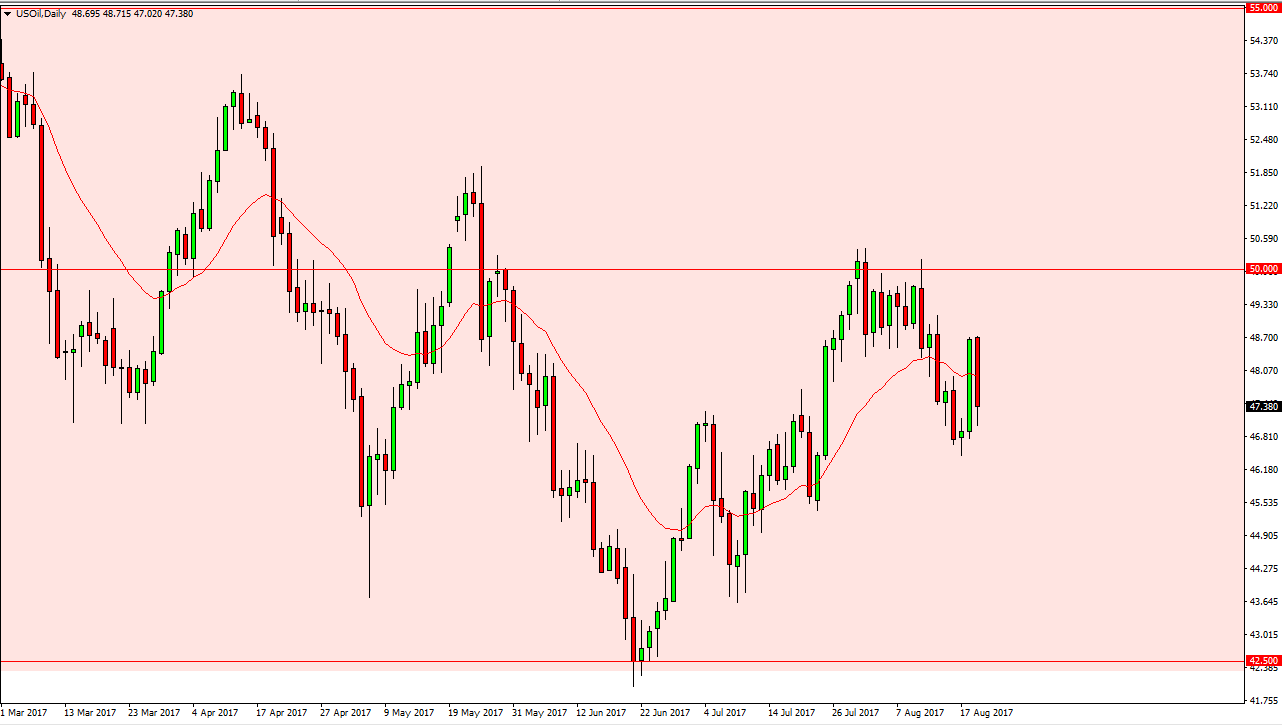

WTI Crude Oil

The WTI Crude Oil market fell during the day on Monday, reaching as low as the bottom of the Friday bullish candle. Because of this, I think we will continue to see trouble in this market, and rallies looks likely to be sold off going forward. I think that the market will eventually go looking towards the $42.50 level underneath, and I believe that the $50 level above will continue to be massively resistive. That being the case, I think that the overall bearish pressure will continue, and I think that we could go as low as the recent lows, and perhaps even down to the $40 level. All things being equal though, if we managed to break above the $50 level, that would be bullish and probably send this market looking towards the $52.50 level next.

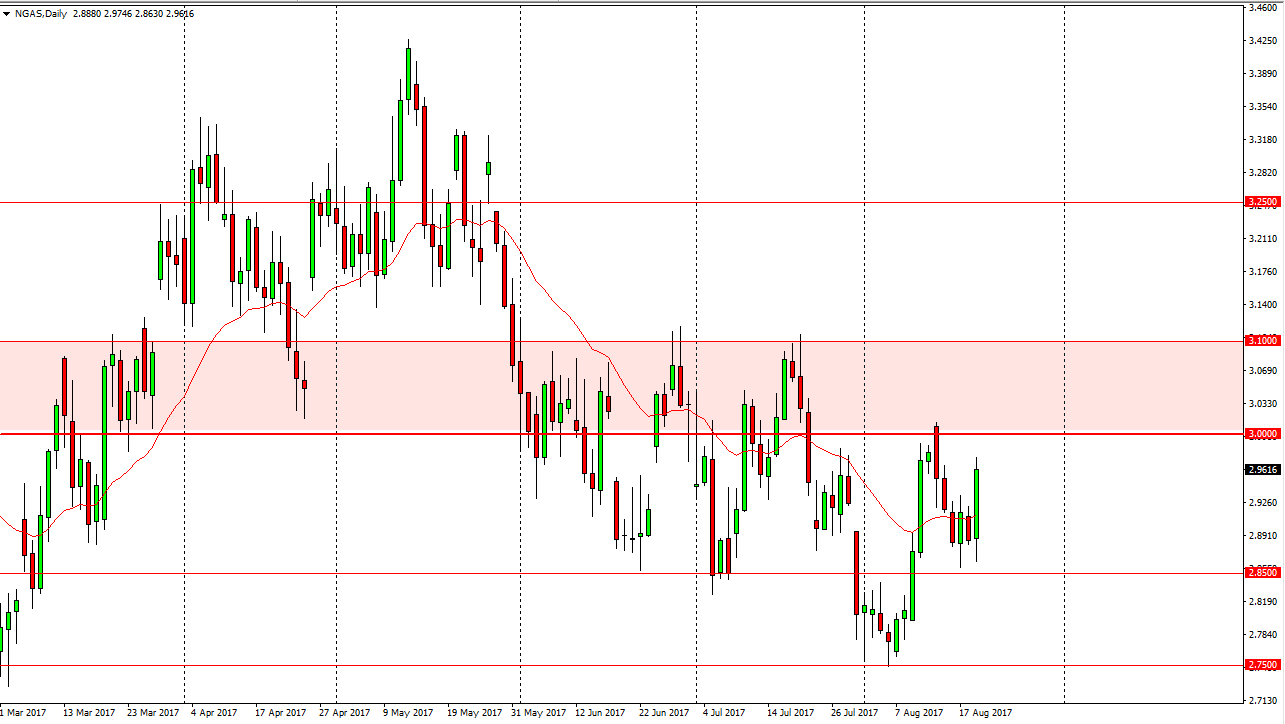

Natural Gas

Natural gas markets initially fell during the day but found enough support at the $2.87 region to turn things around and form a very bullish looking candle. However, the area from $3 to the $3.10 level is massively resistive, and I think will continue to be. Because of this, I’m waiting for and exhaustive candle to start selling. It’s possible we may see a bit of consolidation and the short-term, but I believe that the overall downward pressure will continue in this market. That being the case, I’m looking for selling opportunities only, and I believe that it would be “safe” to start buying this market until we cleared the vinyl $3.10 level. If we turn around a breakdown below the $2.85 level, we should go looking for the $2.75 level after that. I think volatility is here to stay, especially considering that this is one of the least liquid periods during the year.