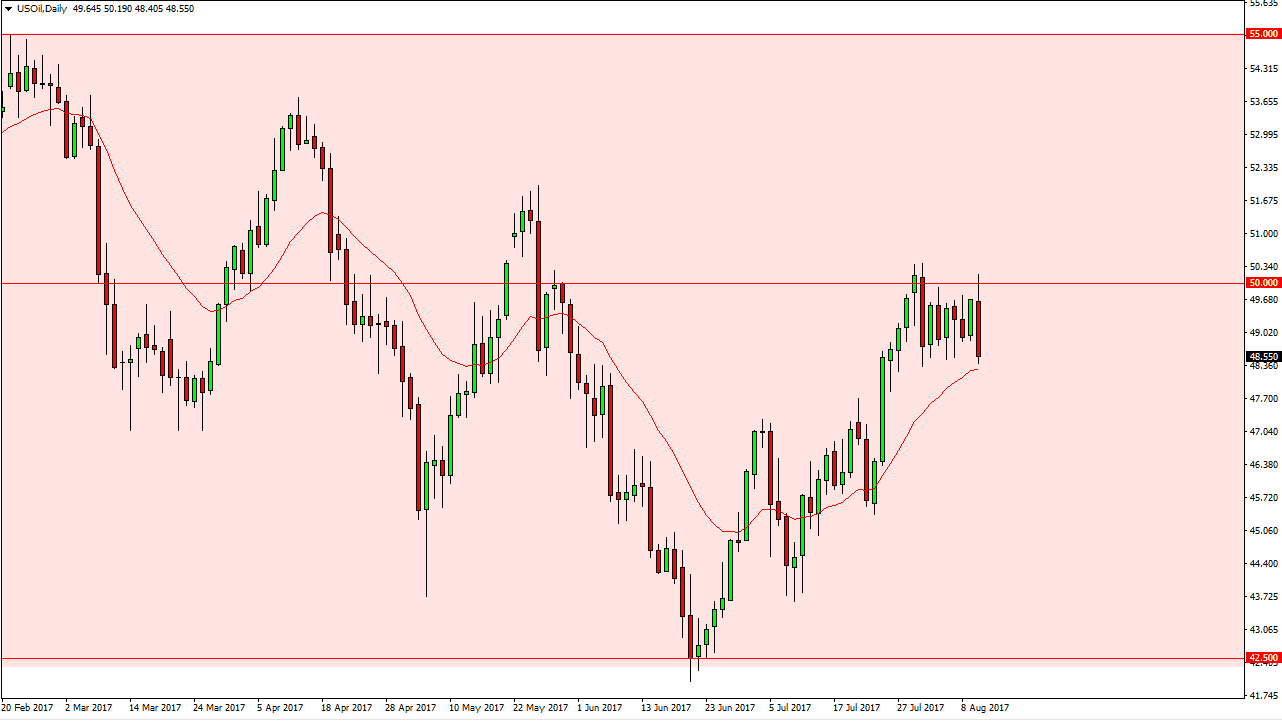

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the day, but found enough resistance above the $50 level on Thursday to turn around and fall significantly. It now looks as if we may try to break down, and if we move below the $48 level, I am more than willing to start selling crude oil again. I think that the market could go looking towards the bottom of the consolidation area again, near the $42.50 level. I do see support at the $47 level in the meantime, as well as the $45 level. Alternately, if we can break higher and reach above the $50.50 level, then we could see a bullish move towards the $52 level next. Overall, I am bearish of this market and I recognize that the oversupply will still be an issue.

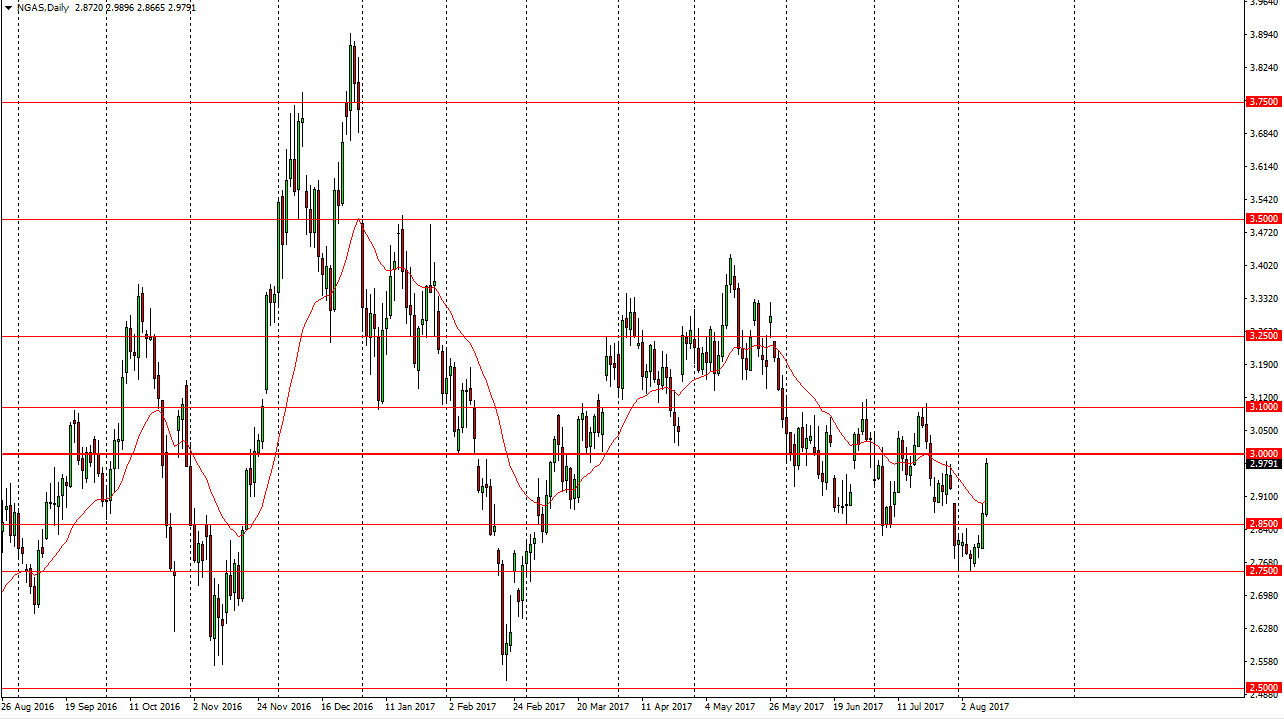

Natural Gas

Natural gas markets exploded to the upside during the day on Thursday, closing just a bit below the vinyl $3 level. The $3 level is the beginning of massive resistance though, extending to the $3.10 level. As long as we stay below there, I’m looking for exhaustive candles to start selling as it should be a nice opportunity to take advantage of what has been a longer-term downtrend in a market that has been massively oversupplied. I have no interest in buying this market, because quite frankly this is a cyclical issue, and I believe that we will go looking towards the $2.75 level again, and then eventually break down below there but obviously is going to take some time to get down to that massive target of mine: $2.50. It is not until we break above the $3.25 that I would remotely consider buying this market, as it would be a complete repudiation of the downtrend.