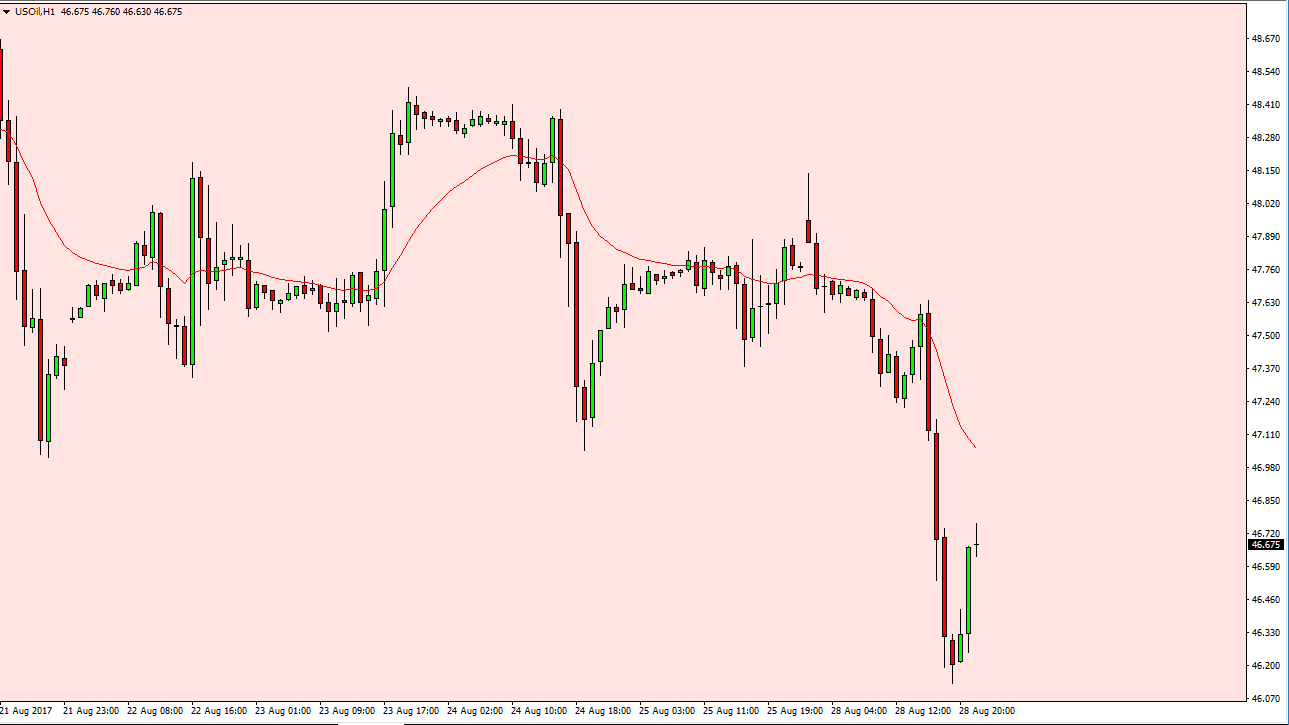

WTI Crude Oil

The WTI Crude Oil market plunged during the session on Monday in reaction to the storms in Texas. With refineries closing down, there will be even less demand for the role petroleum product, and therefore it’s likely that we will continue to see even more bearish pressure on crude oil. Granted, there will come a time when the refineries open and therefore demand more crude. Until then, I suspect that we will have a significant amount of bearish pressure. Exhaustion should be looked at as another selling opportunity in a market that has longer-term issues. Ultimately, I think that the market will go looking towards the $45 level again. Rallies this point will continue to struggle near the $47.50 level. With this, I don’t have any interest in buying and the short-term, because quite frankly we have far too much in the way of noise.

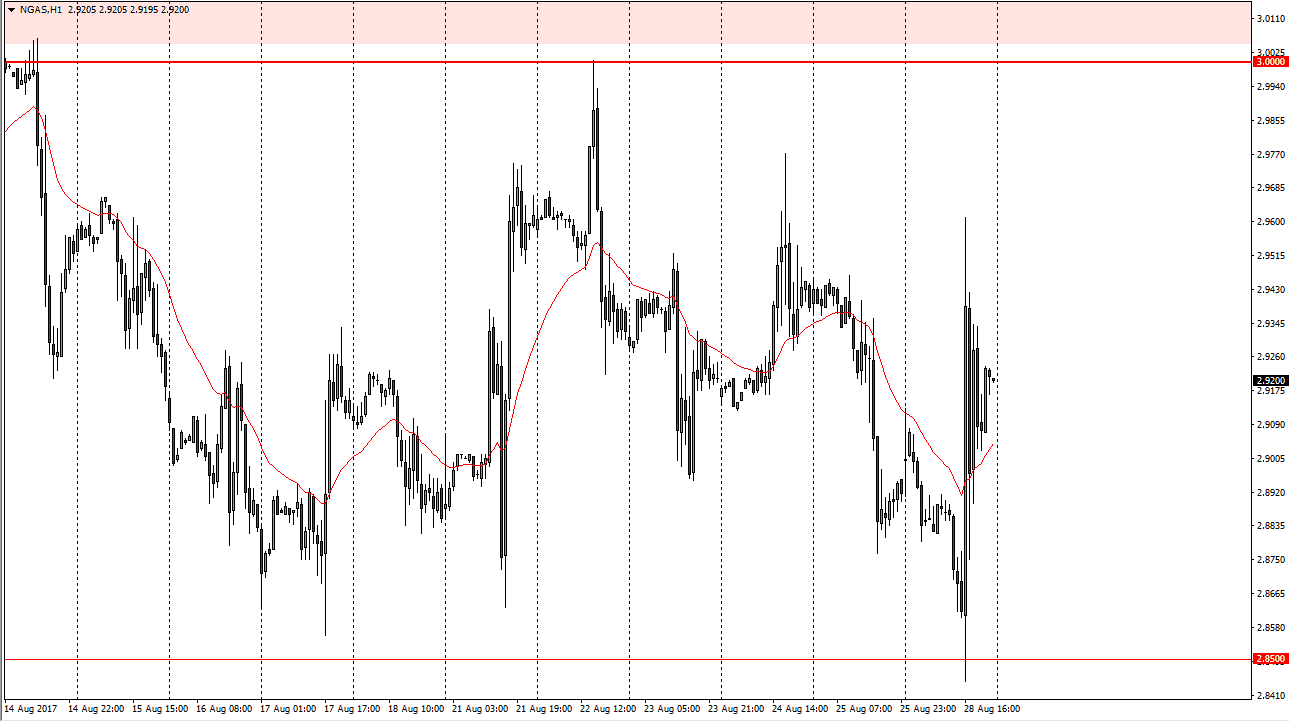

Natural Gas

The natural gas markets were extraordinarily volatile during the session after the hurricane Harvey damage became apparent. We had a wild swing in both directions, so having said that it’s likely that the market will continue to be very difficult to deal with. Ultimately, I do like selling natural gas but with the disruption of the major natural gas refining region of the United States, it’s likely that we will see quite a bit of choppiness as traders tried to get a handle on what’s going to happen next. Ultimately, I believe that the natural gas markets will continue to be very bearish, as there is far too much of the commodity out there, but right now I would suspect there could be a bit of choppy and bullish momentum. I do not think that we will break above the $3 level yet though. With this, I continue to look for selling opportunities.