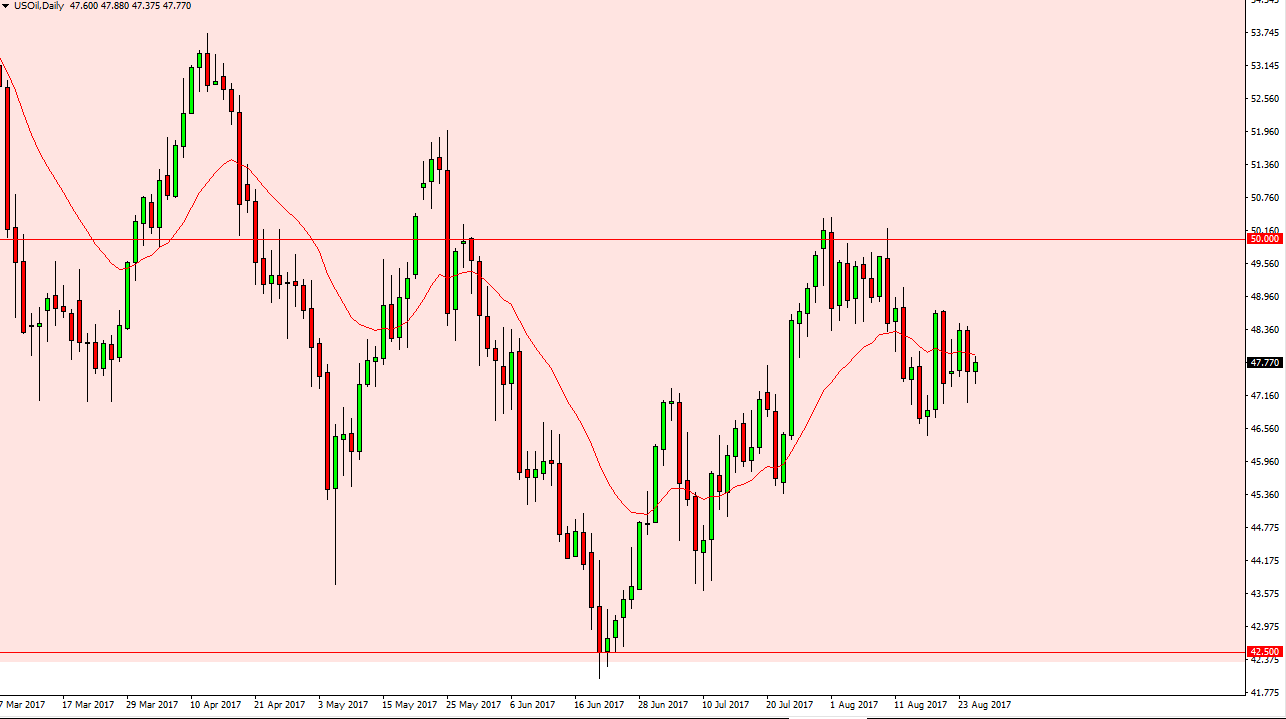

WTI Crude Oil

The WTI Crude Oil market had a very quiet session on Friday as the world of ways to see what happens with the hurricane in Texas. Because of this, I think that the next couple of sessions could be rather choppy, but I think that the $50 level above will offer resistance. I’m looking to sell rallies that show signs of exhaustion, as I have no interest whatsoever in trying to bite crude oil for the longer term. Ultimately, the market should continue to be choppy, and I think the given enough time the oversupply will take over the market again. Any short-term rally due to the weather is more than likely going to roll over quickly.

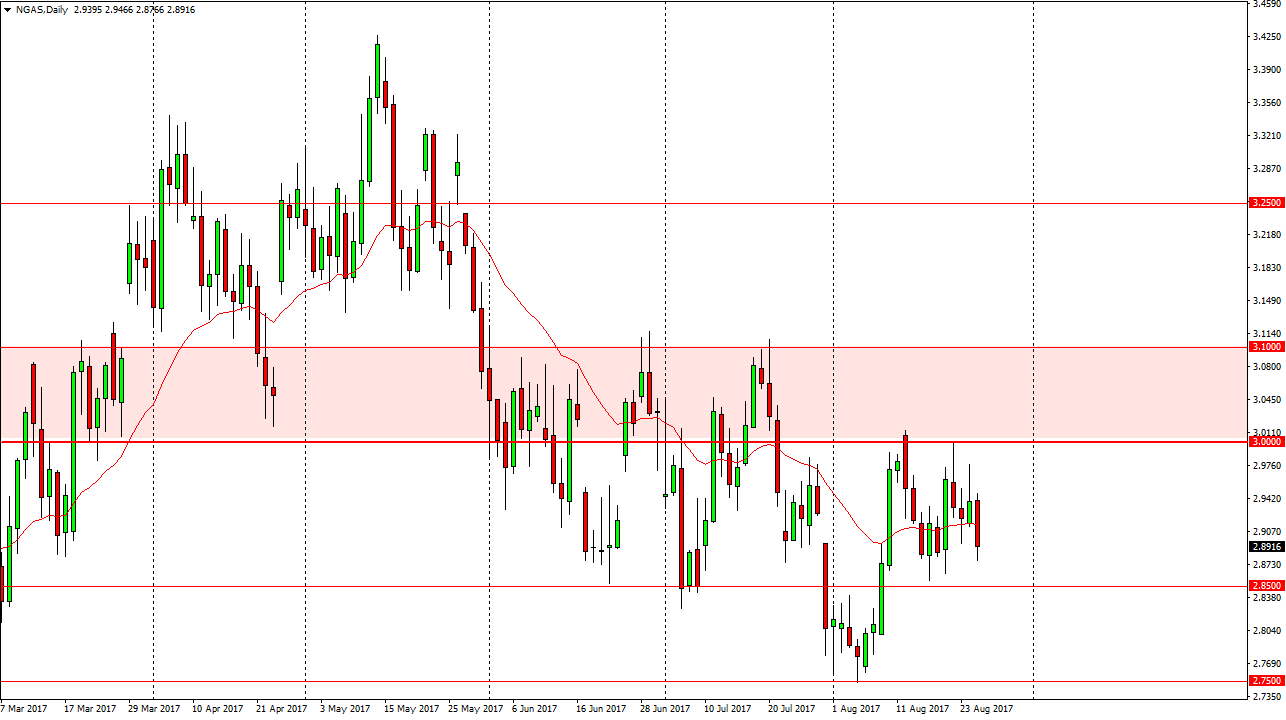

Natural Gas

The natural gas markets fell during the session, as we continue to see a lot of bearish pressure. I think that the market is ready to continue to go down towards the $2.85 level, and if we can break down below there we will probably go to the $2.75 level. The $3 level above is massively resistive, and I believe that the resistance extends to the $3.10 level. Ultimately, every time we rally I think that it’s a selling opportunity, and with this I believe that the market is simply a matter of waiting for the market to go to highs that show weakness. Once we get that, it’s time to start selling again as the downward pressure will continue longer term. I have no interest in buying this market, and quite frankly don’t even really have the scenario to do so. If we get some type of massive rally due to the weather, that’s fine with me, I will simply wait for a longer-term selling opportunity to present itself in higher levels.