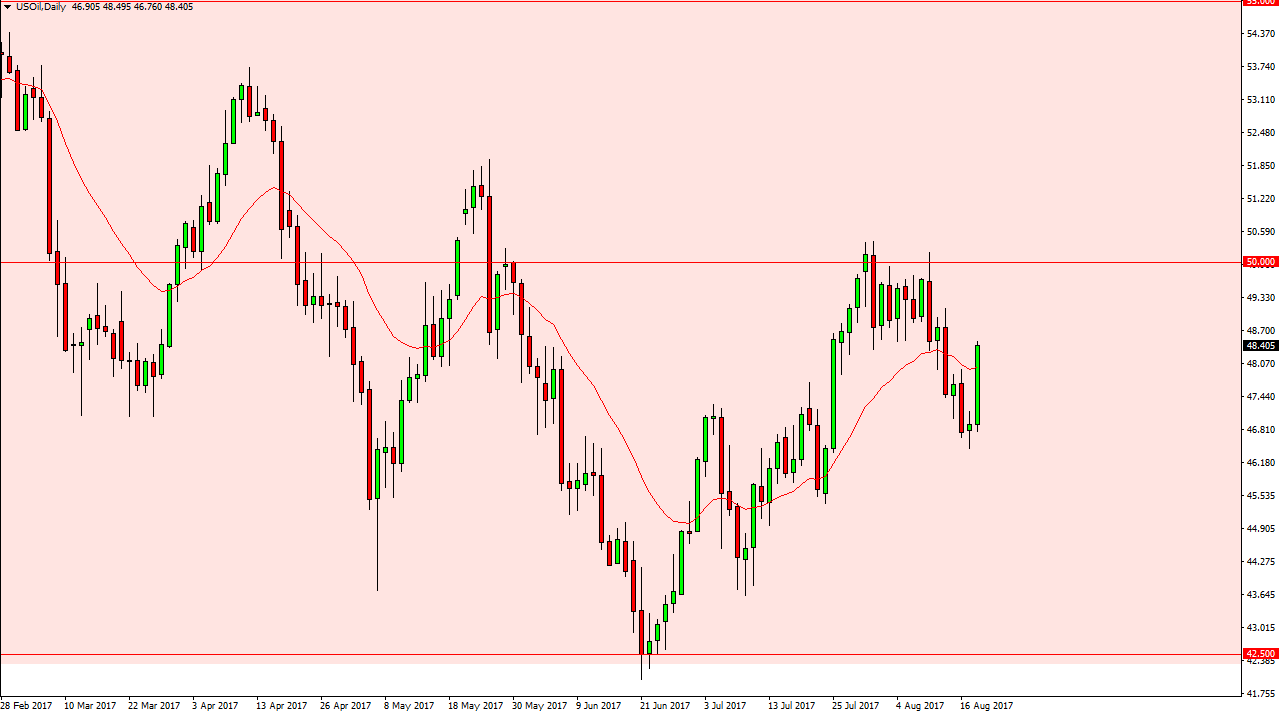

WTI Crude Oil

The WTI Crude Oil market exploded to the upside on Friday, showing signs of life again. As the demand is starting to pick up in the United States, the should continue to push this market higher. I think that the market will go looking towards the $50 level, but I would expect to see a massive amount of resistance in that area. If we can break above $50, that is going to be a very positive sign. However, I don’t think we are going to, least not on the first attempt. So, having said that, I think the you have a short-term buying opportunity followed by what more than likely will be at the very least a pullback. The market will remain volatile as it has been for some time, but ultimately, I think the buyers are going to have their say over the next several sessions.

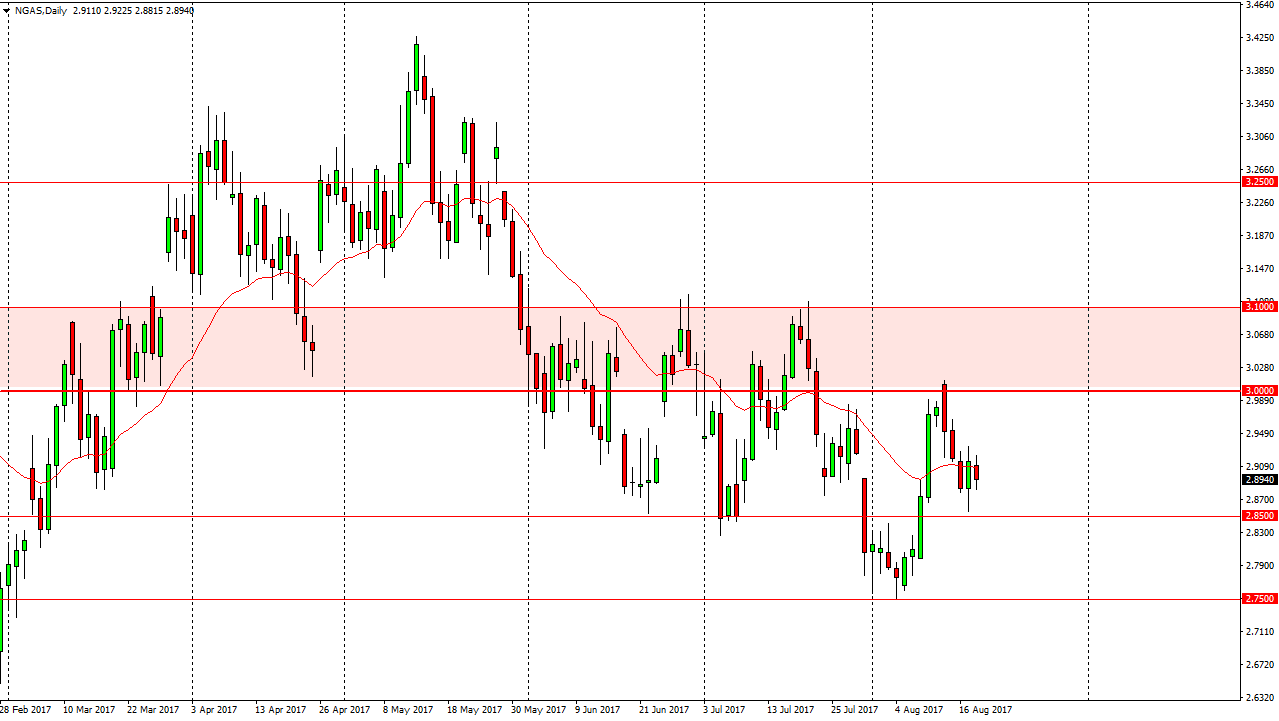

Natural Gas

The natural gas markets fell during the session on Friday, as we continue to see a lot of choppiness and volatility. I believe that the $2.85 level will continue to be massively supportive, and that being the case it’s likely that the market will test the area again, and short-term rallies will course be selling opportunities. I think that if we break down below the $2.85 level, the market will then go looking towards the $2.75 level. A breakdown below there sends this market looking towards the $2.50 level which is my longer-term target. I have no interest in buying, I believe that the $3 level above will continue to be a bit of a massive ceiling for the market going forward as the oversupply continues to be an issue. It’s not until we break above the $3.10 level that I would consider buying.