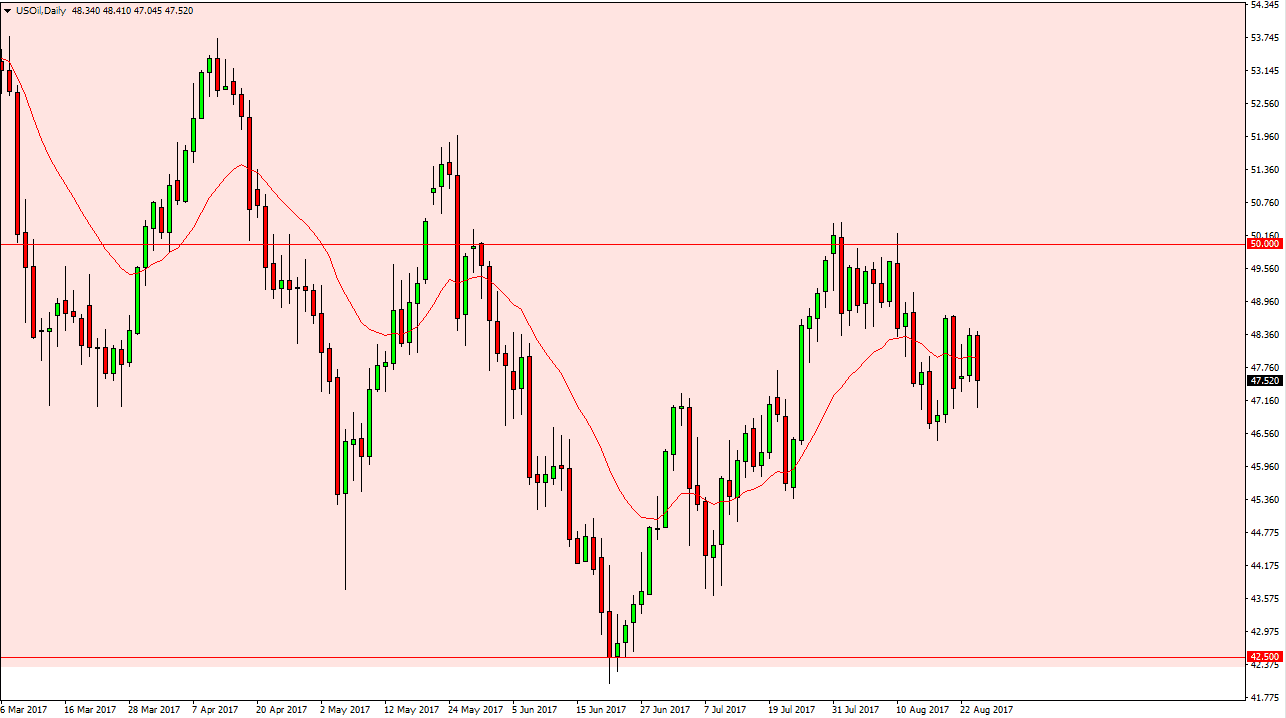

WTI Crude Oil

The WTI Crude Oil market fell during the session on Thursday, reaching down towards the $47 level. However, there is a tropical storm that is changing over into a hurricane heading towards the Gulf Coast refineries, so will be interesting to see what happens next. If we get some type of massive storm on Friday and the weekend, it’s likely that we will see the market rally towards the $50 level, and perhaps even break above there. Otherwise, I think that rallies are to be sold. I also think that eventually when things calm down, the sellers will return as well. I am bearish of oil, because quite frankly we just don’t have the demand yet. Having said all that, there is a possibility of a short-term pop in price, and that of course could be a nice smash and grab trade.

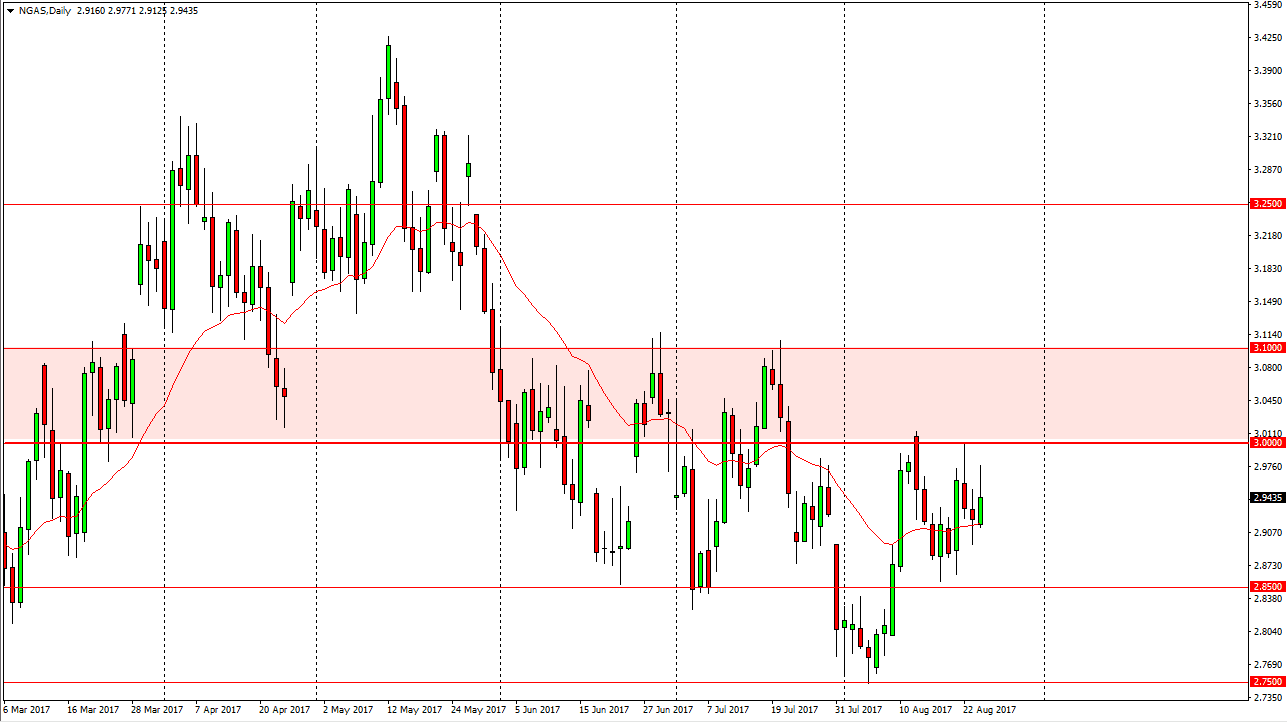

Natural Gas

Natural gas markets are going to have the same issues, as we tried to rally during the day on Thursday after an as expected inventory report, and with that being the case it’s likely that the $3 level above is going to be massive resistance. However, many of the refiners are in the same area mentioned above, and that could be a problem in the short term. Ultimately, I have no interest in buying natural gas until we clear the $3.10 set level, which I think would take something catastrophic to make that happen. Ultimately, this is a cell the rallies type of event, and I think that short-term traders will probably profit quite nicely to the upside if we get some type of destruction, but at the end of the day there is still far too much in the way of natural gas and the supply chain being interrupted will be a temporary event.