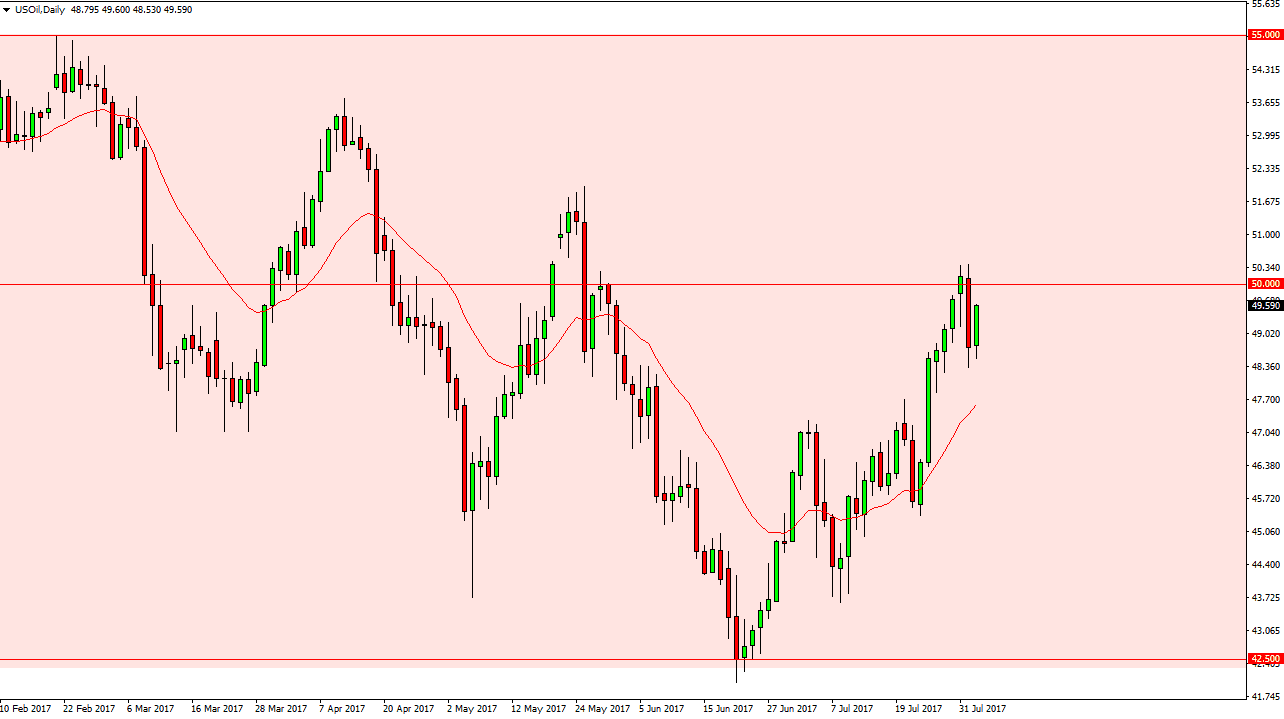

WTI Crude Oil

The WTI Crude Oil market rallied a bit during the day on Wednesday as the inventory number was a bit mixed. The $50 level above is resistive though, so if we see some type of exhaustive action or resistive candle, I would be a seller. If we can break above the $51 level, then we could go higher. We are most certainly in an area that is going to attract a lot of attention, so I expect quite a bit of volatility just waiting to happen. Keep in mind that the jobs number is tomorrow, and that of course will influence this market as well. I expect choppy trading conditions, but right now believe that perhaps the sellers may be returning soon. Again though, if we can break above the $51 level, the buyers should push towards the $52.50 handle.

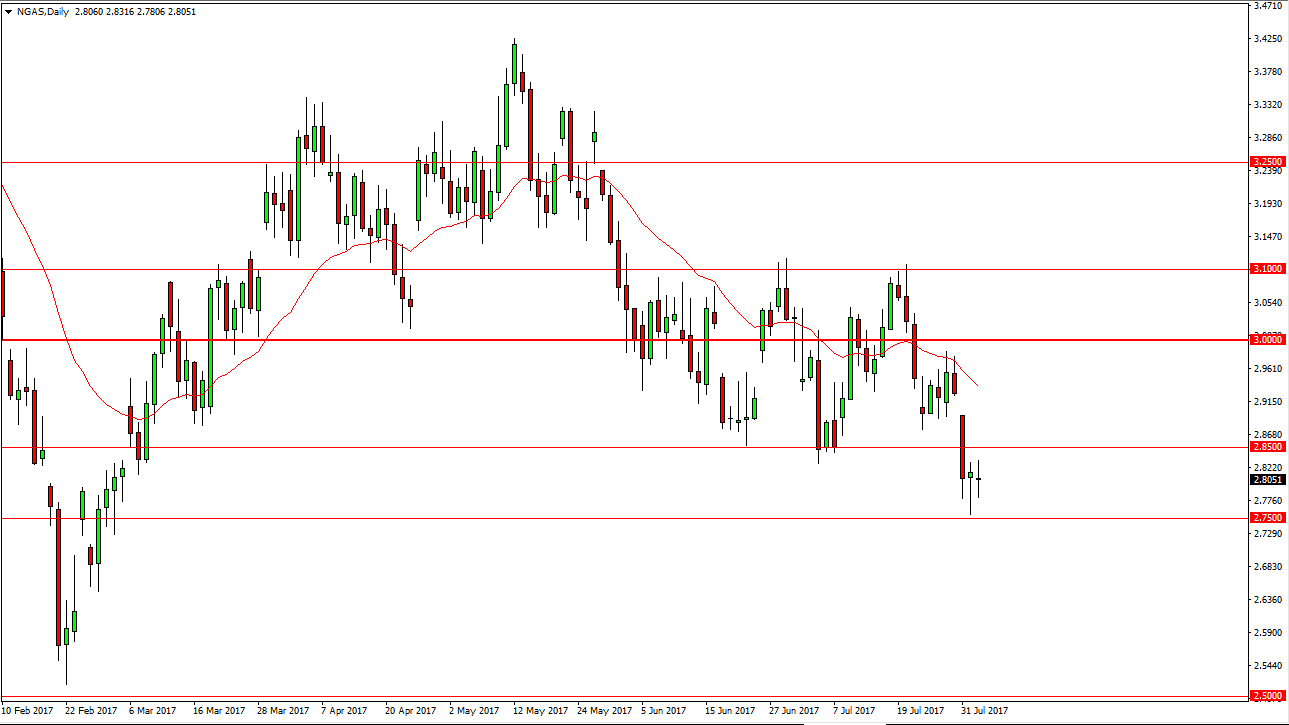

Natural Gas

The natural gas markets went back and forth during the day on Wednesday, as the 2.75 level continues to offer support. After all, we formed a nice-looking hammer on Tuesday, so I suspect that we could get a bit of a bounce. However, there is a nice gap somewhere near the $2.90 level, so any rally at this point in time will probably have selling opportunities above. A breakdown below the 2.75 level would send this market much lower, perhaps towards the $2.50 level after that. I am bearish of this market longer term anyway, and the fact that we break down below the $2.85 level suggests that we are going to continue to collapse. I have no interest in buying this market until we can break above the $3.10 level, something that looks all but impossible right now. Volatility will continue to be an issue, but I still believe that rallies are to be sold.