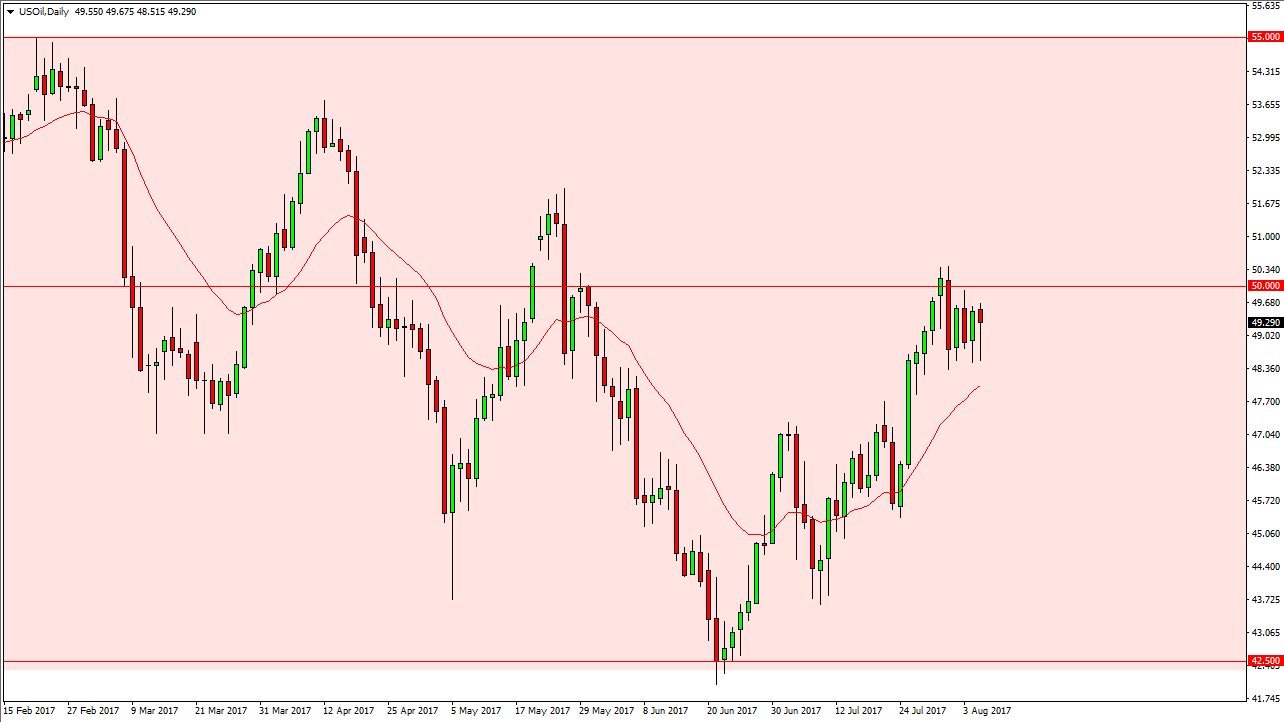

WTI Crude Oil

The WTI Crude Oil market fell during most of the session on Monday, but did bounce a bit from the $48.40 region. By forming a hammer, this suggests that the market is going to try to break back to the upside of $50, but it’s not until we clear the $50.50 level that I would be convinced that we are going to continue the move to the upside. A breakdown below the bottom of the candle for the session on Monday would be very negative, and a move below the $48 level would confirm a more bearish attitude of the market as we should go looking for the $47 level next. I still am longer-term negative of this market, but I recognize that there are a lot of moving pieces that throw momentum back and forth.

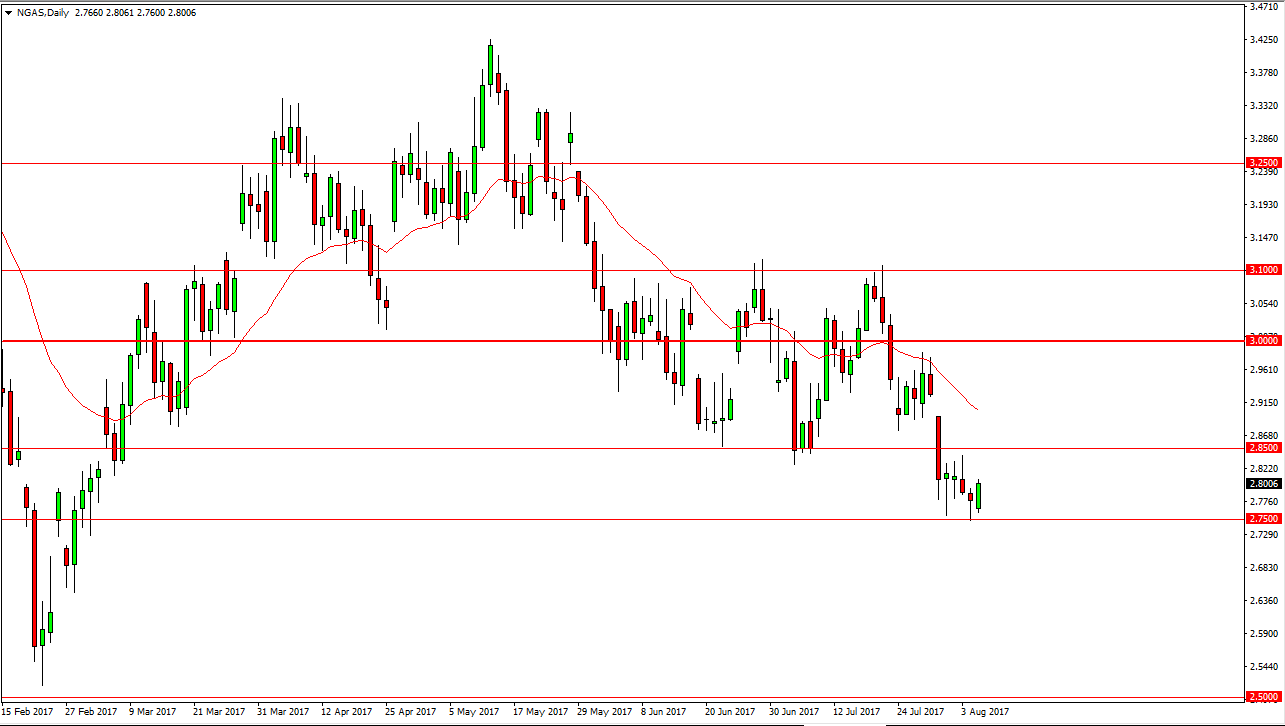

Natural Gas

Natural gas markets rallied after gapping lower during the day on Monday, as the hammer from the Friday session has been broken to the upside. That is a bullish sign, and we do have a gap near the $2.90 level that could be attractive for buyers to try and reach. However, I think that the $2.85 level is going to offer resistance as well so I am a seller short-term rallies that show signs of exhaustion. Honestly, I believe that this is a market that probably best traded off hourly charts as any signs of weakness should be jumped on due to the massive downtrend and of course the long-standing oversupply of natural gas in the markets. If we can break down below the $2.75 level, that should send this market much lower, and aiming towards my longer-term target of $2.50. I have no interest in buying natural gas at all.