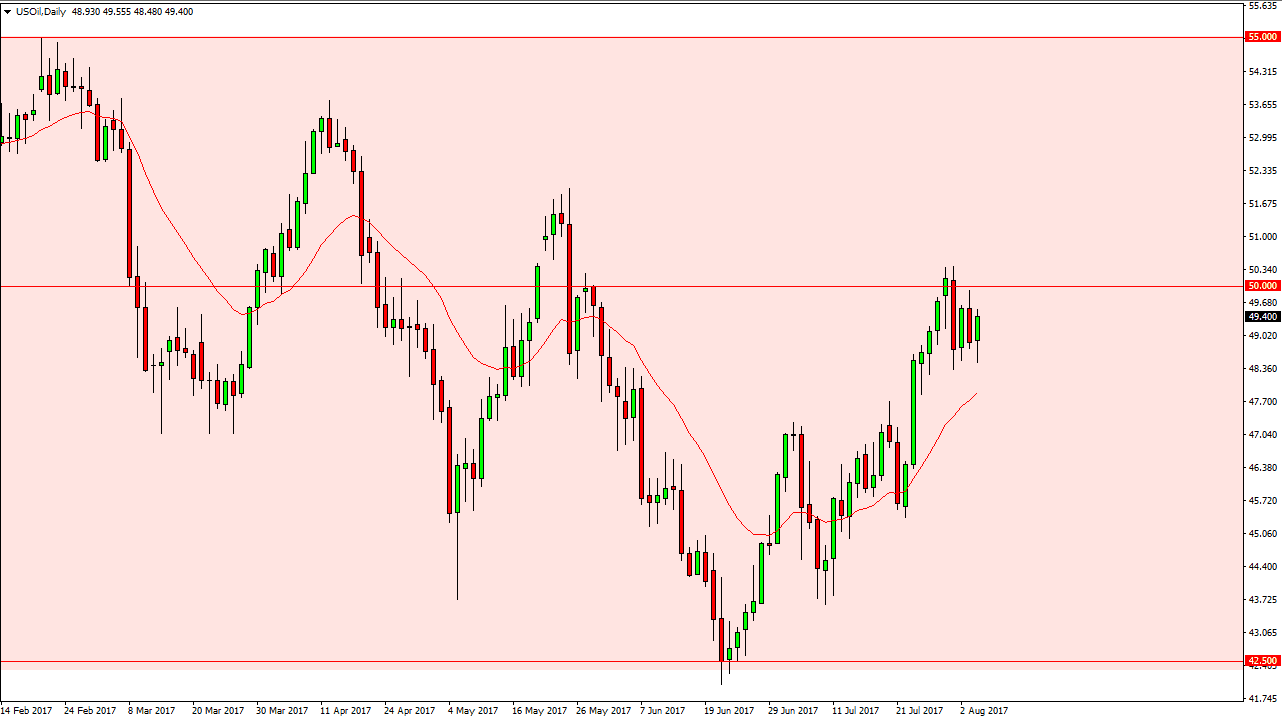

WTI Crude Oil

The WTI market initially sold off during the day on Friday, but then turned around to show signs of strength after the stronger than anticipated job announcement coming out of the United States suggesting that perhaps demand will pick up. Because of this, we continue to consolidate between the $48.50 level on the bottom and the $50 level on the top. I believe that the market continues to see choppiness, and it’s likely that if we can break above to a fresh, new high, the market should then reach towards the $52 level above. Ultimately, a breakdown below the $48.50 level since this market looking towards the $47 handle. I think that there is a significant amount of noise in this market, so I prefer the consolidate of play.

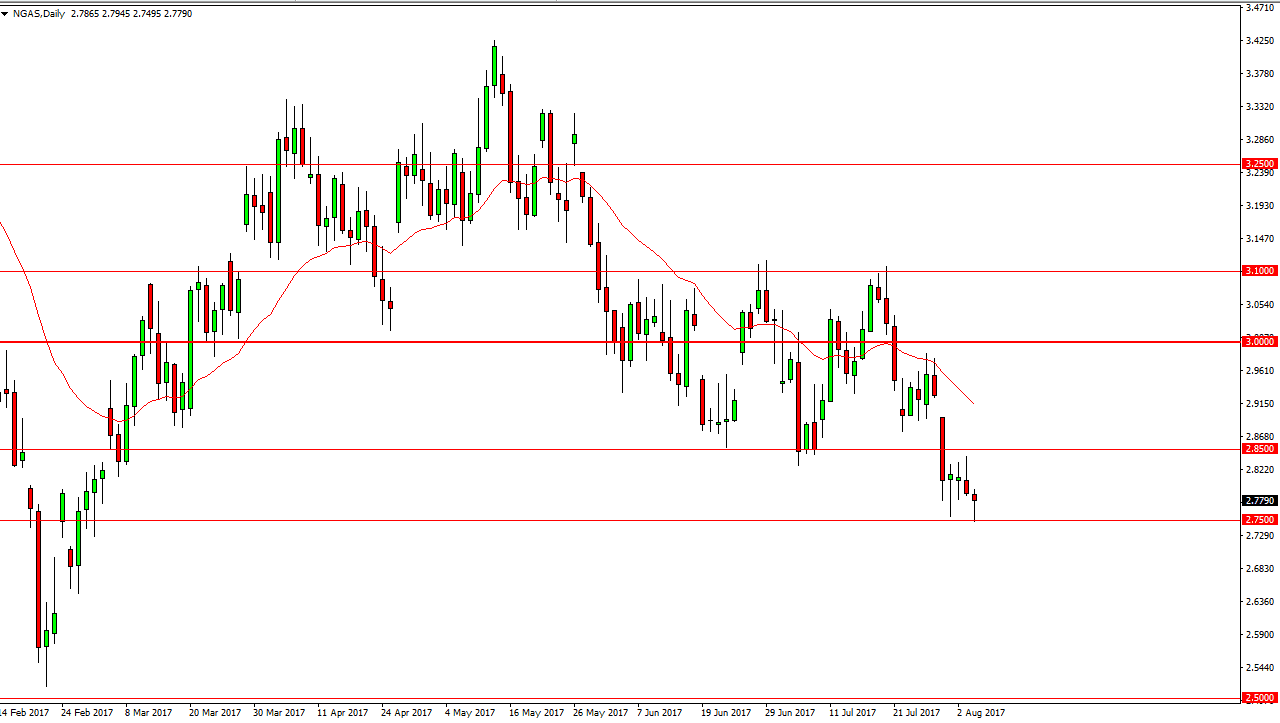

Natural Gas

Natural gas markets initially fell during the day on Friday, testing the $2.75 level. This is an area that is very supportive, so a bounce from here would make quite a bit of sense. However, I think that the $2.85 level above will more than likely be resistive. A break above there could then go looking towards the gap near the $2.92 level, which I think will show a significant amount of bearish pressure. Alternately, we could break down below the $2.75 level, and that should send this market as low as the $2.50 level after that. We still have plenty of oversupply in the market, so I have no interest in buying and I believe the natural gas continues to be a “so on the rallies” situation. This is a market that has an absolute ceiling of $3 above, extending to the $3.10 level. I don’t have any interest in buying this market regardless of what happens next.