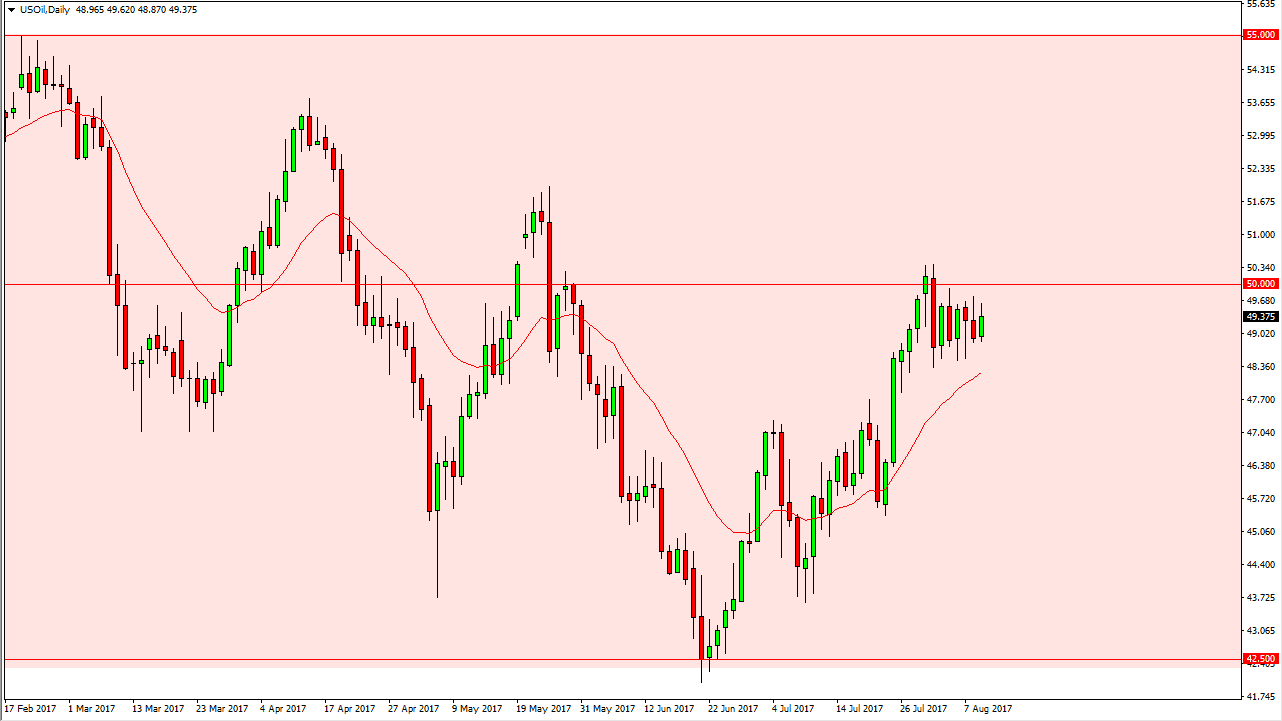

WTI Crude Oil

The WTI Crude Oil market went back and forth during the day on Wednesday again as we continue to hover just below the $50 level. It looks as if this area is offering a significant amount of resistance, especially considering how positive the inventory number should have been during the day. Because of this, I think that we could see a pullback from here, and a move below the $48.25 level census market much lower. If we break above the $50.50 level, the market should then continue to go much higher. Ultimately, I think that the markets are essentially stuck in this range, and I am not expecting any type of major move. If we do break above the $50.50 level, the market should then go to the $52.50 level. If a breakdown occurs in this market, I believe that we will probably go looking for support near the $47 level underneath.

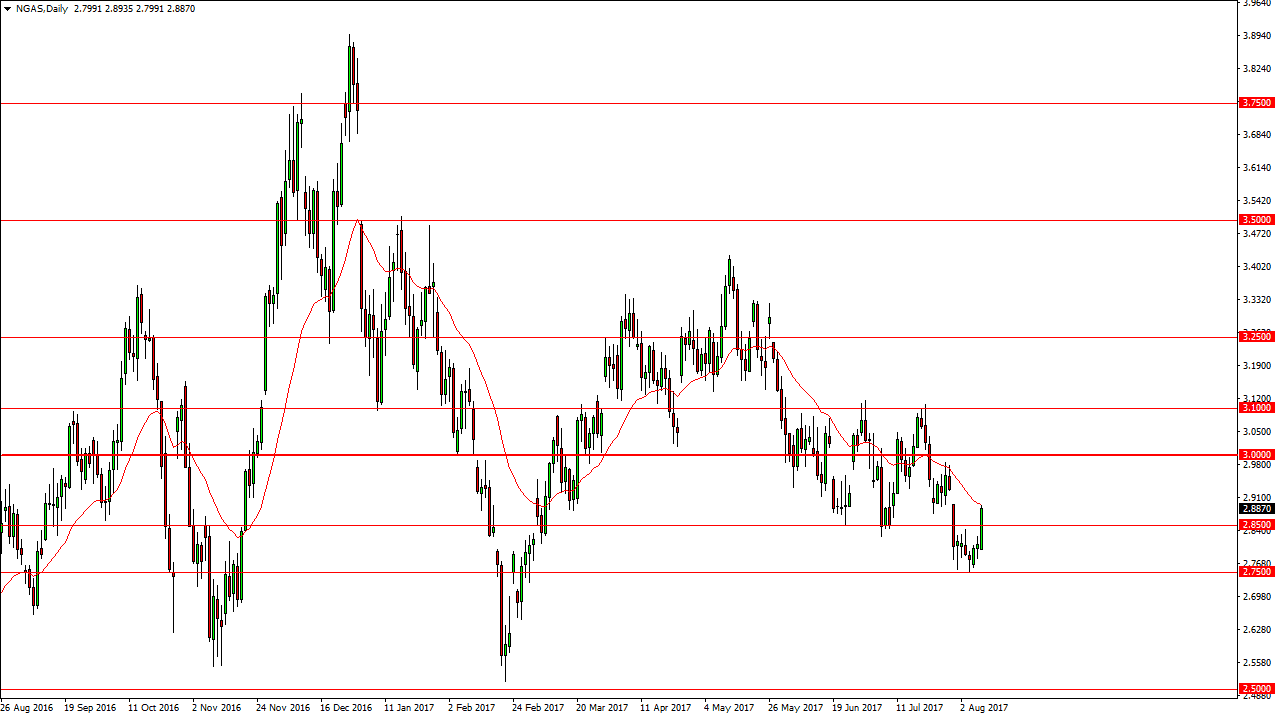

Natural Gas

Natural gas markets had a very bullish session on Wednesday, slicing through the $2.85 level. However, there is a gap just above, and I think it will cause a bit of resistance. On short-term charts, we are starting to see shooting stars for on the hourly chart already, so I think it’s likely that we continue the downward pressure and that people will look at this as an opportunity to start selling again. I believe that the downtrend is in effect as long as we can stay below the $3.10 level. A breakdown below the $2.75 level should send this market down to the $2.60 level underneath where there is another gap. Longer-term, I think that were going to go down to the $2.50 level, which is my longer-term support on the longer-term time frame charts.