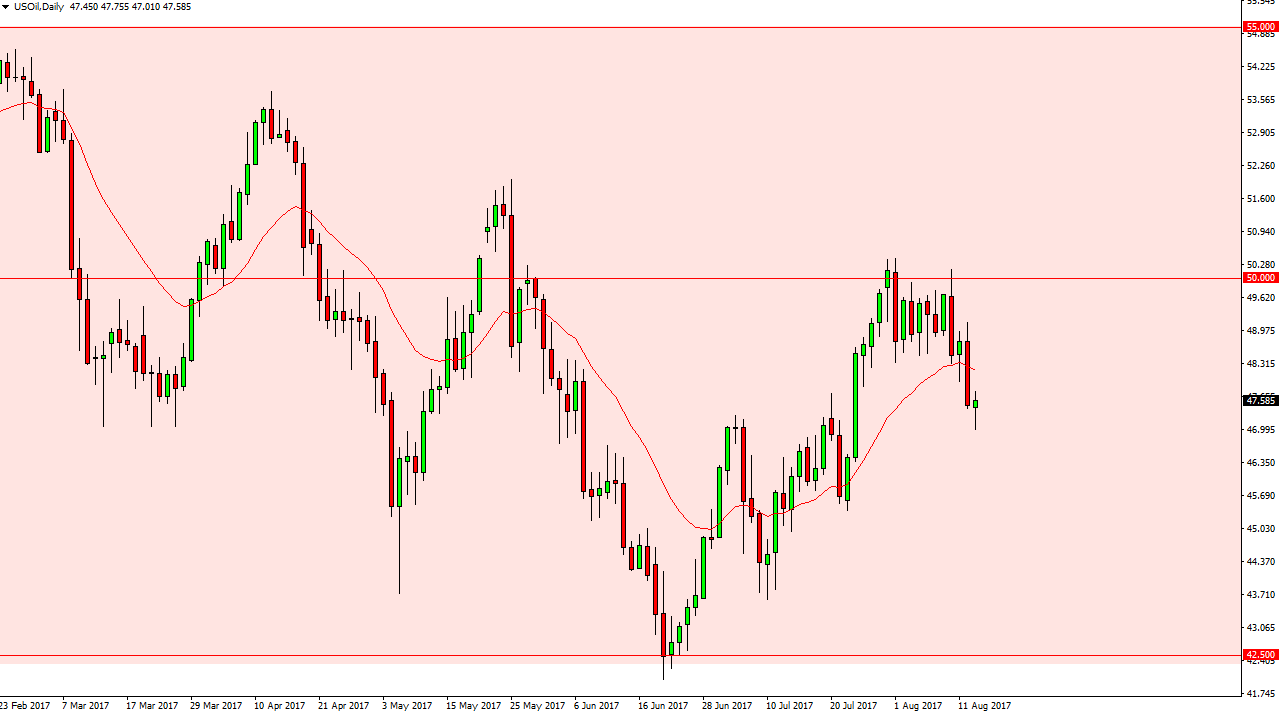

WTI Crude Oil

The WTI Crude Oil market initially fell on Tuesday again, but found enough support underneath the $47 level to turn around and form a hammer. This makes a significant candle for the day, but I recognize that the Crude Oil Inventories announcement comes out today, and that could either confirm this hammer is a bullish sign, or negated, which would be a very negative sign. Because of this, I’m waiting until the market breaks one of those ends of the candle and simply following. I will not take this trade until after the announcement though, because it of course can change the overall attitude. Longer-term, I remain bearish but I recognize that a bounce back to the $50 level wouldn’t necessarily be out of the ordinary.

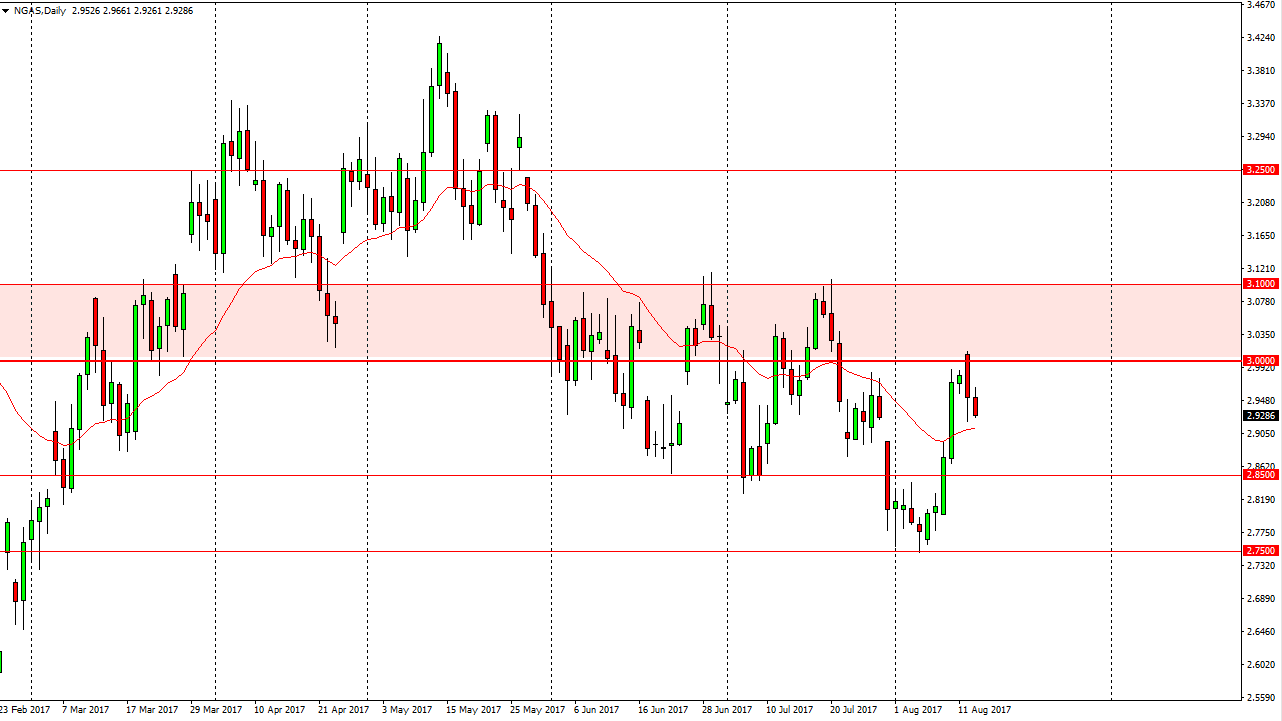

Natural Gas

Natural gas markets continue to look very soft, and now the $3 level looks even more formidable than it did in the past. Previously, the $3 handle offered resistance extending to the $3.10 level. This past time we reached towards that level, we didn’t even try to break towards the $3.10 level. Because of this, I think that the bearish pressure is picking up, and I believe that the market should reach towards the $2.85 level underneath. By breaking below there, the market will probably reach towards the $2.75 level. Rallies at this point should be selling opportunities, and I look at exhaustion after a bounce as a nice opportunity to take advantage of what seems to be a longer-term downtrend. I have no interest in buying this market until we clear the $3.10 level above, which is all but impossible in the next session or so. I believe that the market will continue to drift lower, and that sellers will be very attracted to this market.