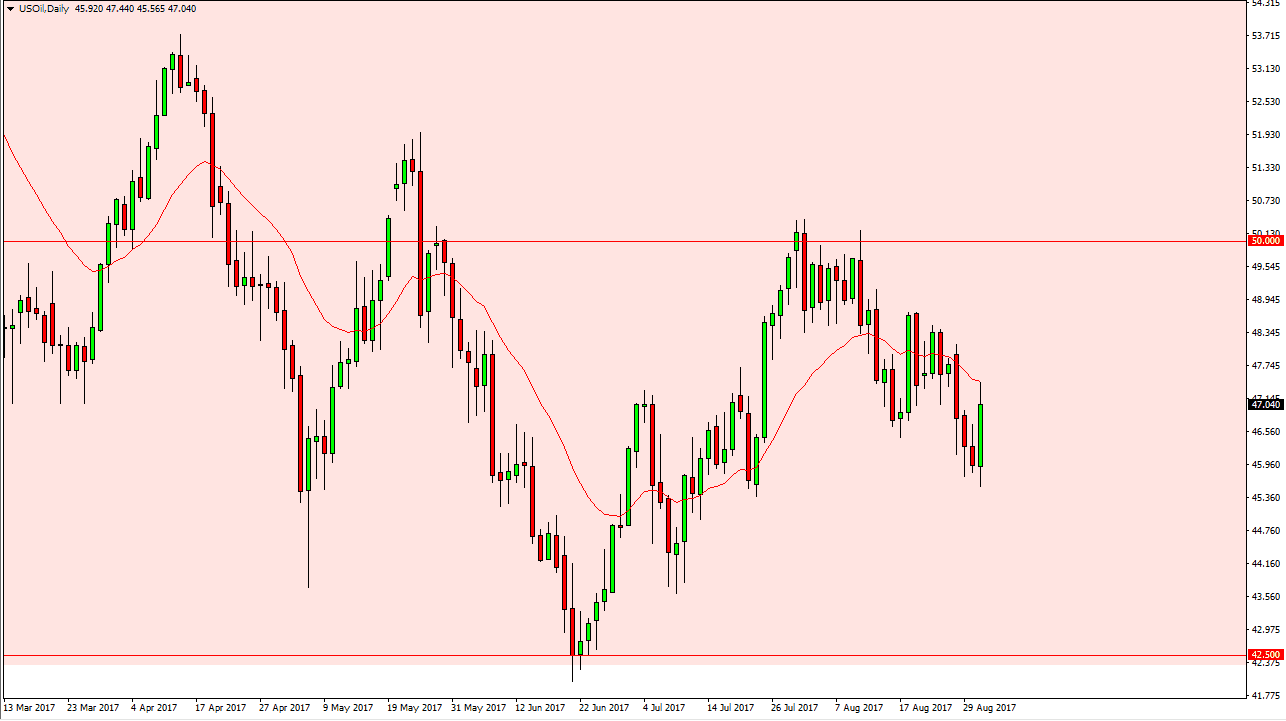

WTI Crude Oil

The WTI Crude Oil market initially fell, but we turned around to form a massive bullish candle for the week. We ran into a bit of trouble at $47.50, and it looks like the sellers may return relatively soon. This explosive move was due to the effects of Harvey in Texas, but I suspect that this is a short-term move at best. I’m looking for exhaustive candle to start selling again, and have no interest in buying. With today’s nonfarm payroll announcement, we will probably see a significant amount of volatility, so keep that in mind. I’m waiting for a daily exhaustive candle to start shorting again as this market continues the overall downtrend. Even if we broke higher, I think that the $50 level above is going to continue to be massively resistive.

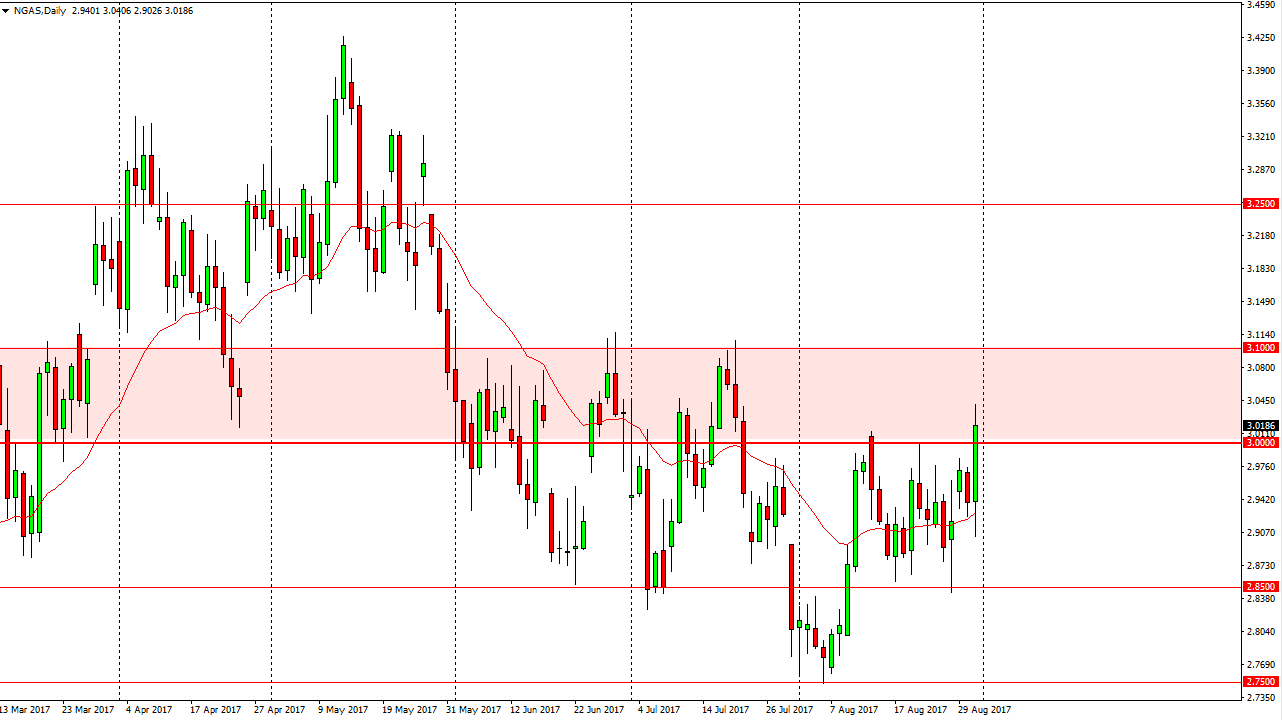

Natural Gas

The natural gas markets broke higher after initially falling as well, for many of the same reasons. Now that we have cleared the $3 level, we will have a significant area of interest extending to the $3.10 level. I don’t have any interest in buying until we get above that level, and I don’t think we’re going to. We’re starting to see some weakness towards the end of the day, and it’s only a matter of time before sellers return. If we break below the $3 level on a daily close, I think it’s starting to sell off yet again, and it’s time to get short. If we broke above the $3.10 level, then the market becomes one that you have to start buying as it shows such a significant turnaround in the overall attitude. The longer-term situation is still a bear market for natural gas overall, so I’m comfortable waiting for a selling opportunity.