USD/JPY

The US dollar went back and forth against the Japanese yen just above the 110 level during the bulk of the trading session on Tuesday, telling me that the buyers are starting to become interested again. I believe that the 110 level continues to look interesting to analyst around the world, and with the ADP numbers coming out today, we could get a bit of volatility in the short term. The markets will be focusing on this harbinger of what we could expect out of the Nonfarm Payroll numbers on Friday, so having said that it’s likely that the volatility could pick up. However, the US dollar is oversold so I think a bounce is probably about to happen. Even if we did breakdown, I believe that there is a significant amount of support at the 109 level as well.

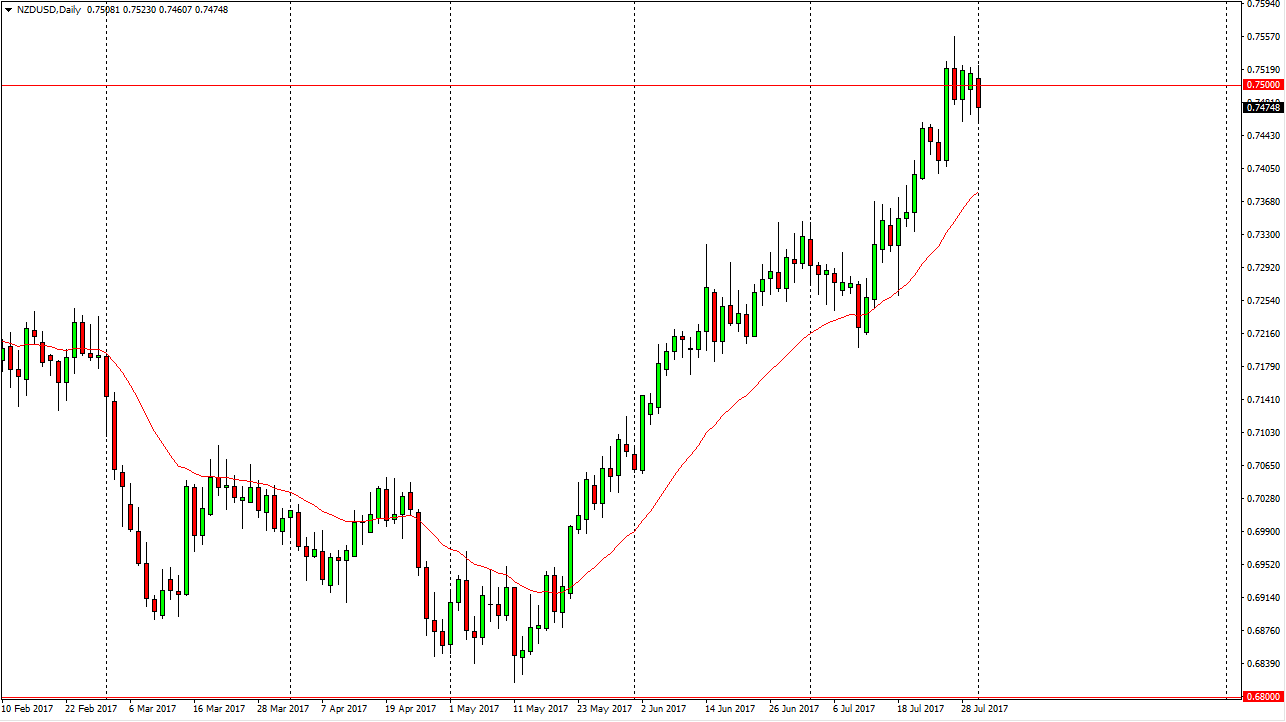

NZD/USD

The New Zealand dollar fell during the day on Tuesday, slicing through the 0.75 handle. The market looks likely to find support underneath, especially at the 0.74 level and of course the 0.73 level. Given enough time, I think the buyers are coming back but we are bit overbought so I would expect to see a bit of a pullback. I look at those pullbacks as potential buying opportunities, and a break to a fresh, new high would only extend the move to the upside as we should then go to the 0.7750 level above. Ultimately, I believe there is a significant amount of noise just waiting to happen, and with the jobs number coming on Friday, it might be fairly quiet over the next couple of sessions, but I think that the moved to the upside is certainly strong. Ultimately, I believe that the New Zealand dollar will continue to be volatile, and beholden to how the commodity markets move.