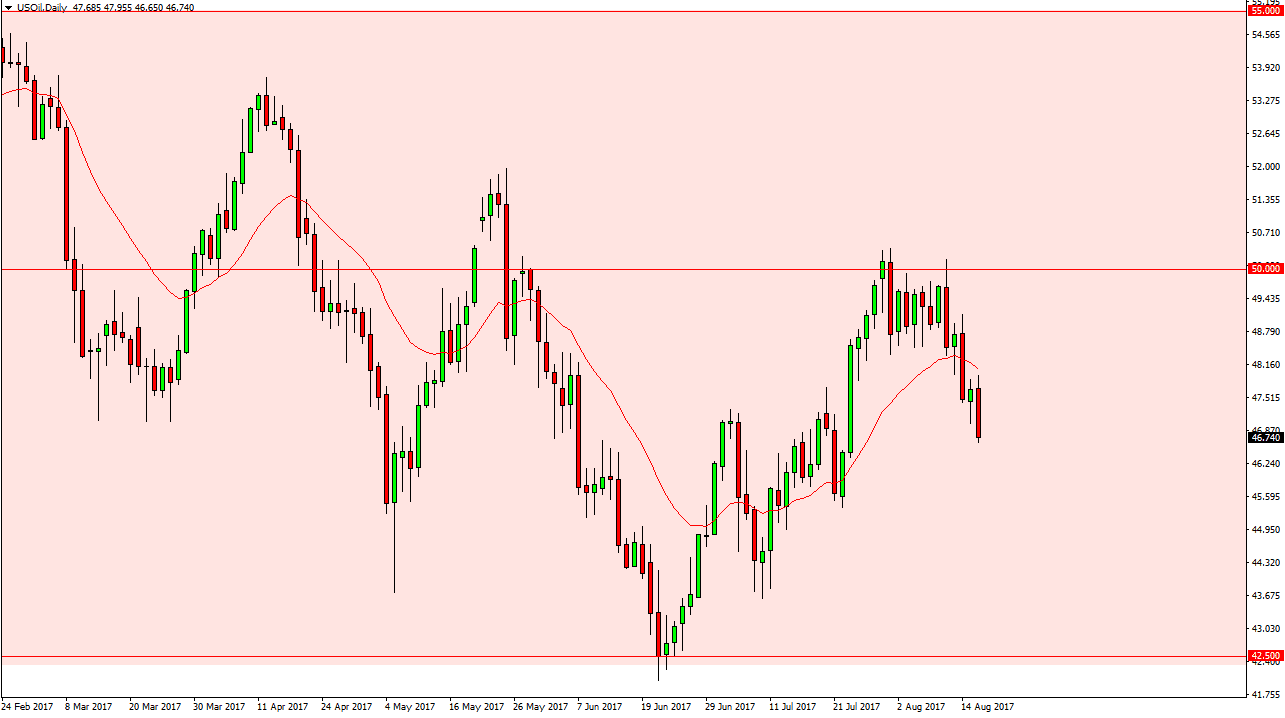

WTI Crude Oil

The WTI Crude Oil market fell significantly during the day on Wednesday, breaking down below the bottom of the hammer from the previous session. By doing so, it looks as if we are going to continue to see bearish pressure, and that the market will more than likely go back towards the bottom of the overall consolidation. Because of this, I’m a seller of short-term rallies, and believe that the market will continue to find a significant amount of bearish pressure. Ultimately, one thing that I cannot help but notice is that the US dollar lost a significant amount of value during the day, but at the same time oil fell. That shows just how weak the crude oil market is. With that in mind, I don’t see any reason why this market will go looking towards the $42.50 level.

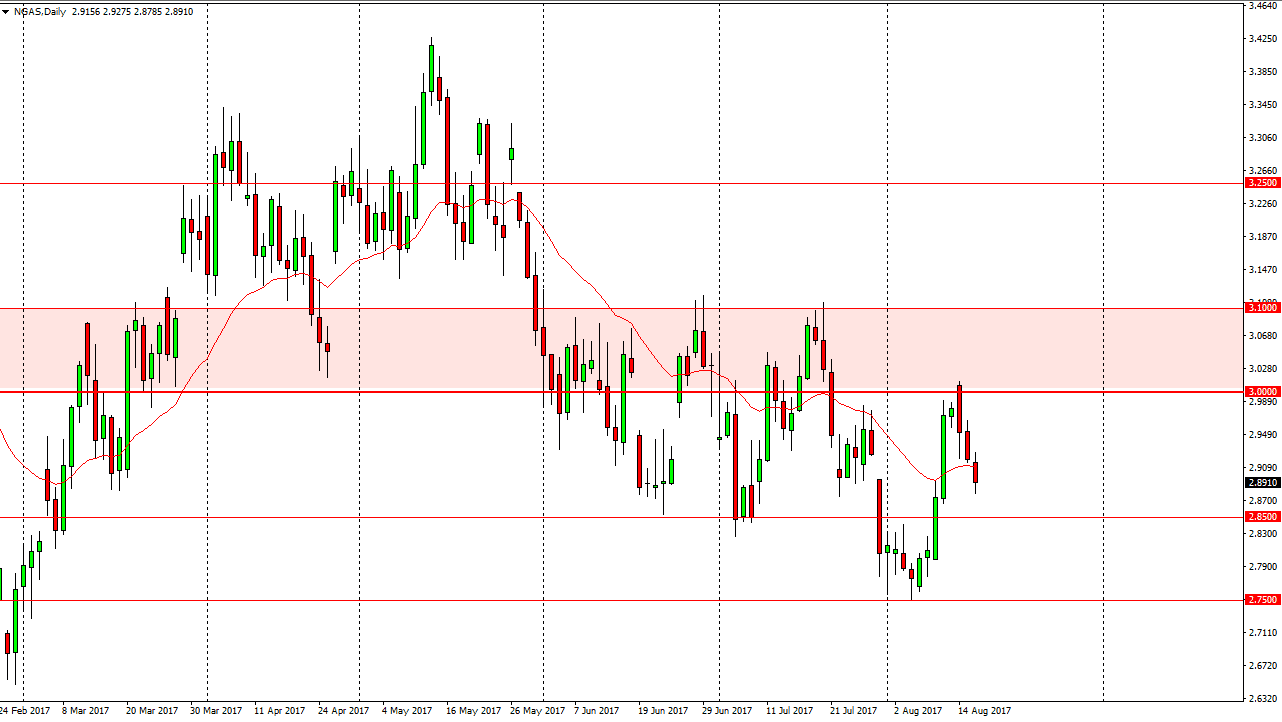

Natural Gas

The natural gas markets initially tried to rally during the day on Wednesday, but then fell significantly, reaching towards the $2.88 level. The $2.85 level under there will be the next support level, and then if we can break down below there I think we go to the $2.75 level. I look at rallies a selling opportunities, and I also believe that the $3.00 level above is massive resistance. The fact that we could not test the $3.10 level this last time we rallied suggests to me that we are going to continue to see bearish pressure and that we should go much lower given enough time. Ultimately, I believe that this market will find a way to get down to the $2.50 level underneath, but it will obviously take a while to get there. I have no interest in buying natural gas under any circumstances.