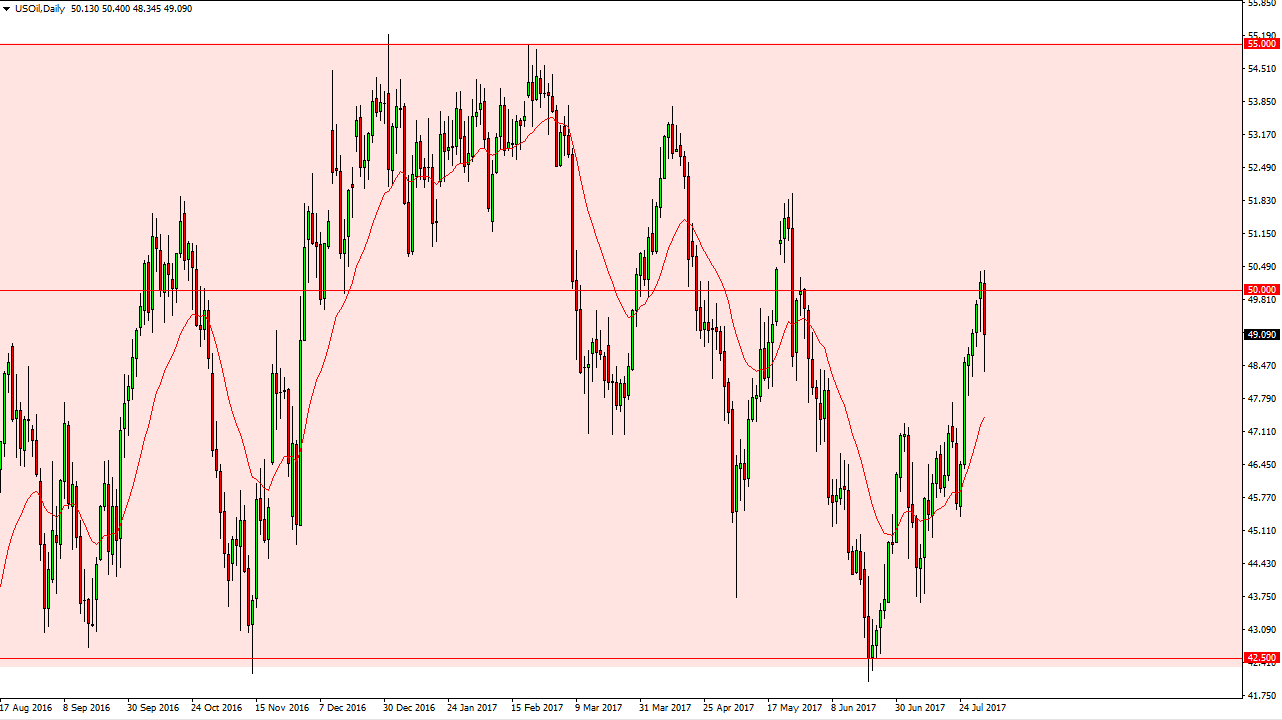

WTI Crude Oil

The WTI Crude Oil market broke down significantly during the day on Tuesday, as the $50 level offered quite a bit of resistance. The market did bounce a bit towards the end of the day, and that makes sense, as the market has the Crude Oil Inventories announcement coming out during the day today. Because of this, I think that there will be extreme volatility but I also believe that unless the market is an extraordinarily bullish move just waiting to happen, I think that we will see this market break down. There is an expectation of a massive drawdown and crude well, and if we don’t get it, we could see this market reach towards the $47 level almost immediately. A break to a fresh, new highs census market looking towards the $52 level.

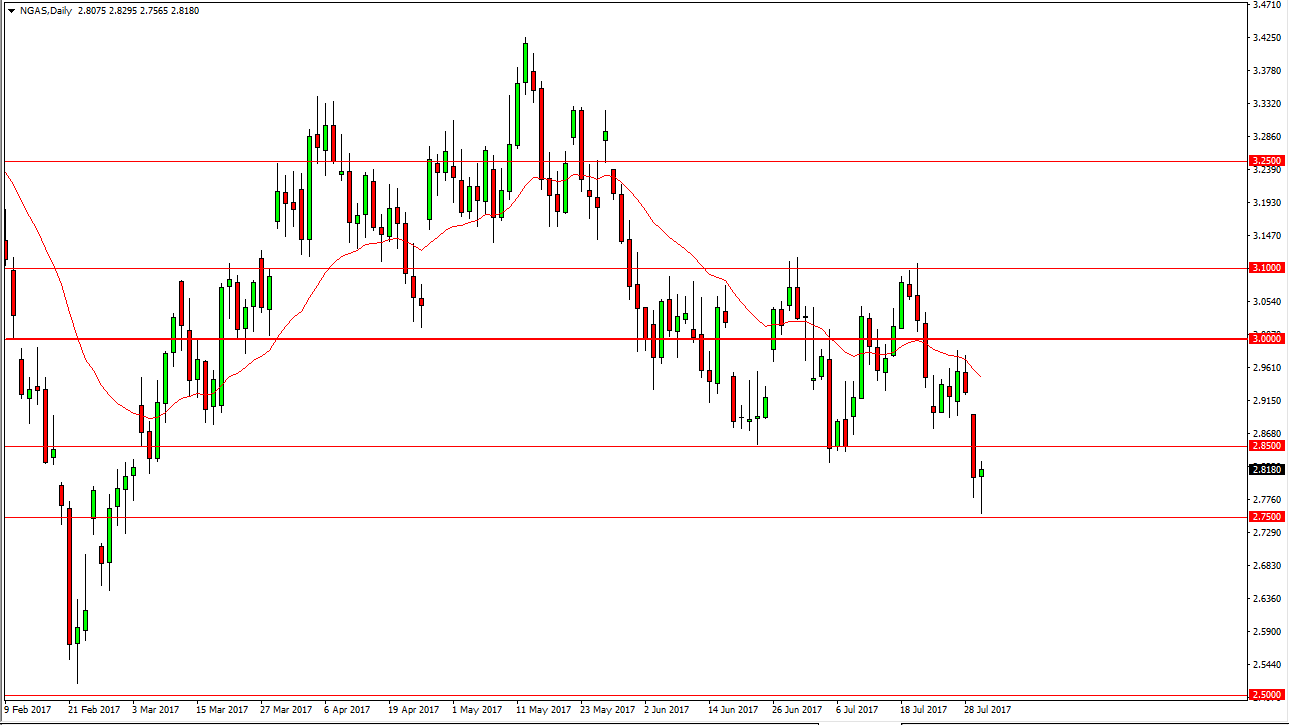

Natural Gas

Natural gas markets fell to the $2.75 level, which is very supportive on the longer-term charts. Not only that, we ended up forming a hammer and that of course is a very bullish sign. Because of this, we may get a bit of a bounce, and perhaps an attempt to fill the gap from a couple of sessions ago. Alternately, if we break down below the bottom of the hammer, which is at the $2.75 level, I would be attempting that this market should continue to go much lower, perhaps reaching down to the $2.50 level after that. Because of this, I believe that the market may bounce but it should only offer and I selling opportunities of higher levels as the downtrend has been very strong. I believe that the $3.00 level above is a massive “ceiling” in the market, and because of this I remain very bearish over the long-term as well.