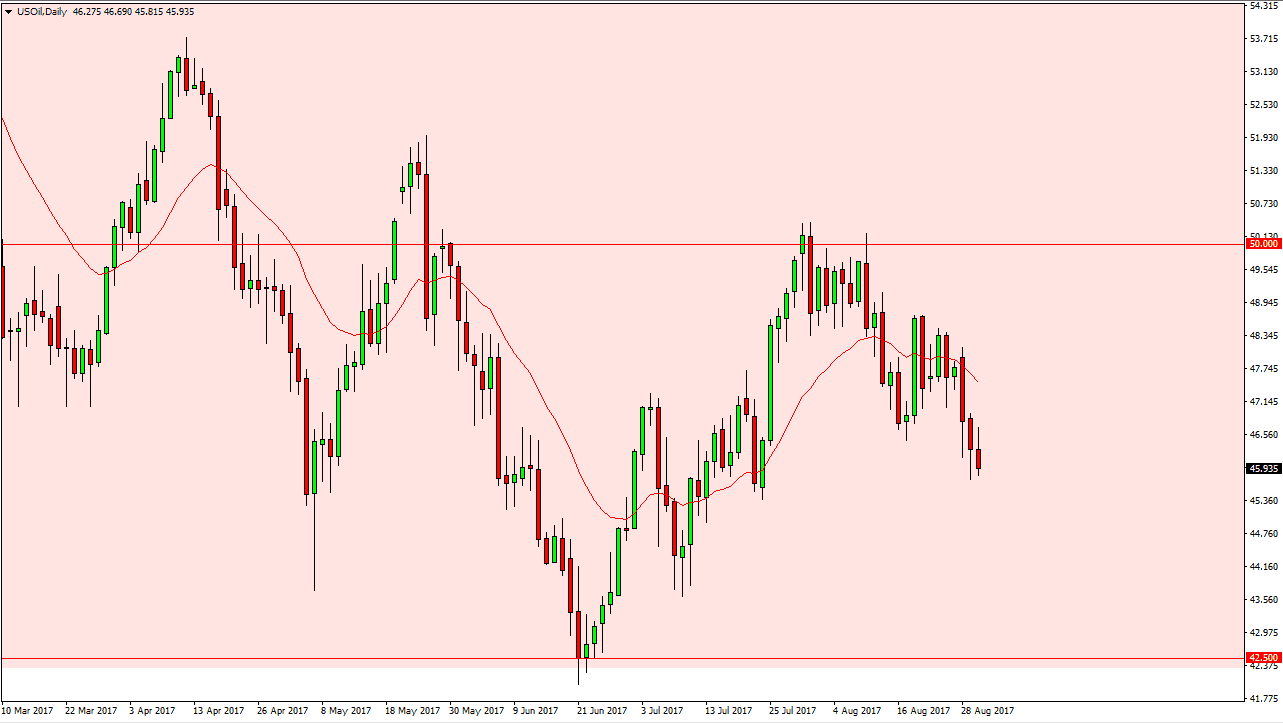

WTI Crude Oil

The WTI Crude Oil market initially tried to rally on Wednesday, but fell again as we continue to see negative pressure in the market. Ultimately, the market looks as if it will go back towards the $42.50 level below, which has been massively supportive. That’s not to say that the market will be going lower immediately, but more than likely we will see short-term rallies that we can start selling again. The $50 level above is the “ceiling”, but ultimately, I don’t even think we get there in the short term. There is no demand for crude oil as most refineries in the United States are going to be closed in the short term. The market looks very likely to see volatility, but every time it rallies I think it’s time to start selling yet again.

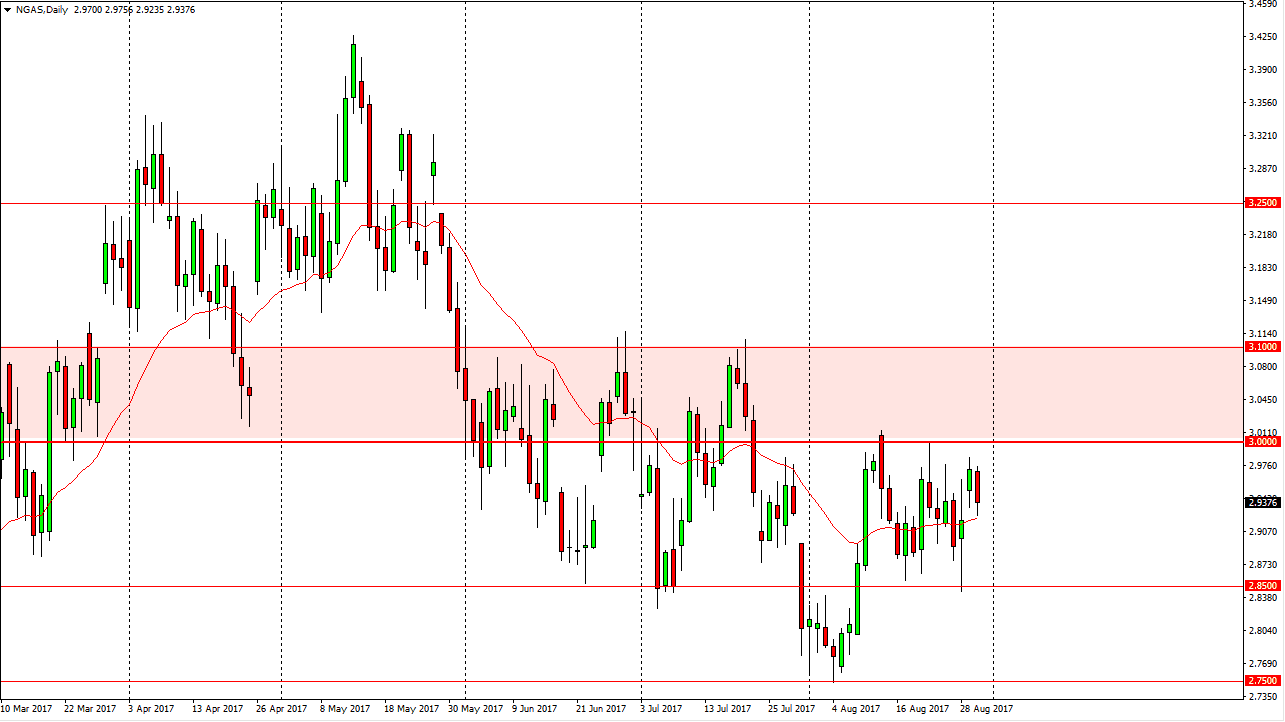

Natural Gas

The natural gas markets fell during the day on Wednesday, after initially trying to rally. The gap has been filled from a couple of days ago, and I think we will continue to see sellers jump into this market at the $3 handle. Ultimately, I don’t think we get above there, and I recognize it as a zone of resistance that extends to the $3.10 level. Ultimately, I think this market goes down to the $2.85 level underneath, and perhaps even breaks down below there. We’re not going to do it in the short term, I think that the illiquid markets of the summertime and especially during the holiday time, won’t allow for that move yet. However, once it does happen we should go down to the $2.75 level where we see support as well. I have no scenario in which I buy natural gas below the $3.10 level at this time.