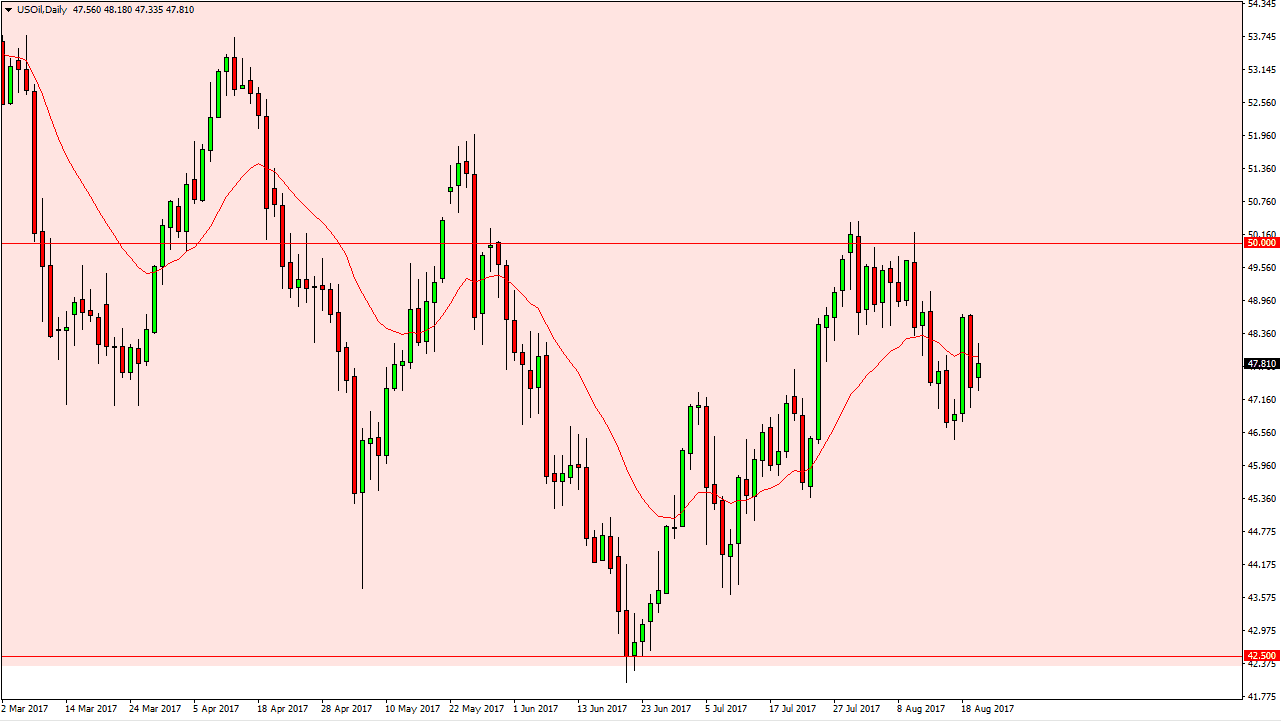

WTI Crude Oil

The WTI Crude Oil market had a volatile session on Tuesday, as we continue to bang around the $40 level. With the Crude Oil Inventories announcement coming out today, I think we will see more volatility and perhaps even a move in one direction or the other. If we break higher, I think that the $50 level will offer a bit of a ceiling though, unless of course the inventory number is much more bullish than anticipated. Currently, it’s expected to be a loss of roughly 4 million barrels. If we break down below the $46.50 level, the market should then go looking for the $45 handle, and then eventually $42.50 from what I can see. I still believe in the downside, I think that oil is going to continue to have several issues ahead of it.

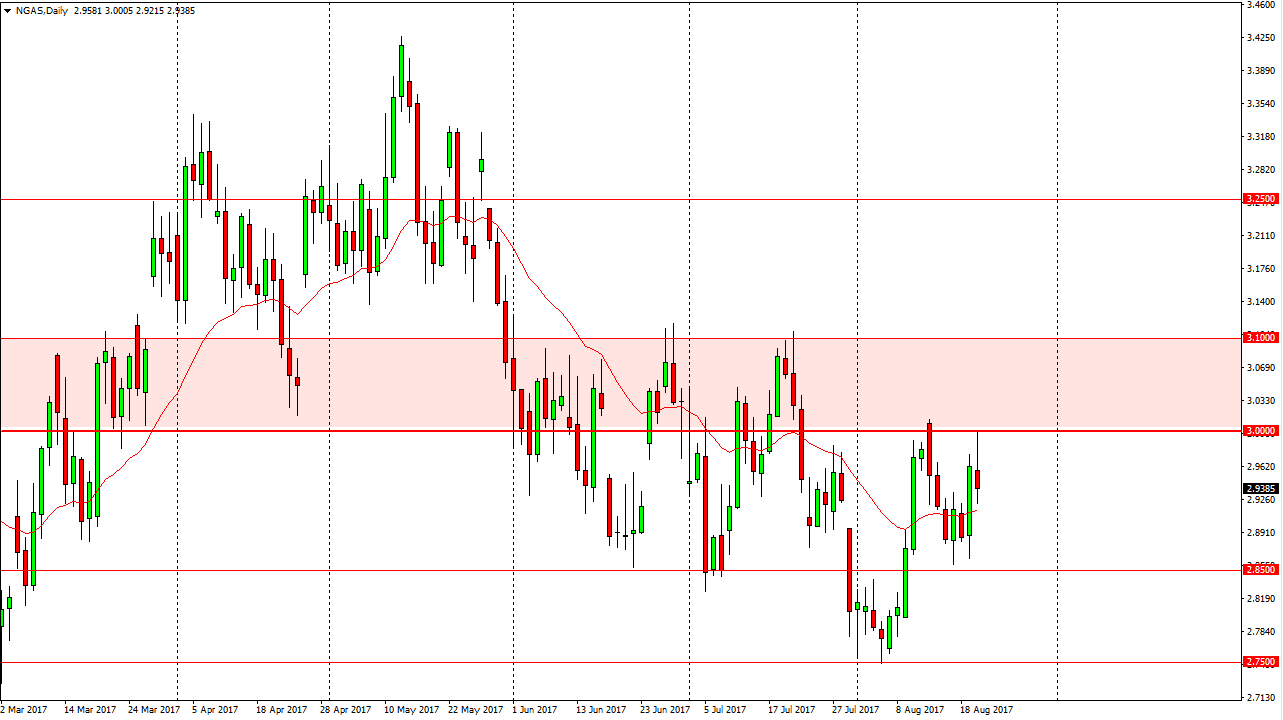

Natural Gas

Natural gas markets initially tried to rally on Tuesday, but found the $3 level to be far too resistive yet again. It now looks by forming a shooting star as a market that’s ready to fall. If we reached down below, I think that the $2.85 level is the next target, and then eventually will go looking for the $2.75 level. A breakdown below there would be very negative, and I think it’s coming. However, it’s probably can to take a certain amount of momentum building to break down like that, so expect rallies from time to time. It is not until we break above the $3.10 level that I would even remotely consider a bullish position, and that doesn’t look very likely anytime soon. Natural gas continues to be a very bearish market, and I think that it offers plenty of opportunities for those who are patient enough to wait for selling opportunities.